John Rogers' Firm Trims Alithya Stake

John Rogers (Trades, Portfolio)' Ariel Investments disclosed earlier this week that it trimmed its holding in Alithya Group Inc. (NASDAQ:ALYA). This and other real-time Guru portfolio updates are available on GuruFocus Real-Time Picks, a Premium feature.

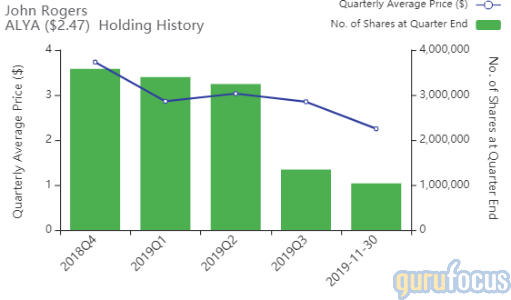

The firm disclosed a holding of 1,035,698 shares, down 22.88% from the third quarter-end holding of 1,343,006. Shares traded around $2.25 apiece on the Nov. 30 transaction date.

Company background and financial highlights

The Montreal, Quebec-based company deploys solutions, services and skill sets to craft tools tailored to its clients' business needs in a wide range of market sectors, including financial services, manufacturing and health care. The company said in its Nov. 13 press release that as of the quarter ended Sept. 30, Alithya has over 2,000 professionals offering digital business solutions across Canada, the U.S. and Europe.

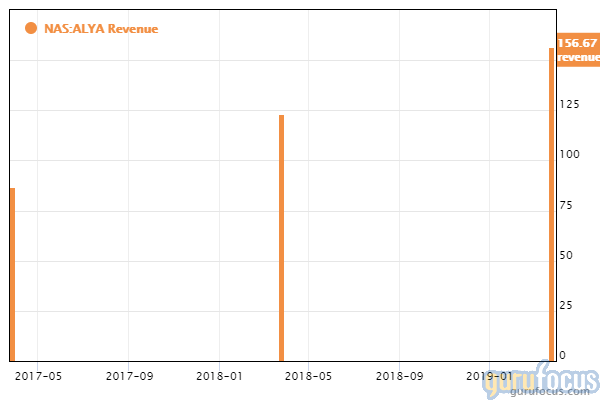

Alithya reported revenues of $67,373 million Canadian dollars (approximately $50.942 million USD) for the September quarter, which included $30.9 million CAD from the acquisition of Edgewater. Despite this, the decline in lower margin service revenues offset growth in higher value-added service revenues, leading to a pre-acquisition revenue decline of $600,000 CAD.

According to GuruFocus, Alithya's cash-to-debt ratio and debt-to-equity ratio underperform approximately 77% and 55% of global competitors, suggesting moderately-low financial strength.

See also

We are glad to have Rupal Bhansali as one of our speakers at the 2020 GuruFocus Value Conference. Bhansali, who manages Ariel Investments' international and global equity strategies, started her buy-side investing career at George Soros (Trades, Portfolio)' Soros Fund Management.

Disclosure: No positions.

Read more here:

Top 5 Buys of John Rogers' Ariel Investment

Wasatch International Growth's Top 5 Buys of the 3rd Quarter

Bill Ackman's Pershing Square Packs Into Agilent

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here

This article first appeared on GuruFocus.