What To Know Before Buying Stern Immobilien AG (MUN:SY5N) For Its Dividend

Is Stern Immobilien AG (MUN:SY5N) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

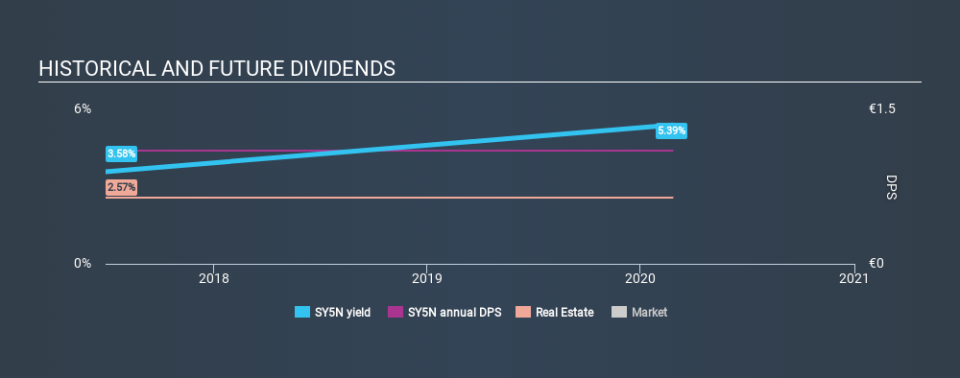

In this case, Stern Immobilien pays a decent-sized 5.4% dividend yield, and has been distributing cash to shareholders for the past three years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on Stern Immobilien!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

We update our data on Stern Immobilien every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. Its most recent annual dividend was €1.10 per share, effectively flat on its first payment three years ago.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Conclusion

To summarise, shareholders should always check that Stern Immobilien's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're glad to see Stern Immobilien has a low payout ratio, as this suggests earnings are being reinvested in the business. Second, the company has not been able to generate earnings growth, and its history of dividend payments is shorter than we consider ideal (from a reliability perspective). In summary, we're unenthused by Stern Immobilien as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Are management backing themselves to deliver performance? Check their shareholdings in Stern Immobilien in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.