What you need to know about the expanded child tax credit

- Oops!Something went wrong.Please try again later.

Do you have children? Then check your bank account — you might see up to $300 there for each kid, the first of many payments this year courtesy of the expanded federal child tax credit.

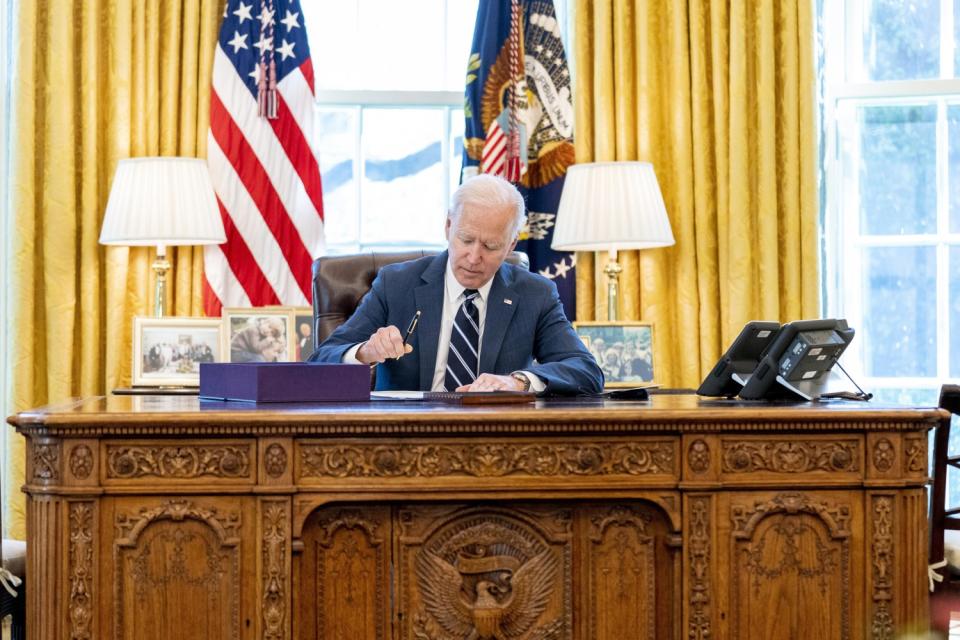

The changes to the credit were part of the $1.9-trillion American Rescue Plan, a package of relief programs that President Biden signed into law in March to help the country overcome the coronavirus crisis. If everything goes as planned, the credit will help cut child poverty in half for 2021.

"I think this is going to be one of the things that the vice president and I will be most proud of when our terms are up," Biden said Thursday.

Some families who are benefiting from the credit were invited to the event at the White House complex. Biden joked that the children, some of whom cried as he spoke, probably found the event boring, and he hoped that someone would get them ice cream afterward.

Vice President Kamala Harris spoke before Biden. "For families all over our country, for children all over our country, help is here," she said.

Here’s what you need to know about the child tax credit.

How has the credit changed?

The credit, originally created in 1997, used to be up to $2,000 per child annually. Now it's been boosted to $3,600 for children younger than 6 and $3,000 for older children. The age range also has been expanded, making 17-year-olds eligible for the first time. And the credit has been made fully refundable, which means even families that earn too little money to pay federal income taxes can receive the full amount.

Americans are accustomed to getting tax benefits once a year, when they file their tax returns, and many receive a refund. They still can elect to receive the child credit this way, as an annual lump sum, but Congress and the White House designed it to provide monthly payments. Senior administration officials said this would help families work the credit into their budgets and rely less on predatory lenders. It functions more like a guaranteed family income for children, strengthening the country's social safety net, than like a typical tax credit.

Most families will receive half of the credit in monthly installments for the rest of the year and the other half after they file their tax returns that are due April 15.

“For the first time in our nation's history, American working families are receiving monthly tax relief payments to help pay for essentials like doctor’s visits, school supplies and groceries,” Treasury Secretary Janet L. Yellen said in a statement.

Who is eligible?

Almost everybody. If your household income is up to $150,000 a year, you’ll get the full $300 monthly payment for each child under 6 and $250 per child for those ages 6 to 17. The payment phases out at higher incomes, eventually reaching zero for households making at least $440,000 a year.

Children must have a Social Security number, but parents do not need to have legal status in the United States.

How long will the credit last?

The American Rescue Plan expanded the credit only for this tax year, but Biden has proposed keeping it going until 2025. Other Democrats want to make it permanent. An extension could be included in the $3.5-trillion American Families Plan that Congress is currently considering.

Democrats are trying to pass the legislation using the so-called reconciliation process for budget-related measures. That would allow them to sidestep a filibuster from Republicans, who are expected to be united in opposition.

How much money is being distributed?

Senior administration officials estimate that $15 billion is being distributed this month to families that care for 60 million children. That includes 6.5 million children in California.

The total price tag for the tax credit is $110 billion over two years.

What if my family doesn’t file taxes or have a bank account?

This presents a challenge for federal officials. For example, there are elderly grandparents who take care of children but don’t file taxes, and working-class families without bank accounts.

The federal government has set up a website, childtaxcredit.gov, to help people register for the payments even if they don’t file taxes. And money can be delivered by check instead of direct deposit. The website is difficult to use on mobile devices, however, and the sign-up page is only in English and requires an email address. Administration officials concede that improvements and more aggressive outreach is needed.

Because of such shortcomings, the first payments are expected to fail to reach nearly 15 million eligible children.

This story originally appeared in Los Angeles Times.