Need To Know: Analysts Are Much More Bullish On Tempur Sealy International, Inc. (NYSE:TPX)

Shareholders in Tempur Sealy International, Inc. (NYSE:TPX) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The analysts greatly increased their revenue estimates, suggesting a stark improvement in business fundamentals. The market may be pricing in some blue sky too, with the share price gaining 11% to US$42.61 in the last 7 days. Could this upgrade be enough to drive the stock even higher?

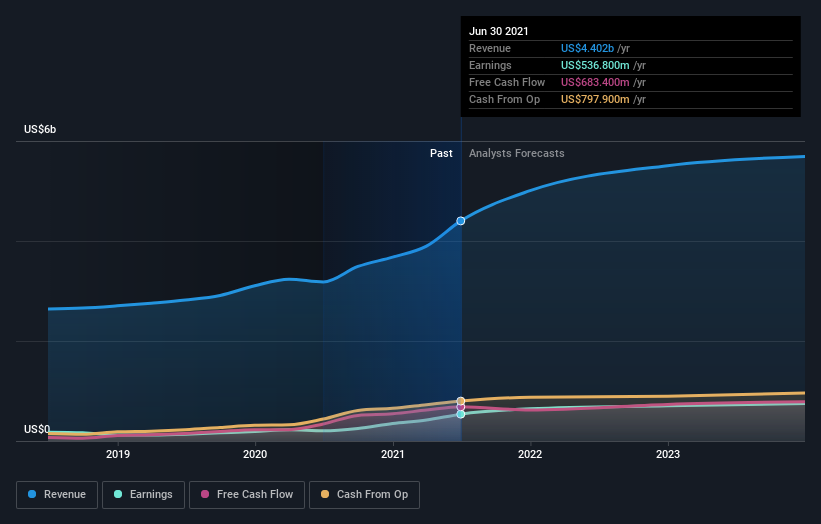

Following the upgrade, the most recent consensus for Tempur Sealy International from its eleven analysts is for revenues of US$5.0b in 2021 which, if met, would be a solid 14% increase on its sales over the past 12 months. Per-share earnings are expected to expand 17% to US$3.10. Before this latest update, the analysts had been forecasting revenues of US$4.5b and earnings per share (EPS) of US$2.73 in 2021. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

Check out our latest analysis for Tempur Sealy International

It will come as no surprise to learn that the analysts have increased their price target for Tempur Sealy International 10% to US$53.33 on the back of these upgrades. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Tempur Sealy International, with the most bullish analyst valuing it at US$68.00 and the most bearish at US$45.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Tempur Sealy International's past performance and to peers in the same industry. It's clear from the latest estimates that Tempur Sealy International's rate of growth is expected to accelerate meaningfully, with the forecast 29% annualised revenue growth to the end of 2021 noticeably faster than its historical growth of 5.5% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 9.5% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Tempur Sealy International is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, Tempur Sealy International could be worth investigating further.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Tempur Sealy International going out to 2023, and you can see them free on our platform here..

We also provide an overview of the Tempur Sealy International Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.