Kaveri Seed Company Limited (NSE:KSCL): A Fundamentally Attractive Investment

Kaveri Seed Company Limited (NSE:KSCL) is a stock with outstanding fundamental characteristics. When we build an investment case, we need to look at the stock with a holistic perspective. In the case of KSCL, it is a financially-sound , dividend-paying company with an impressive track record of performance. Below, I've touched on some key aspects you should know on a high level. For those interested in digging a bit deeper into my commentary, take a look at the report on Kaveri Seed here.

Excellent balance sheet with proven track record and pays a dividend

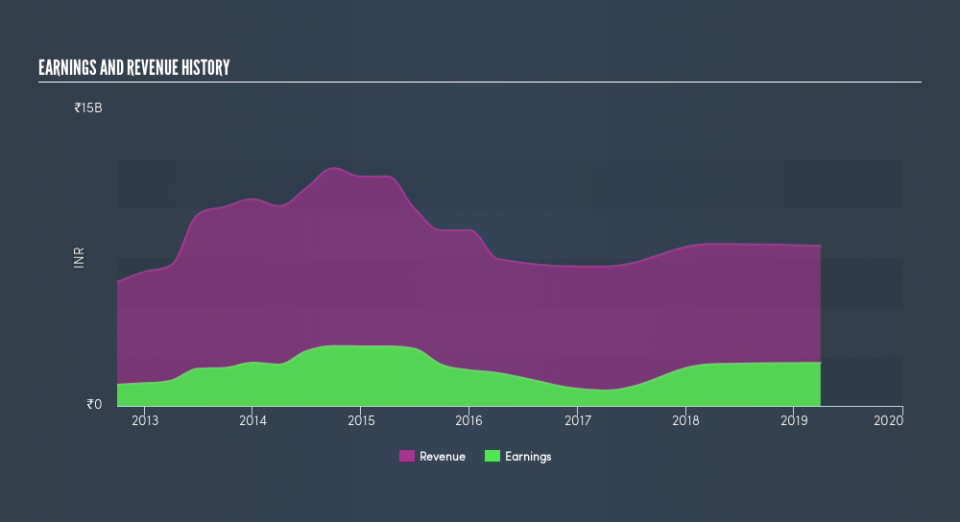

In the previous year, KSCL has ramped up its bottom line by 2.9%, with its latest earnings level surpassing its average level over the last five years. This strong performance generated a robust double-digit return on equity of 22%, which is an notable feat for the company. KSCL's ability to maintain an adequate level of cash to meet upcoming liabilities is a good sign for its financial health. This indicates that KSCL has sufficient cash flows and proper cash management in place, which is an important determinant of the company’s health. KSCL's has produced operating cash levels of 22.24x total debt over the past year, which implies that KSCL's management has put its borrowings into good use by generating enough cash to cover a sufficient portion of borrowings.

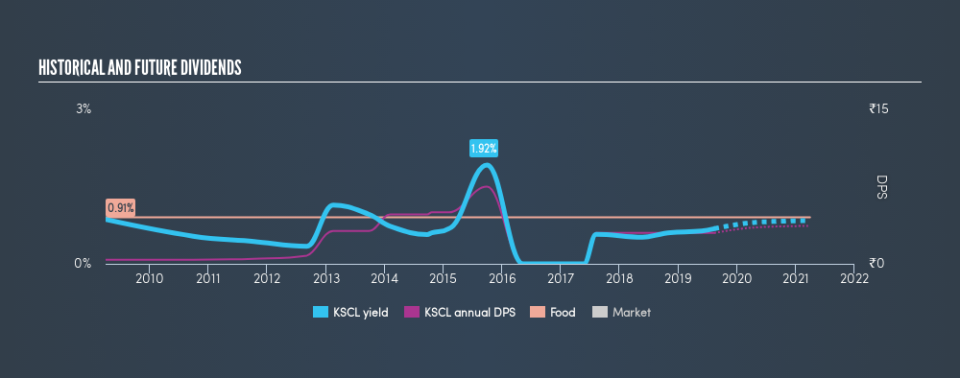

KSCL is also a dividend company, with ample net income to cover its dividend payout, which has been consistently growing over the past decade, keeping income investors happy.

Next Steps:

For Kaveri Seed, there are three key factors you should further research:

Future Outlook: What are well-informed industry analysts predicting for KSCL’s future growth? Take a look at our free research report of analyst consensus for KSCL’s outlook.

Valuation: What is KSCL worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether KSCL is currently mispriced by the market.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of KSCL? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.