This just won't save that much money: Ohio auditors oppose 'band-aid' to property tax hikes

- Oops!Something went wrong.Please try again later.

Ohio county auditors say a proposed state law changing the way properties are valued will be chaotic and expensive to implement and do nothing to seriously change the property tax burden on Ohio homeowners.

The legislation, approved by the Ohio House on Wednesday but yet to pass the Senate, would require property appraisals to be based on three years of home sales instead of the most recent year. Proponents argue that such a method would reduce the big jumps seen in reappraisals this year, when many counties saw values leap more than 30% or even 40%. Reducing the values, in turn, would help reduce property tax increases, argue supporters of the legislation.

Auditors, who are responsible for appraising property, say recalculating values based on three years of sales data would be very difficult, especially if expected before tax bills go out the first of the year.

"It appears that members of the General Assembly are watching too much Loki," said Franklin County Auditor Michael Stinziano, referring to the superhero television series that involves alternate timelines. "This presumes a time that doesn’t exist in terms of execution, in terms of what’s required, and how it would impact and correlate with tax bills."

Franklin County is one of 28 Ohio counties this year to undertake a mass reappraisal, which based new values largely on sale prices from 2022. Another 13 counties updated values based on the same method.

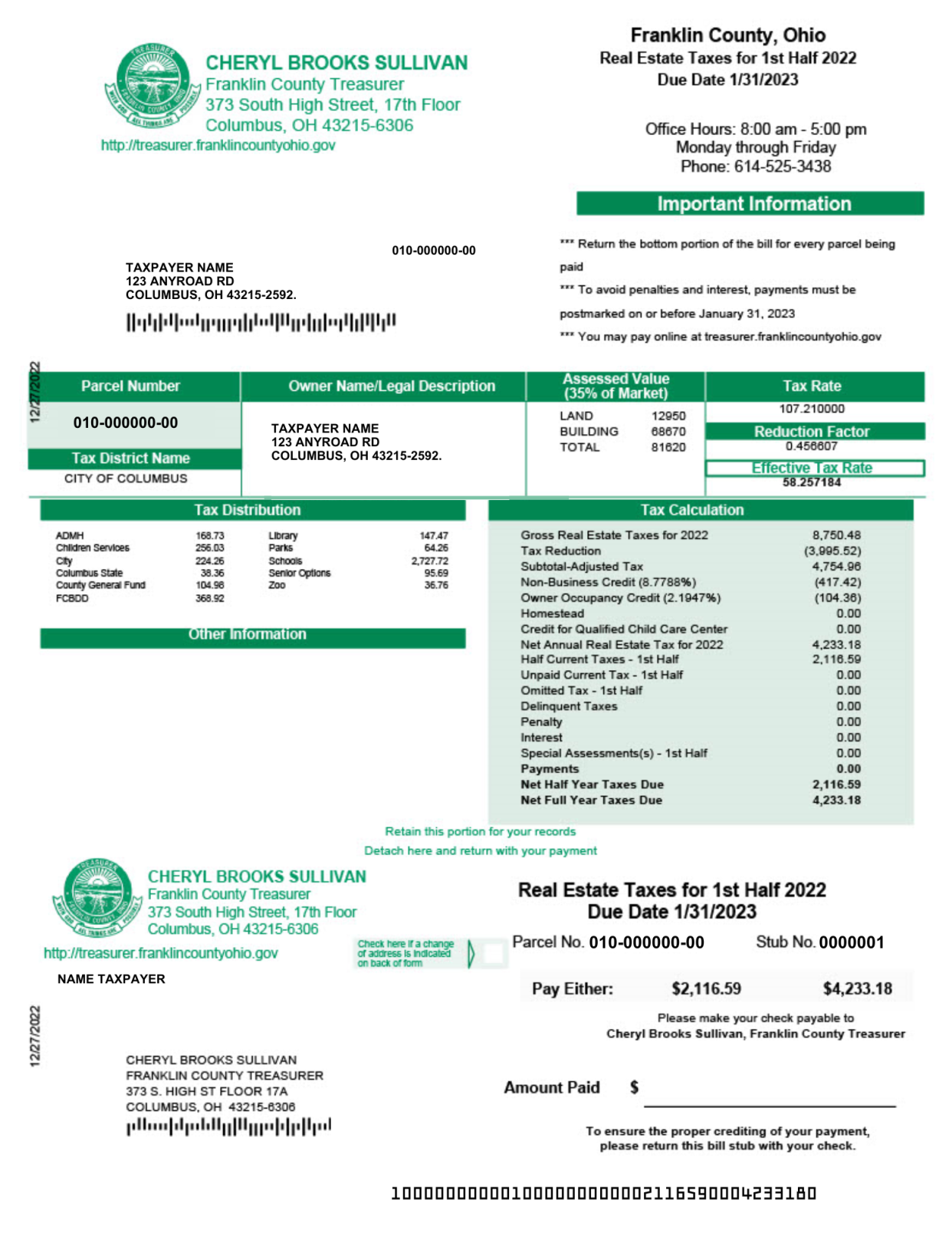

Franklin County found that home values rose more than 41% since the last update three years ago. While Franklin County home values rose the most in the state, other counties saw historic value jumps, prompting concerns from homeowners and politicians about big jumps in property taxes, which are based on property values.

Stinziano and other auditors say they share those concerns but don't believe artificially reducing values is the right answer.

"We auditors are committed to work on true property tax solutions," said Stinziano. "This legislation doesn’t do that."

Some auditors, including Delaware County Auditor George Kaitsa, are in favor of the legislation.

"I support the change to the three-year average because this has been a generational increase in home values," Kaitsa said in an email.

But most auditors appear to agree with Stinziano.

The County Auditors’ Association of Ohio and the County Treasurers Association of Ohio issued a statement Wednesday saying the bill, if signed into law, "will have serious unintended consequences on the tax collection process. The timing for passage of the bill, even with an emergency clause that would allow it to go into effect immediately, would wreak havoc on timely certification, require counties that have already finalized amounts to redo those numbers, and cause tax amounts to be different for the first and second half of 2024."

Auditors note that values have already been determined after months, or even years, of effort. Those values, once approved by the Department of Taxation, will form the basis of tax bills mailed the first of the year. Redoing the values in time for those tax bills would be all but impossible, they say.

"We think the General Assembly assumes we just plug this into a formula. A mass reappraisal isn’t that," Stinziano said. "It took two-and-a-half years to go out and review all those properties, 450,000 parcels."

Instead, tax bills for the first half of the year might be based on the current values, and adjusted in the spring for the June tax bills.

"I hate the thought of 40 some counties that will do this two times, and have two different values and bills for the first and second half of the year," said Licking County Auditor Michael Smith.

Smith said if the legislation is signed into law, his office has a tentative plan to reduce five taxing districts by 5% and apply a 2% to 3% reduction to the rest of the county, instead of revaluing each specific parcel.

"Now we have to just use a multiplier on all the parcels," he said. "That’s the only way to get this completed in a short amount of time."

Smith and Stinziano also argue that the change will not make a significant difference for taxpayers.

"This just won't save that much money," said Smith, who estimated that a 5% reduction in property value would save 5% on 1/7th of a homeowner's total tax bill, or about $35 on a $5,000 tax bill.

The law could also be setting up homeowners for an even more catastrophic property value increase in a few years because it applies only to the next three years of reappraisals. So when counties such as Franklin undertake their next reappraisal in three years, they will be comparing that value to a value that will be, in effect, four or five years old.

In a statement to The Dispatch, the Ohio Department of Taxation raised questions about the constitutionality of the proposed law, and warned that it could delay tax bills.

"The Ohio Constitution and Ohio Revised Code require uniform valuation of property at true market value," according to the statement. "The bills being considered would revise the system for reviewing property values submitted to the Department of Taxation by county auditors. Dependent upon the ultimate nature and timing of such changes, this will produce delays for local officials to collect and distribute property tax revenues."

Smith, Stinziano and the auditors' association argue the bill also ignores the larger issue of property tax reform and merely "kicks the can down the road."

Auditors urged legislators to look instead at reforming the state's property tax system, which was ruled unconstitutional in 1997.

Legislators should "look more fully at the property tax picture" instead of "this hastily crafted band-aid approach," said county auditors and treasurers in their response to Wednesday's action.

"There needs to be a huge, from 10,000 feet down, reform," Smith said. "There are different ways to do this."

jweiker@dispatch.com

@JimWeiker

This article originally appeared on The Columbus Dispatch: Ohio Auditors resist legislative answer to property values and taxes