Kansas Senate advances income, sales tax bill

Kan. Senate rewrites bill dropping income tax rates but canceling decrease in state sales tax

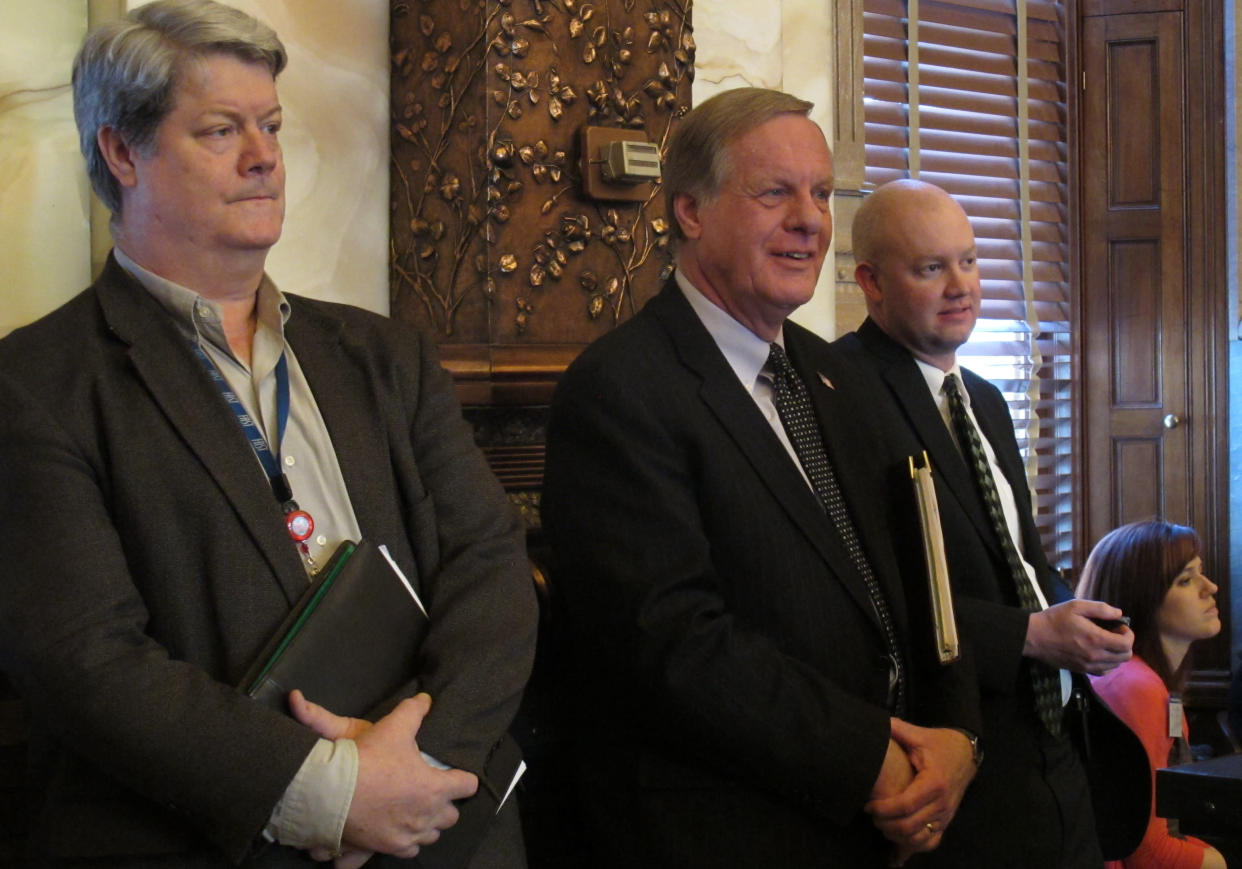

Steve Stotts, left, the Kansas Department of Revenue's taxation director, watches the state Senate's debate on tax legislation, Wednesday, March 13, 2013, at the Statehouse in Topeka, Kan. Watching with him are Revenue Secretary Nick Jordan, center, and Jon Hummel, right, Gov. Sam Brownback's policy director. (AP Photo/John Hanna)

TOPEKA, Kan. (AP) -- The Republican-dominated Kansas Senate rewrote tax legislation before giving it first-round approval Wednesday night, keeping GOP Gov. Sam Brownback's proposals for cutting income tax rates further but scrapping part of his plan for revenue-raising offsets to stabilize the budget.

Senators advanced the measure on a voice vote after nearly five hours of debate. A second, final vote is set for Thursday, when approval would send the legislation to the House, which is considering its own alternative to Brownback's plan.

The governor and many Republican legislators would like to eventually phase out personal income taxes, and the Senate's bill follows up on massive income tax cuts enacted last year. The measure phases in a second round of rate reductions over the next four years.

The bill also retains Brownback's proposal to cancel a decrease in the state sales tax scheduled for July. Most members of the chamber's 32-8 Republican majority voted twice to keep the sales tax at its current rate, despite a promise made by lawmakers three years ago that it would decline.

Brownback said in a statement after the debate that the bill "protects our state's core responsibilities and continues our state on the path to a zero income tax."

Most of the Senate's tinkering with Brownback's plan came on income tax deductions. Brownback wanted to scrap two popular deductions for homeowners, for their property taxes and the interest on their mortgages. Senators opted instead for phasing out most income tax deductions as tax rates dropped largely along lines suggested by the Kansas Association of Realtors, aimed at keeping at least partial breaks for homeowners.

Supporters of additional income tax cuts believe they'll stimulate the economy. But many of them — including the governor — acknowledge that last year's aggressive cuts created budget problems that threaten aid to public schools and spending on social services.

The bill would net the state $497 million in new revenues over the next five years, according to legislative researchers. That's still far short of what last year's tax cuts were worth.

"So here we are, back here, trying to make the best of, or repair something, that needs work," said Senate Assessment and Taxation Committee Chairman Les Donovan, a conservative Wichita Republican.

Brownback has received national attention for seeking aggressive income tax cuts. This week, the Missouri Senate approved income tax cuts prompted by a desire to keep up with Kansas, and the Oklahoma House passed reductions backed by Republican Gov. Mary Fallin.

Under the Kansas Senate's bill, the state's top rate would drop for 2017 to 3.5 percent from 4.9 percent.

But Brownback and Senate GOP leaders faced criticism both from Democrats and a few conservative Republicans, particularly over canceling the sales tax decrease. The tax is now 6.3 percent — boosted to that rate in 2010 by budget-balancing legislation — and set to decline to 5.7 percent.

Critics note eliminating income taxes would force the state to rely most heavily on its sales tax to finance its programs, and poorer families tend to pay a higher percentage of their incomes to that tax than wealthy ones. And unlike most states, Kansas imposes the full tax on groceries.

Many of those critics viewed last year's tax cuts as reckless.

"The governor's misguided tax policy is setting the state of Kansas up for a future fiscal crash and burn," said Sen. Tom Holland, a Baldwin City Democrat who ran unsuccessfully against Brownback for governor in 2010. "At the same time, this is a big shift in tax burden to the working middle class and the working poor."

The conservative Republican dissenters also viewed the sales tax measure as a tax increase. Sen. Dennis Pyle, a conservative Republican, said searching for additional revenues to plug budget gaps goes against many Republicans' often-stated support for smaller government.

"I'm going to vote for every tax cut I can, because my intention is truly to limit government," Pyle said.

The Kansas Association of Realtors' backing for the legislation is significant because the group had spent $195,000 in January on radio, newspaper and Internet advertising attacking Brownback's proposals to scrap the tax deductions for homeowners. Lobbyist Luke Bell said the association ultimately didn't think it was reasonable to ask senators to keep the full deductions in place and worked on them to approve what it saw as a reasonable compromise.

The tinkering didn't end there. Senators decided to immediately scrap a current income tax deduction for gambling losses and to permanently keep a full deduction for charitable contributions. They also restored a tax credit for parents who adopt children.

___

The legislation before the Senate is HB 2059.

___

Follow John Hanna on Twitter at www.twitter.com/apjdhanna