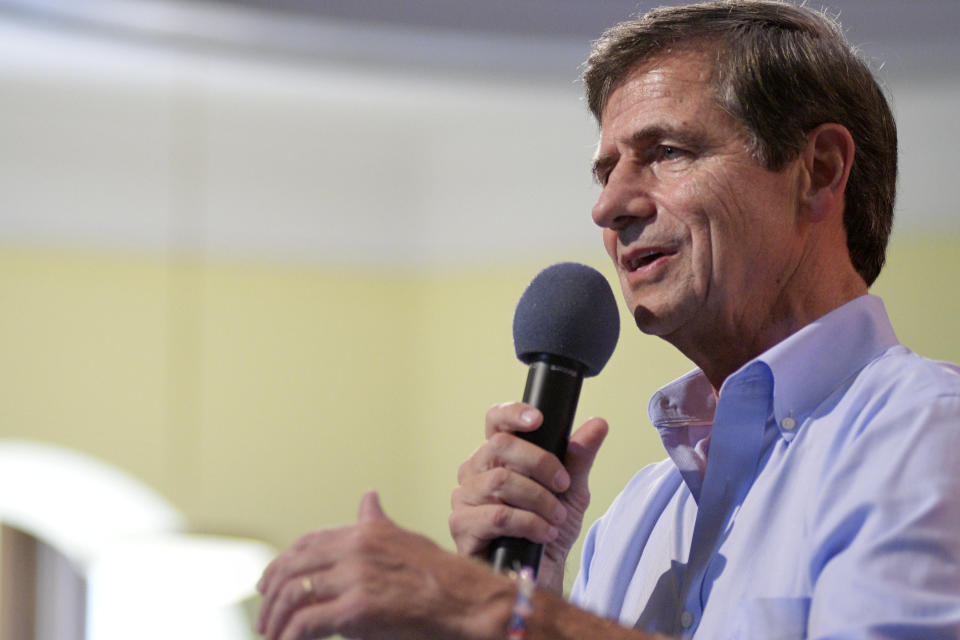

Joe Sestak: The Retirement Survey

Yahoo Finance and the Funding our Future campaign (an alliance of organizations dedicated to making a secure retirement possible for all Americans) teamed up to get more details on where the 2020 candidates for president stand on retirement. According to a recent Gallup poll, “Not having enough money for retirement” is a top financial worry among Americans yet the issue has received minimal attention thus far on the campaign trail. During the September debate, the words “Social Security” or “Retirement” weren’t uttered, according to ABC’s transcript.

The following are the responses from Joe Sestak, the former Congressman from Pennsylvania.

Will you address the coming insolvency of Social Security’s Old-Age and Survivors Insurance trust fund in your first term as president? If so, what specific policies will you advance?

We must work hard to ensure that Social Security remains solvent for future generations. Under President Reagan, Social Security’s taxable income cap covered 90% of all nationwide wage and salary income, with those earning above the cap contributing nothing on that income. Today, just 83% of all income is covered, as earnings above today’s $132,900 cap have greatly increased — and almost all the loss in covered income has gone to the highest earners. We need to increase that cap so it is no longer so regressive — with the burden of paying into the system overwhelming felt by lower-income workers — and look at various other pieces of the Social Security puzzle. I have also proposed increasing payroll taxes for those earning about $250,000 — and while currently the proceeds of such taxes only benefit the Medicare program, they could benefit Social Security as well. Of course, we must also hold the line against Republican attempts to privatize both of these vital programs that have given security and peace-of-mind to seniors for generations.

Should every person who pays into Social Security be eligible for full benefits, regardless of their socioeconomic status? In other words, will your plan include means testing?

• Will your plan include raising the retirement age or other benefit reductions?

No, no means testing. No, will not raise the retirement age or otherwise reduce benefits.

Should Social Security be funded primarily through payroll taxes, as it is currently, or should other revenue be used to shore up the program’s funding? If so, what revenue source(s) do you propose using?

If we raise the cap, as discussed above, we will not need to look elsewhere to shore up funding.

Should Social Security benefits be increased for any beneficiaries? If so, how do you propose increasing them, and how will your plan pay for any increase in benefits?

I believe we need to change the way we calculate cost-of-living increases in order to better reflect what seniors spend most of their money on: food, housing, and healthcare. That change alone will result in an increase of benefits. Raising the cap on taxable income will allow us to increase benefits.

Current legislation in Congress, the SECURE Act, has bipartisan support. Its primary pillars are expanding access to workplace retirement savings plans, increasing retirement income options, and enabling people to contribute to and retain their funds in IRAs and 401(k)s at later ages. Do you support the legislation? Why? Are there certain aspects you oppose? Why?

Yes, I support the SECURE ACT, because it will get more part-time workers into 401(k)s, allow multi-employer 401(k)s, and give workers 18 more months to pay into their IRA (from age 70.5 to 72). In general, it would increase funds in individual retirement accounts, and that can only be a good thing.

Should every worker have access to a workplace retirement savings account?

a) If so, how would you make that happen?

b) If not, why not?

c) Many states are establishing plans of their own. Do you support these plans and what role do you envision them playing in the broader system?

I favor every worker having access to a retirement savings account, and there are various options for doing this. I do support states implementing their own plans, and I expect them to play an important role in increasing retirement savings for young professionals especially.

The gig economy has upended traditional retirement models, and those workers face some of the greatest barriers when it comes to saving for retirement. How would you improve the ability of gig workers to save for retirement?

The SECURE Act would help older gig workers by giving them more time to pay into their individual account. But I would be open to other ways to improve the ability of gig workers to save for their retirement.

Do you support making it easier for workers to move their retirement benefits from one employer to another, such as a portable benefits model? How would you achieve that?

Yes. I would direct my cabinet (in particular Treasury and HHS) to determine how best to achieve portable benefits.

How would you propose improving retirement security for low-income Americans, many of whom cannot afford to put away savings?

I would direct expanded outreach to low-income Americans, who may not know what options are available to them. But overall I expect Social Security will continue to be the main financial support for low-income elderly people.

More Responses

Every active campaign was invited to participate. Several declined or did not respond to repeated requests for comment. Some campaigns opted to respond only to select questions and are not included here.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.