Keir Starmer's pension: how much tax he could save

- Oops!Something went wrong.Please try again later.

Labour has been rocked by the revelation that its leader, Sir Keir Starmer, enjoys a unique and highly generous pension deal, which allows him to avoid tax on his savings pot.

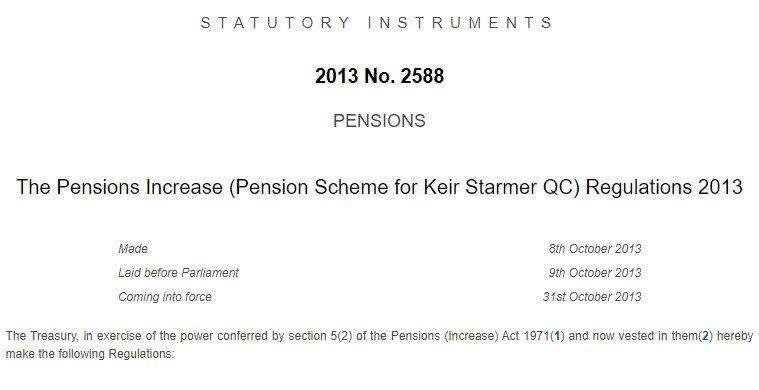

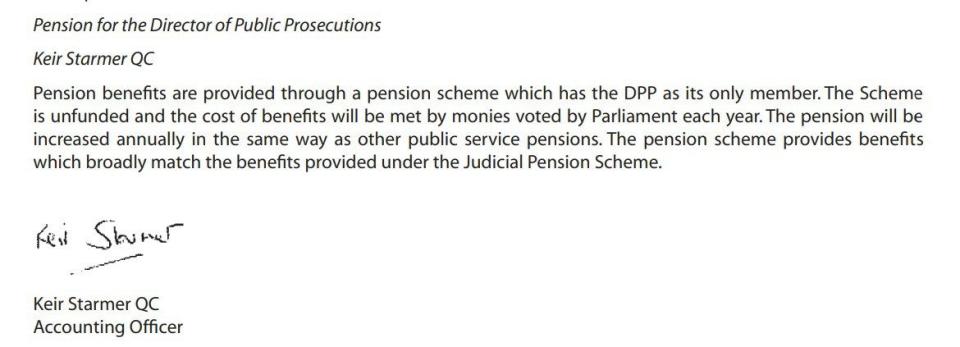

The Telegraph has revealed Sir Keir benefited from a one-man “tax-unregistered” pension scheme during his time as Director of Public Prosecutions (DPP) between 2008 and 2013.

The scheme “broadly” mirrored the tax perks enjoyed by judges, which placed no lifetime cap on pension savings – the same cap which Sir Keir and Labour fought to keep in place.

How did Sir Keir get the tax perk?

Sir Keir was the only member of a taxpayer-funded pension scheme in his role as DPP – a perk which his predecessors enjoyed, but was not extended to other senior civil servants of an equivalent rank.

In 2014, after Sir Keir had stepped down from the role, the pension scheme for the DPP was changed to reflect that of other civil servants, not judges.

The Judicial Pensions Scheme was not subject to normal tax rules. The majority of members were not subject to the lifetime allowance, annual allowance and received a generous accrual rate.

Because of the scheme’s status as “tax unregistered” members also did not benefit from tax relief on contributions, nor were they entitled to take a 25pc tax-free lump sum as with other pensions.

However, judges are given an extra sum from the scheme to cover any tax bill they might incur on a lump sum withdrawal.

Tom McPhail, of financial consultancy The Lang Cat, said: “I don't think anyone who knows anything about pensions would regard this as any less than one of the most generous workplace pensions in the UK.”

Will the Labour leader save on tax?

Under Sir Keir’s arrangement with the Government, his DPP pension is increased annually to keep pace with rising prices.

Experts estimated he will have almost £700,000 in the scheme on retirement, based on his nest egg being 20 times the annual pension – £620,000, plus a lump sum of £74,000.

But the money accrued in this pot sits outside the lifetime cap which applies to his other pension savings. It is estimated that Sir Keir’s MP pension is worth roughly £300,000, this combined with the £700,000 DPP pension would be close to current £1.073m cap if it was subject to normal tax rules – before any private pension from his time as a barrister was taken into account.

However, as his pension from the DPP is not counted towards the lifetime allowance, it means he can save an additional £700,000 into pensions without penalty, based on £300,000 being already being accounted for using his MP pension.

John Ralfe, independent pension consultant, said: “If Sir Keir Starmer's DPP pension was covered by the lifetime allowance rules, then combined with his parliamentary pension, he could be on the cusp of hitting the £1.07m cap.”

If Sir Keir were to still exceed the lifetime allowance in his parliamentary and private pensions, he would pay a tax rate of 55pc on any lump sum taken. But any lump sum he takes from his DDP pension will be taxed instead at a lower rate of either 40pc as a higher-rate taxpayer or 45pc as an additional-rate taxpayer.

The Cabinet Office is yet to confirm whether the Labour leader qualified for extra payments from his DDP pension to cover any tax bill on lump sums taken from the pot, as is enjoyed by judges. Labour was contacted for comment.