Jokowi Readies G-20 Deals to Showcase Indonesia’s Growing Clout

- Oops!Something went wrong.Please try again later.

(Bloomberg) -- Indonesia is using the Group of 20 summit next week to power through deals ranging from infrastructure to carbon trading that spotlights its ambitions as a Southeast Asian economic powerhouse.

Most Read from Bloomberg

Elon Musk Tells Twitter Followers to Vote for a Republican Congress

Evelyn De Rothschild, London Head of Banking Dynasty, Dies at 91

CZ's Binance to Buy Rival FTX After Sam Bankman-Fried Faces Liquidity Crunch

Elon Musk Walks Back on Twitter Job Cuts, Blue Checks in Second Week

Much is at stake for Indonesian President Joko Widodo, who is targeting $89 billion in investments next year while pushing ahead with a $34 billion new capital in Borneo. All these plans need funding and support from wealthier, developed nations.

“This message is mostly for the domestic audience to show that the G-20 forum running this whole time did result in some concrete projects,” said Yose Rizal Damuri, Executive Director at the Center for Strategic and International Studies.

It’s also a way for Jokowi, as the president is popularly known, to leave behind a legacy of growth and investment, he added. Jokowi is currently in his second and final term in power.

Indonesia has long been criticized by analysts for not punching above its own weight for economic and diplomatic influence given its domestic pressures and political elites. Clinching the G-20 presidency has been a way for Jokowi’s administration to showcase the country’s potential and his officials are not going to let that opportunity pass.

Here’s a list of deals that Indonesia is looking to announce:

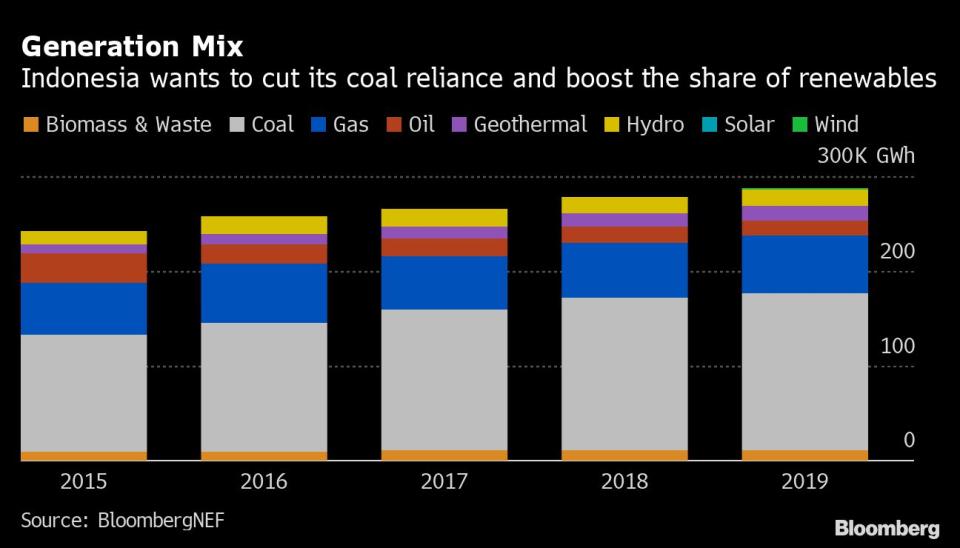

Coal Phaseout

Indonesia aims to clinch a deal during the summit with rich countries to fund programs to phase out coal. Jokowi has pledged to shut all of the archipelago’s coal-fired power plants by 2050 and be 100% dependent on renewable sources five years later. However, his cabinet has been divided on how to phase out coal, which contributes over half of the country’s total power capacity.

The Asian Development Bank is studying similar plans for Vietnam and the Philippines, hoping to announce a concrete result during the summit.

Digital Money

Indonesia’s central bank along with Malaysia, Thailand, Singapore and Philippines aim to sign a deal this month to link their payment systems that will allow some 384 million people to pay for goods and services through QR code scanning. The system would allow for local currency settlements, bypassing the need for the US dollar as an intermediary.

Just 51.8% of Indonesians have access to a financial account, one of the lowest among Southeast Asia’s major economies, according to World Bank data. This made financial inclusion a main focus for Indonesia during its G-20 presidency.

Bank Indonesia also plans to release the conceptual design of digital rupiah by the end of this year, said Governor Perry Warjiyo. The central bank has been studying the digital rupiah since last year to get ahead of the global adoption of cryptocurrency as a payment method.

Trains

Jokowi has invited President Xi Jinping to witness the trial run of a $8 billion Chinese-backed high-speed railway via Zoom videoconferencing from Bali on Nov. 16, according to Coordinating Maritime Affairs and Investment Minister Luhut Panjaitan. The train, which connects Jakarta to nearby cities, is backed by the Chinese Development Bank Corp. and China Railway International Co. Ltd.

Indonesia also plans to sign deals with foreign investors for the 188 trillion rupiah ($12 billion) expansion of the Jakarta MRT train system, a project that Jokowi has claimed as his legacy when he was governor. Funding would come from Japan, South Korea and the UK, according to Transport Minister Budi Karya Sumadi.

Carbon Trading

Finance Ministry special staff Masyita Crystallin said the government would release a road map for carbon market, carbon tax and energy transition before the G-20 summit. This would be a prerequisite to issuing a long-awaited regulation on carbon tax and trading meant to help Southeast Asia’s largest economy attain net zero emissions by 2060.

Crystallin said the road map would outline the potential demand for such a market. The government already assigned the Indonesia Stock Exchange to set up a carbon exchange, which is expected to commence operations in 2025.

Most Read from Bloomberg Businessweek

Seizing a Russian Superyacht Is Much More Complicated Than You Think

Inflation-Focused Voters Defy Biden’s Bid to Change the Subject

©2022 Bloomberg L.P.