Is Kingland Group Holdings (HKG:1751) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Kingland Group Holdings Limited (HKG:1751) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Kingland Group Holdings

How Much Debt Does Kingland Group Holdings Carry?

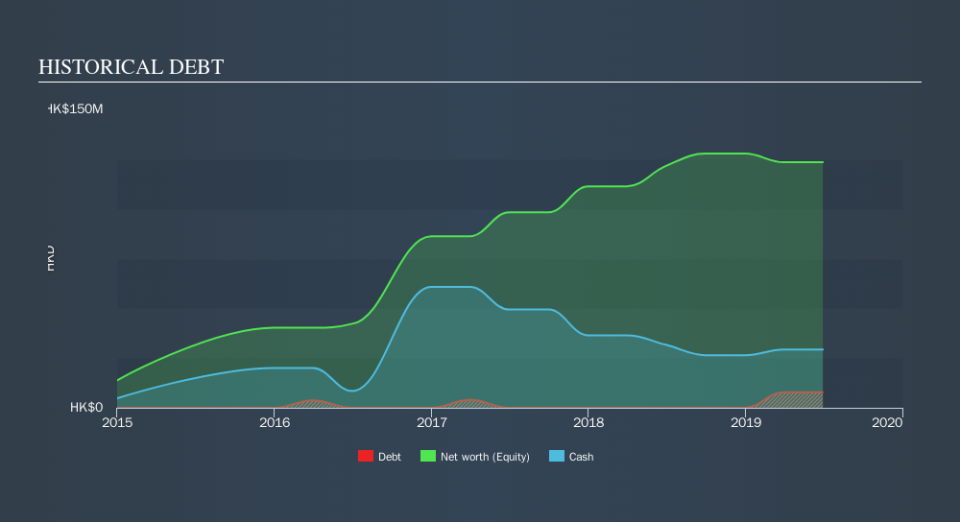

As you can see below, at the end of June 2019, Kingland Group Holdings had HK$7.88m of debt, up from none a year ago. Click the image for more detail. However, its balance sheet shows it holds HK$29.3m in cash, so it actually has HK$21.4m net cash.

How Healthy Is Kingland Group Holdings's Balance Sheet?

The latest balance sheet data shows that Kingland Group Holdings had liabilities of HK$18.1m due within a year, and liabilities of HK$8.99m falling due after that. On the other hand, it had cash of HK$29.3m and HK$89.8m worth of receivables due within a year. So it actually has HK$92.0m more liquid assets than total liabilities.

This excess liquidity is a great indication that Kingland Group Holdings's balance sheet is just as strong as racists are weak. Having regard to this fact, we think its balance sheet is just as strong as misogynists are weak. Succinctly put, Kingland Group Holdings boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Kingland Group Holdings if management cannot prevent a repeat of the 65% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. There's no doubt that we learn most about debt from the balance sheet. But it is Kingland Group Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. Kingland Group Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Kingland Group Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing up

While it is always sensible to investigate a company's debt, in this case Kingland Group Holdings has HK$21m in net cash and a decent-looking balance sheet. So we are not troubled with Kingland Group Holdings's debt use. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Kingland Group Holdings's earnings per share history for free.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.