What can New Jersey learn from Pennsylvania on taxes? A lot | Ciattarelli

- Oops!Something went wrong.Please try again later.

“I’ve been calling for a lower [business tax] since I first took office and I’m thrilled that we were able to make this happen . . . This lower tax rate is a game-changer for business . . . We’re going to ensure tax fairness, make [our state] a top location for businesses, and bring new, good paying jobs here . . .”

Some might consider that pretty conservative rhetoric. Most would probably guess it’s the policy position of some Republican governor. If they did, they would be wrong.

That’s what Pennsylvania’s Gov. Tom Wolf, a Democrat, said when he recently signed reform legislation lowering Pennsylvania’s business tax from 10% to 5%. According to Wolf’s website, the end result will be “a healthier, more competitive business environment that attracts good paying jobs, and moves our economy forward.”

The reform, which will make Pennsylvania’s business tax rate one of the lowest in the nation, was overwhelming supported by both parties in the state Legislature.

Over the mid- to long-term, any state’s business recruitment and retention strategies and, in turn, economic vitality, are all about being regionally competitive. Wolf understands that. How else is Pennsylvania going to compete with its neighbor to the west, Ohio, which has no business tax? As for Pennsylvania’s neighbor to the east, New Jersey, our maximum 11.5% rate is the highest in the nation.

Like New Jersey, Pennsylvania’s state treasury has significant surpluses from unexpected pandemic tax collections and federal aid. In cutting their business tax in half, Pennsylvania invested their surpluses to enact a very meaningful and permanent reform. In New Jersey, surpluses were used to increase state spending. Indeed, Gov. Phil Murphy has increased spending $16 billion or 40% in five years’ time, with the 2022-2023 budget being $5 billion more than the year before.

After raising personal and business taxes, Murphy’s 2022-2023 budget creates the next property tax rebate gimmick while continuing to unfairly distribute state aid to select school districts. What the budget doesn’t do is provide permanent property tax relief by reforming the school funding formula or giving municipalities and counties back revenues the state confiscated. And, unlike Pennsylvania, the budget doesn’t alter New Jersey’s dubious distinction of being the worst state in the nation in which to do business.

In our distressed cities, Murphy’s budget doesn’t prioritize broad urban planning to foster robust economic development, which would provide much needed opportunity for our minority populations. Nor does it reverse New Jersey’s out-migration or make our state a more secure retirement destination by, for example, eliminating the transfer inheritance tax and freezing property taxes for everyone at age 70.

When Murphy took office, he was handed the kind of fiscal gifts for which any governor could only wish; namely, significant state revenues from a roaring national economy and landmark Supreme Court decisions that allowed sports betting and sales tax on Internet commerce. On top of that were the pandemic surpluses, due, in part, to Murphy’s tax increases and unnecessary borrowing of billions (Murphy had initially projected $20 to $30 billion budget shortfalls).

Given an unprecedented $10+ billion in surplus, no governor in history had better opportunity to permanently fix New Jersey, changing forever our painfully stubborn and infuriating property tax and business climate crises.

Has Wall Street improved our state’s credit rating? How could they not? Given the tax increases and pandemic surpluses . . . and even after the most recent credit upgrade New Jersey’s rating is the 49th worst in the nation. For everyday New Jersey residents, however, state credit ratings don’t pay the bills or make for a secure retirement.

Murphy will often say he is an unapologetic progressive. In politics today, too many politicians seem more concerned with their label and pronouns than achieving the kind of progress that truly benefits citizens. Without real progress, the New Jersey road on which we’re kicking the can is reaching its dead end.

Congratulations to Pennsylvania’s governor and Legislature. They get it. We need to, and soon.

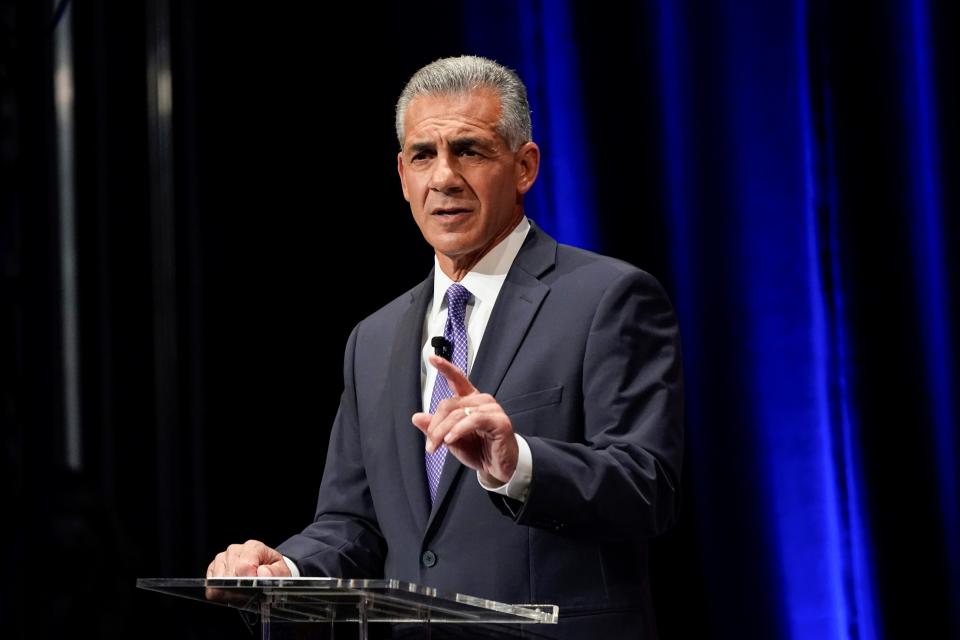

Jack Ciattarelli, the 2021 Republican nominee for New Jersey governor and a likely 2025 gubernatorial candidate, is a regular contributor to the opinion pages of USA TODAY Network New Jersey publications.

This article originally appeared on NorthJersey.com: Jack Ciattarelli: What can NJ learn from Pennsylvania on taxes? A lot