Is Jersey Electricity (LON:JEL) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Jersey Electricity plc (LON:JEL) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Jersey Electricity

What Is Jersey Electricity's Net Debt?

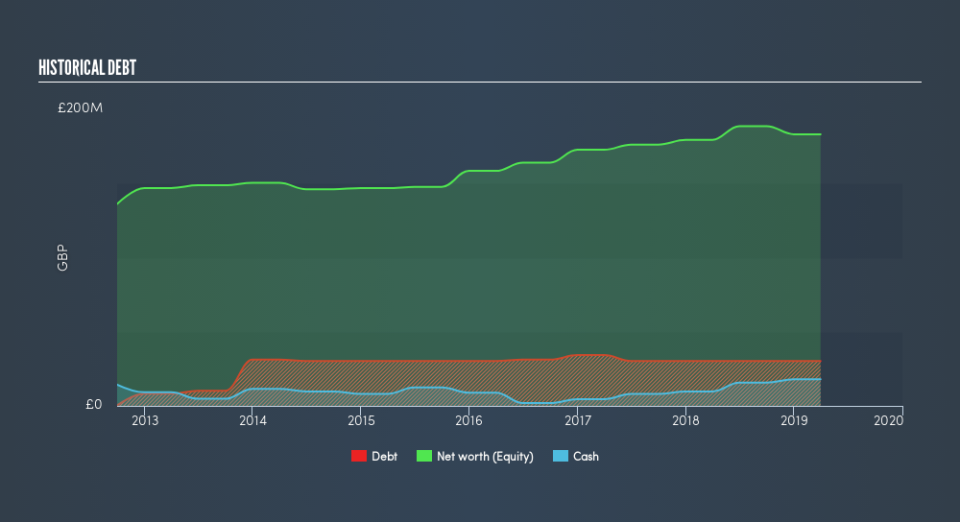

The chart below, which you can click on for greater detail, shows that Jersey Electricity had UK£30.2m in debt in March 2019; about the same as the year before. On the flip side, it has UK£17.9m in cash leading to net debt of about UK£12.3m.

How Strong Is Jersey Electricity's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Jersey Electricity had liabilities of UK£20.8m due within 12 months and liabilities of UK£79.2m due beyond that. Offsetting these obligations, it had cash of UK£17.9m as well as receivables valued at UK£20.5m due within 12 months. So it has liabilities totalling UK£61.5m more than its cash and near-term receivables, combined.

While this might seem like a lot, it is not so bad since Jersey Electricity has a market capitalization of UK£137.0m, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Jersey Electricity has a low net debt to EBITDA ratio of only 0.46. And its EBIT easily covers its interest expense, being 11.8 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. The good news is that Jersey Electricity has increased its EBIT by 2.3% over twelve months, which should ease any concerns about debt repayment. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Jersey Electricity's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, Jersey Electricity's free cash flow amounted to 47% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

When it comes to the balance sheet, the standout positive for Jersey Electricity was the fact that it seems able to cover its interest expense with its EBIT confidently. But the other factors we noted above weren't so encouraging. For example, its level of total liabilities makes us a little nervous about its debt. We would also note that Electric Utilities industry companies like Jersey Electricity commonly do use debt without problems. Considering this range of data points, we think Jersey Electricity is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. Given Jersey Electricity has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.