Job vacancies surge to pre-Covid levels

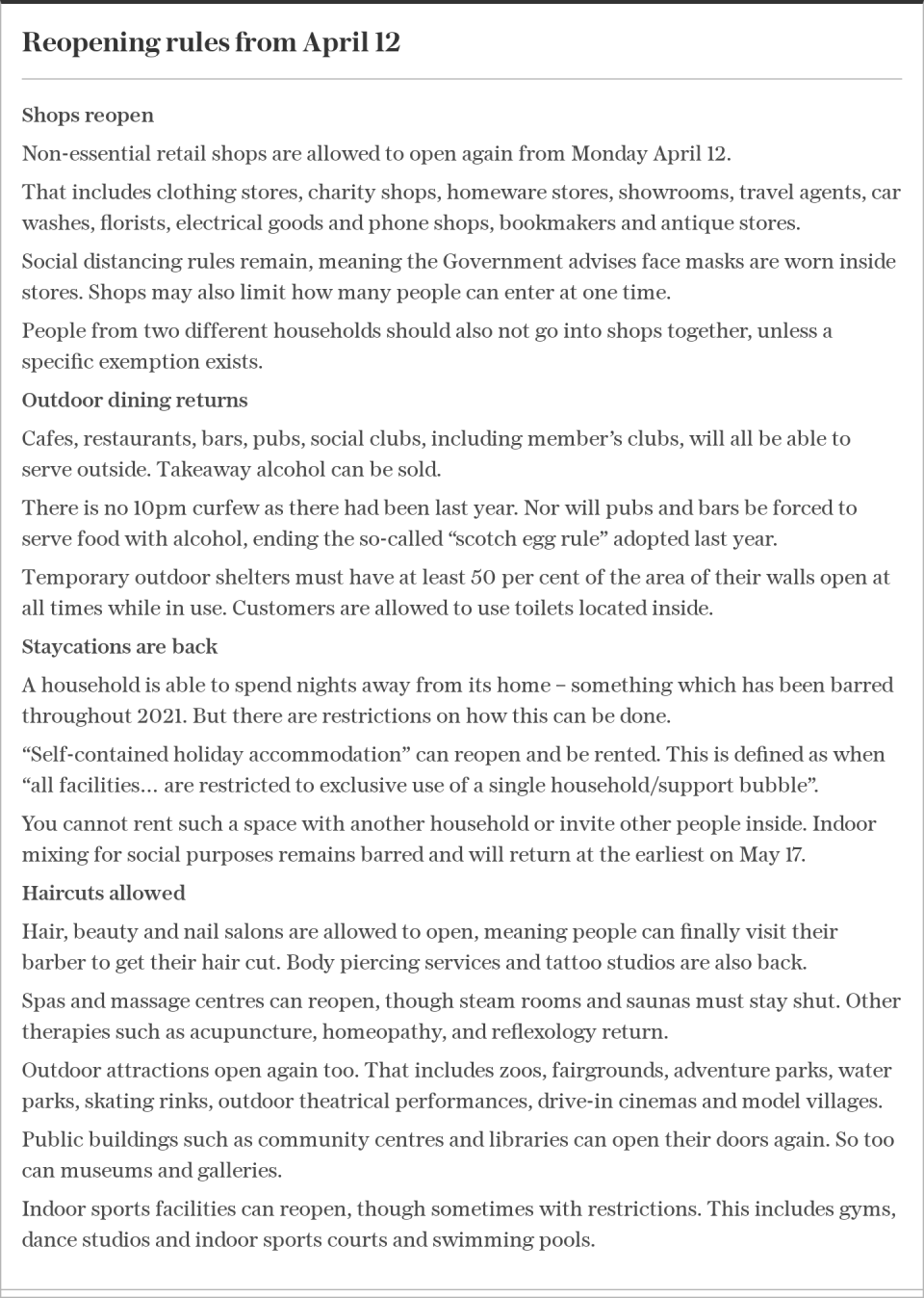

Job vacancies surged last week as the economy sprang back to life with the partial reopening of the retail and hospitality industries.

The number of positions on offer last week was back up to 99.5pc of its February 2020 level, according to the Office for National Statistics and Adzuna.

This was driven in part by a large jump in hiring in catering and hospitality.

Vacancies in the industry rose to 58pc of pre-pandemic levels, according to the Office for National Statistics and Adzuna, the first time it has risen above half since last March, as outdoor dining and drinking returns.

Reservations through OpenTable for reopening day, April 12, hit 79pc of their level on the same day of 2019. .

Retail and wholesale workers are also in more demand than at any point in the past 12 months as shops are allowed to throw open their doors, even if only a limited number of masked customers are permitted inside. Job adverts in the industry are above three-quarters of their level in February 2020.

Adverts for construction workers are around 60pc higher than their pre-Covid level, while those looking for jobs in transport and logistics can find almost twice as many jobs now as were available in early 2020.

By region the north east of England has witnessed the biggest surge in jobs with 28pc more vacancies now than it had before Covid. London is lagging the most with adverts still down one-sixth.

Renewed hiring and restaurant bookings are not the only sign of life returning to town centres.

More entrepreneurs are setting up businesses; last month 25,320 new companies registered to report VAT, the biggest increase since August 2016.

Road traffic volumes are back at 91pc of their pre-Covid levels, up seven percentage points on the week as more drivers took to the road to get to work or social engagements.

Meanwhile banks anticipate a surge in demand for mortgages and consumer loans in the second quarter of the year.

Lenders reported a slump in demand for home loans in the opening months of the year - a period that coincided with the anticipated end of the stamp duty holiday in March. But they now expect a renewed surge, according to the Bank of England, after the tax break was extended.

Similarly, demand for credit card and other loans slid in the first quarter as lockdown was imposed, but is expected to pick up as restrictions lift.

Despite this anticipated rise in spending, banks still expect the flood of household savings into accounts to continue almost unabated, dipping only slightly back to last autumn’s levels rather than disappearing in a frenzy of retail therapy and social binging – suggesting there will be some caution among families when it comes to returning to pre-lockdown habits right away.