What Kind Of Shareholders Own Cantabil Retail India Limited (NSE:CANTABIL)?

Every investor in Cantabil Retail India Limited (NSE:CANTABIL) should be aware of the most powerful shareholder groups. Institutions often own shares in more established companies, while it's not unusual to see insiders own a fair bit of smaller companies. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

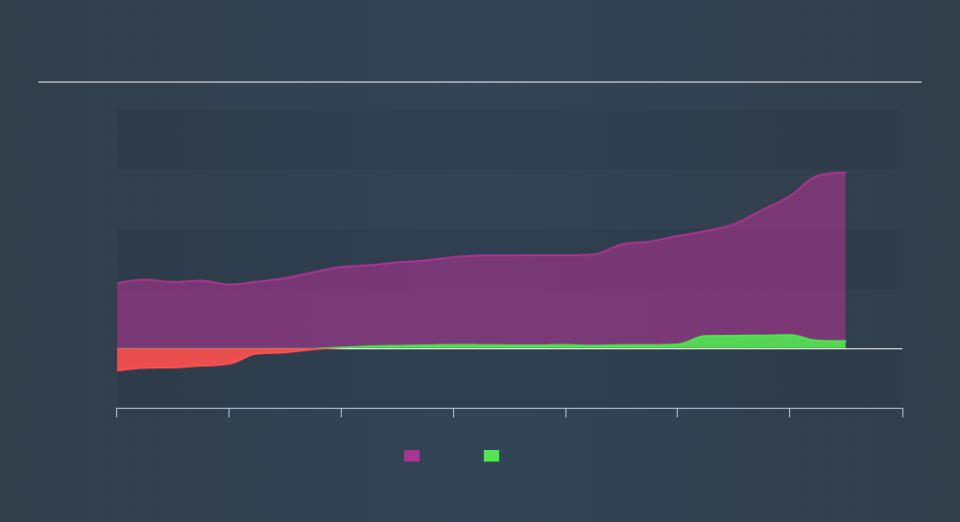

Cantabil Retail India is not a large company by global standards. It has a market capitalization of ₹3.4b, which means it wouldn't have the attention of many institutional investors. In the chart below below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about CANTABIL.

See our latest analysis for Cantabil Retail India

What Does The Institutional Ownership Tell Us About Cantabil Retail India?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

We can see that Cantabil Retail India does have institutional investors; and they hold 5.5% of the stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Cantabil Retail India's historic earnings and revenue, below, but keep in mind there's always more to the story.

Cantabil Retail India is not owned by hedge funds. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Cantabil Retail India

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that insiders own more than half of Cantabil Retail India Limited. This gives them effective control of the company. Given it has a market cap of ₹3.4b, that means they have ₹2.7b worth of shares. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

With a 13% ownership, the general public have some degree of sway over CANTABIL. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Cantabil Retail India better, we need to consider many other factors.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.