What Kind Of Shareholder Owns Most GE Power India Limited (NSE:GEPIL) Stock?

A look at the shareholders of GE Power India Limited (NSE:GEPIL) can tell us which group is most powerful. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. We also tend to see lower insider ownership in companies that were previously publicly owned.

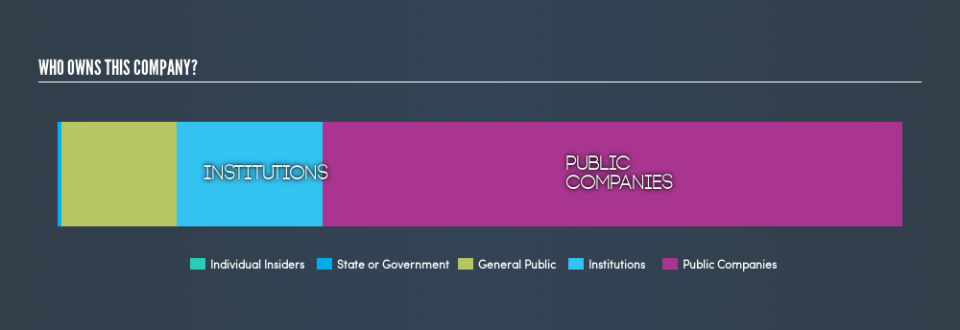

GE Power India is not a large company by global standards. It has a market capitalization of ₹51b, which means it wouldn't have the attention of many institutional investors. Taking a look at our data on the ownership groups (below), it's seems that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about GEPIL.

See our latest analysis for GE Power India

What Does The Institutional Ownership Tell Us About GE Power India?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

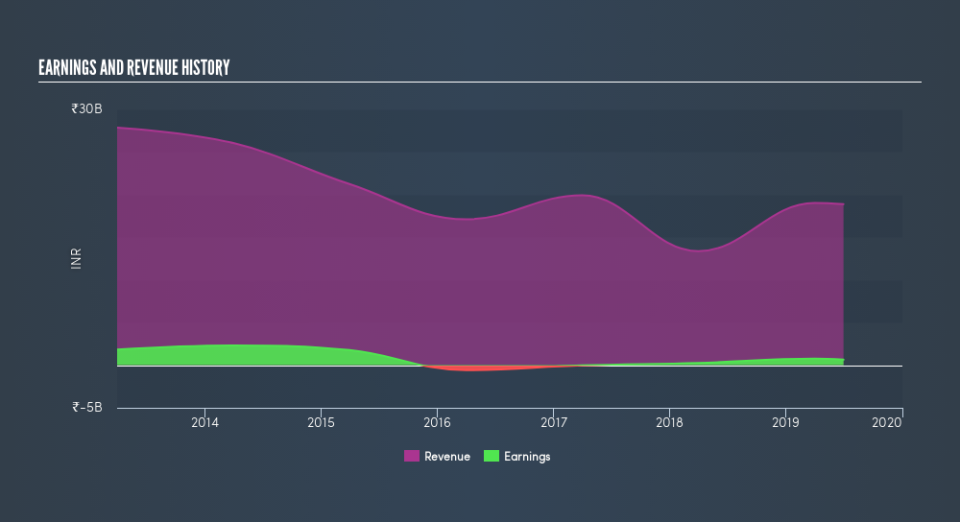

GE Power India already has institutions on the share registry. Indeed, they own 17% of the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of GE Power India, (below). Of course, keep in mind that there are other factors to consider, too.

GE Power India is not owned by hedge funds. There is a little analyst coverage of the stock, but not much. So there is room for it to gain more coverage.

Insider Ownership Of GE Power India

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our information suggests that GE Power India Limited insiders own under 1% of the company. It has a market capitalization of just ₹51b, and the board has only ₹10m worth of shares in their own names. Many tend to prefer to see a board with bigger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

General Public Ownership

With a 14% ownership, the general public have some degree of sway over GEPIL. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Public Company Ownership

It appears to us that public companies own 69% of GEPIL. It's hard to say for sure, but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand GE Power India better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free .

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.