Ken Heebner's CGM Builds Residential Construction Holdings in 3rd Quarter

Capital Growth Management, the firm co-founded by Ken Heebner (Trades, Portfolio), disclosed last week that its top three buys for the third quarter came from the residential construction industry.

The firm has a history of making swift sector calls: Heebner is not afraid to make large bets based on his convictions. During the third quarter, Heebner's firm's top five buys were in D.R. Horton Inc. (NYSE:DHI), Meritage Homes Corp. (NYSE:MTH), Taylor Morrison Home Corp. (THMC), Lithia Motors Inc. (NYSE:LAD) and Tyson Foods Inc. (NYSE:TSN).

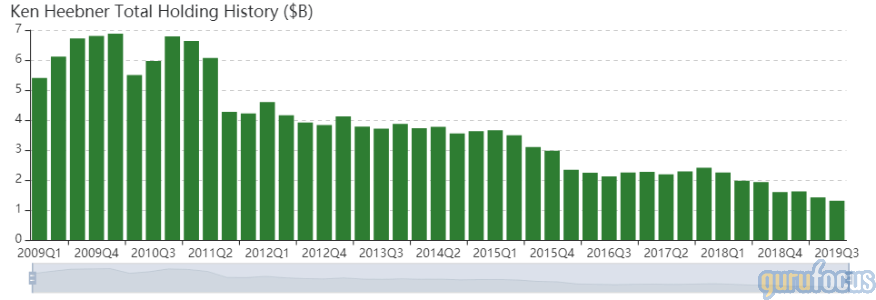

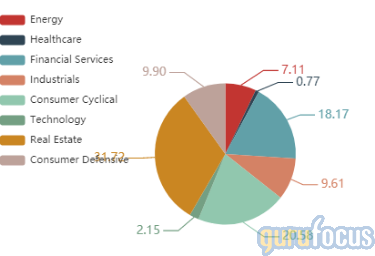

As of quarter-end, CGM's $1.31 billion equity portfolio contains 45 stocks, of which 24 are new holdings. The portfolio had a turnover rate of 44% for the quarter, suggesting that the firm often replaces its holdings quarter over quarter. The top three sectors in terms of portfolio weight are real estate, consumer cyclical and financial services.

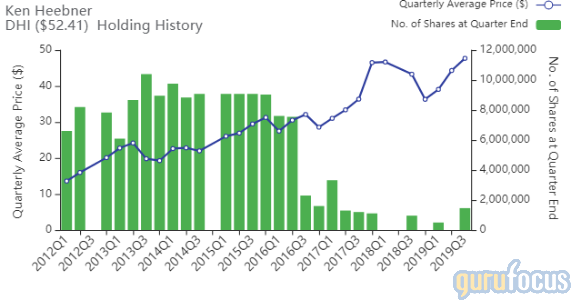

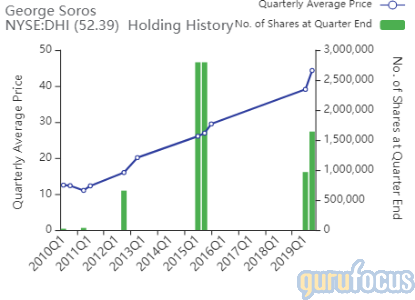

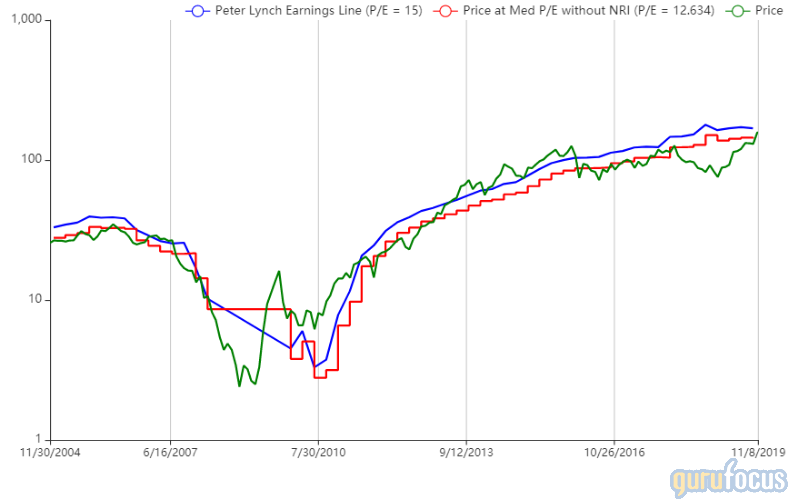

D.R. Horton

CGM purchased 1.46 million shares of D.R. Horton, giving the position 5.89% weight in the equity portfolio. Shares averaged $47.69 during the quarter.

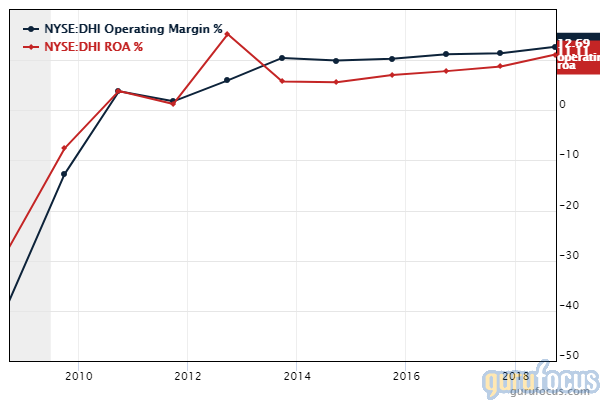

The Arlington, Texas-based homebuilder offers products to entry-level, move-up, luxury buyers and active adults. GuruFocus ranks D.R. Horton's profitability 8 out of 10: The company's return on assets is outperforming 84.68% of global competitors despite profit margins outperforming just over 67% of global peers.

Gurus with large holdings in D.R. Horton include Steve Mandel (Trades, Portfolio)'s Lone Pine and George Soros (Trades, Portfolio)' Soros Fund Management.

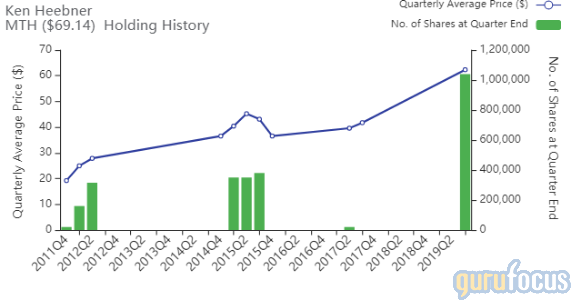

Meritage

CGM purchased 1.04 million shares of Meritage, giving the position 5.60% weight in the equity portfolio. Shares averaged $62.34 during the quarter.

The Scottsdale, Arizona-based homebuilder operates primarily in the western, southern and southeastern parts of the U.S. GuruFocus ranks Meritage's profitability 7 out of 10: Even though operating margins have declined and are underperforming 53.15% of global competitors, Meritage has a strong Piotroski F-score of 7 and a Joel Greenblatt (Trades, Portfolio) return on capital that outperforms 97.30% of global competitors.

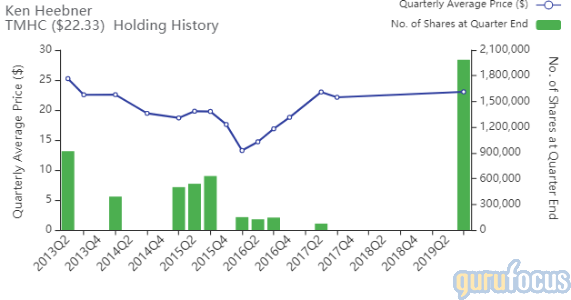

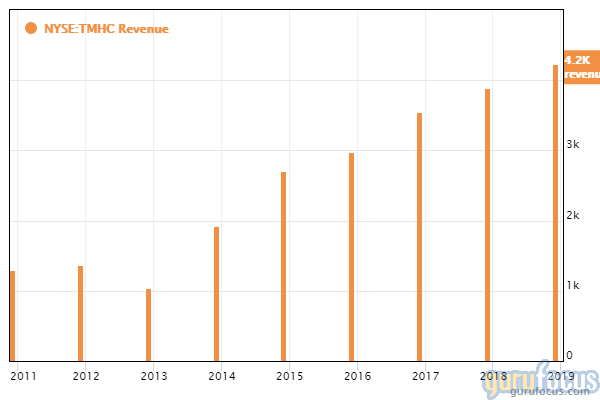

Taylor Morrison

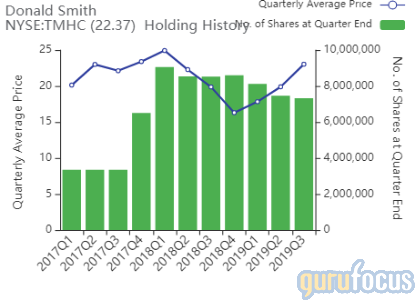

CGM purchased 1.985 million shares of Taylor Morrison, giving the position 3.94% weight in the equity portfolio. Shares averaged $23.03 during the quarter.

Taylor Morrison builds single-family homes and communities throughout California, Arizona, Texas and other states in the U.S. GuruFocus ranks the company's profitability 7 out of 10 on the heels of a three-year revenue growth rate that outperforms 68.57% of global competitors.

Other gurus with holdings in Taylor Morrison include Donald Smith (Trades, Portfolio) and Charles Brandes (Trades, Portfolio)' Brandes Investments.

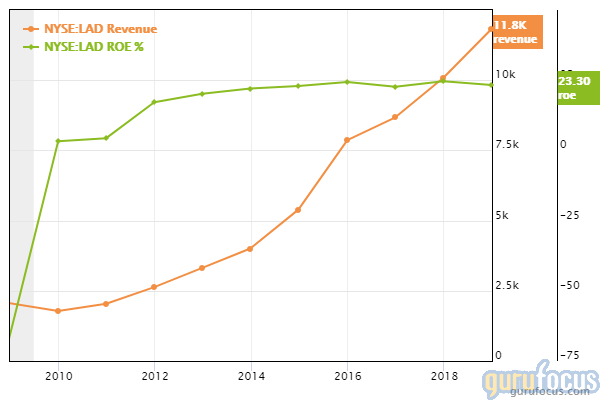

Lithia Motors

CGM purchased 303,000 shares of Lithia Motors, giving the position 3.07% weight in the equity portfolio. Shares averaged $127.74 during the quarter.

The Medford, Oregon-based company retails new and used vehicles. GuruFocus ranks Lithia's profitability 7 out of 10: Even though operating margins have declined and are underperforming 56.28% of global competitors, the company's return on equity and three-year revenue growth rate are outperforming 87% of global auto and truck dealerships.

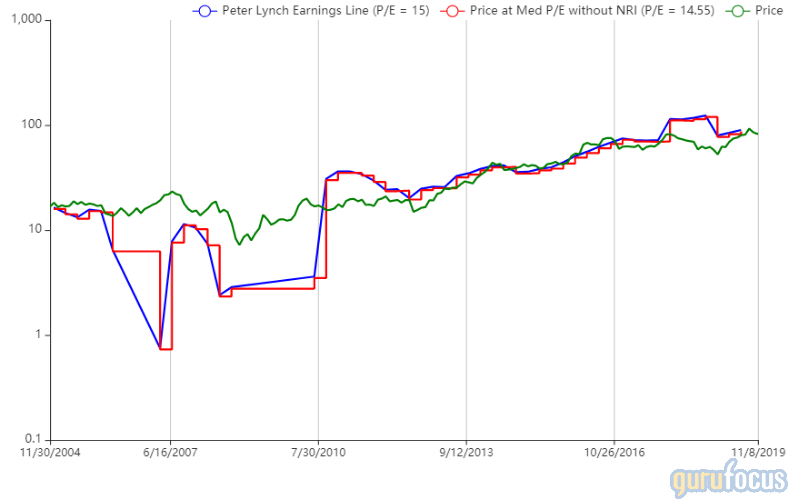

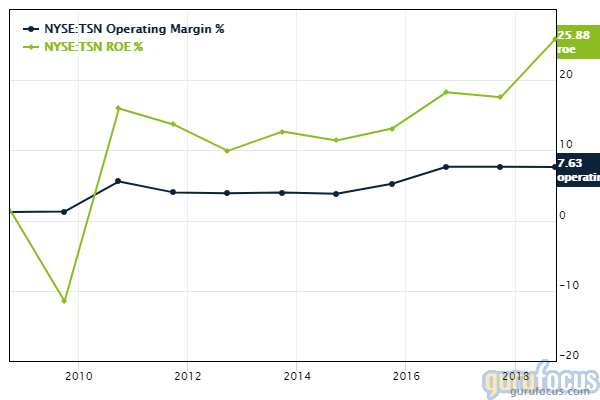

Tyson Foods

CGM purchased 400,000 shares of Tyson Foods, giving the position 2.64% weight in the equity portfolio. Shares averaged $85.11 during the quarter.

The Springdale, Arkansas-based company raises, processes and distributes raw and value-added beef, chicken, pork and prepared-food products through brands like Wright, Jimmy Dean, Hillshire Farm, and its popular Tyson Chicken. GuruFocus ranks the company's profitability 7 out of 10 on several positive investing signs, which include expanding profit margins and a return on equity that outperforms 81.15% of global competitors.

Disclosure: No positions.

Read more here:

Francisco Garcia Parames' Top 5 Buys of the 3rd Quarter

Yacktman Asset Management's 3rd-Quarter Buys

Gayner Invests in Embattled Berkshire Holding Kraft Heinz

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.