Jones Lang LaSalle: A Strong Record of Predictable Growth, but a Mushy Balance Sheet

Jones Lang LaSalle Inc. (NYSE:JLL) is a real estate company that earned the distinction of being on the Buffett-Munger Screener list. Only 20 companies currently hold a place on the screen that searches for quality companies at a reasonable price.

Calling it a real estate company is an understatement; it operates in multiple segments and around the world. In its annual report for 2019, it noted, "We do this by addressing the needs of real estate owners, occupiers and investors, leveraging our deep real estate expertise and experience to provide clients with a full range of services on a local, regional and global scale."

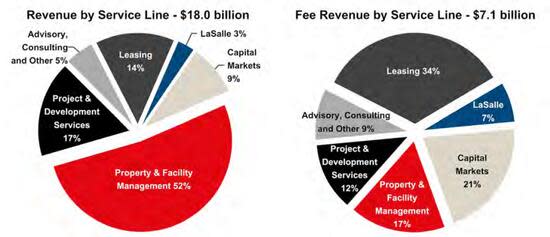

These are its revenue sources, broken down by segments:

It is currently a $6 billion company by market cap, and is actively courting growth, both organically and through acquisitions. In his fourth-quarter 2019 commentary, published before the Covid-19 crisis began, guru John Rogers (Trades, Portfolio) of the Ariel Fund observed: "Strong organic growth, along with robust performance from JLL's recent acquisition of HFF - leading provider of capital market transaction services to the United States and Western Europe - drove double digit increases across fee revenue, adjusted EBITDA, and adjusted EPS. With a 5% increase in semi-annual dividends and a new $200 million share repurchase program announced this quarter, we remain optimistic about JLL's continued value proposition for shareholders."

HFF was acquired in 2019 for $1.8 billion and contributed $144.4 million in new revenue to the capital markets division in the first quarter. Regarding organic growth, it sees good prospects, based on four "key trends and drivers":

Increasing capital allocations going to real estate.

Outsourcing is gaining speed in a growing number of companies.

The world's major cities will continue to grow.

The fourth industrial revolution ("Technological advances are blurring the lines between the physical, digital and biological spheres.")

Analysis

Stocks that make it through the Buffett-Munger Screener have met or exceeded four criteria:

A high Predictability rank, from consistently growing revenue and earnings.

Competitive advantage or a moat, to maintain or grow profit margins.

Little or no debt.

Fairly valued or undervaluation, based on the PEPG indicator (PEPG is the price-earnings ratio divided by the average growth rate of Ebitda over the past five years - also known as PEG).

Predictability

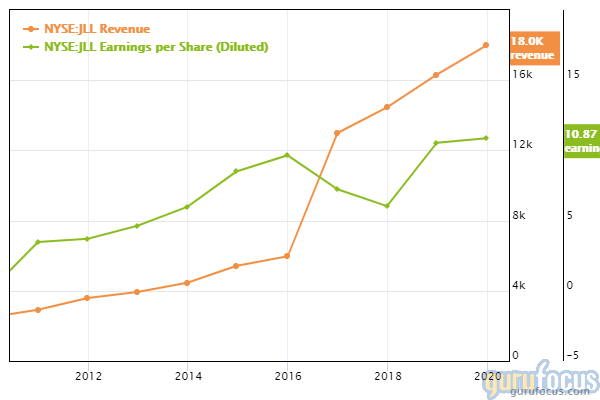

Jones Lang LaSalle has a Predictability score of 4 out 5. This chart shows it delivering on revenue and on (most of the time) diluted earnings per share:

We should expect the Covid-19 and economic crises to affect this year's results. In its first-quarter 2020 earnings report, the company had bad news. Despite a strong performance by the real estate services segment, key metrics were down:

Net income attributable to common shareholders for the first quarter fell from $21.3 million last year to $5.3 million this year.

The decline in earnings before interest, taxes, depreciation and amortization was less pronounced, from $95.6 million in 2019 to $95.4 million in 2020.

Diluted earnings per share fell from 46 cents last year to 10 cents this year (adjusted diluted earnings per share were 89 cents in 2019 to 49 cents in 2020.

Competitive advantage

Using the tools in the Macpherson model, we can quantitatively assess Jones Lang LaSalle's moat using return on capital and return on tangible equity. The model requires a company to have a median ROC and ROTE of at least 15% over the preceding 10 years:

Over the past decade, ROC has ranged between 4.4% and 9.69%, therefore missing the 15% threshold.

Return on tangible equity (net income attributable to common stockholders divided by its average total shareholder tangible equity) consistently has been above 100%, and was 115% in 2019.

Because of the split results, we will give the company a qualified pass.

Debt

The following chart shows Jones Lang LaSalle's long-term debt and capital lease obligations over the past 10 years:

As the chart makes clear, it loaded on debt in 2019. Part of that will be attributable to the acquisition of HFF, which totaled $1.8 billion, and was financed with a combination of shares, cash reserves and its syndicated credit facility.

On the other side of the balance sheet is $752 million in cash and cash equivalents. Interest coverage is a comfortable 15.22 times.

The company took on a lot of debt, weakening its balance sheet, when the market was overvalued. That can be seen in the Buffett Indicator, which shows the relationship between the market as a whole (represented by the Wilshire 3000 index) and the growth of gross domestic product:

In words, the market had raced far in front of the economy, something that was clear when it took on its new debt.

Valuation

Jones Lang LaSalle receives an excellent valuation rating from the GuruFocus system, 10 out of 10. This rating is based on a combination of absolute valuation, historical valuation and industry-relative valuation.

The PEG ratio is 0.95, putting it just inside the undervalued zone. Its price-earnings ratio is currently 11.35, which is lower than it has been in the recent past.

Why the strong valuation? Because the price plunged with the Covid-19 transition to working at home and general market weakness:

Looking back at the four criteria, we see the company has good predictability, a qualified moat, growing debt and a price driven down dramatically by external events.

Gurus

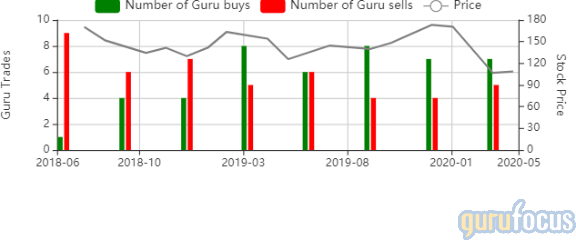

The investing giants have been buying more than they've been selling for over a year now:

Nine gurus have positions in Jones Lang LaSalle. Al Gore (Trades, Portfolio) of Generation Investment Management has by far the largest share, with almost 4.8 million shares. John Rogers (Trades, Portfolio) of the Ariel Fund has just over 800,000 and Diamond Hill Capital (Trades, Portfolio) had 259,000 shares.

Conclusion

Jones Lang LaSalle, one of the largest American and international players in commercial real estate, earned its position on the Buffett-Munger Screener list with its positive attributes. As a company with a high predictability score, it is likely to deliver above-average returns with a low likelihood of failure.

On the negative side, it has indebted itself in the past few years even if that debt allowed it to grow through a major acquisition. And the value as established by the PEG ratio is hardly into undervalued territory.

For investors who have had Jones Lang LaSalle on their watch list, this may be the time to buy, given that the price is down significantly. For other value investors, though, there is not much to compel further interest.

Disclosure: I do not own shares in any companies named in this article and do not expect to buy any in the next 72 hours.

Read more here:

Choice Hotels: A Solid Buffett-Munger Stock

ViacomCBS: Can You Get Past Its Debt?

Booking: Is This a Value Stock?

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.