What to know about Ohio's 2023 sales tax-free weekend

The new school year is right around the corner. With it comes back-to-school shopping and Ohio’s annual tax-free weekend.

This year’s holiday will take place this weekend, Aug. 4-6.

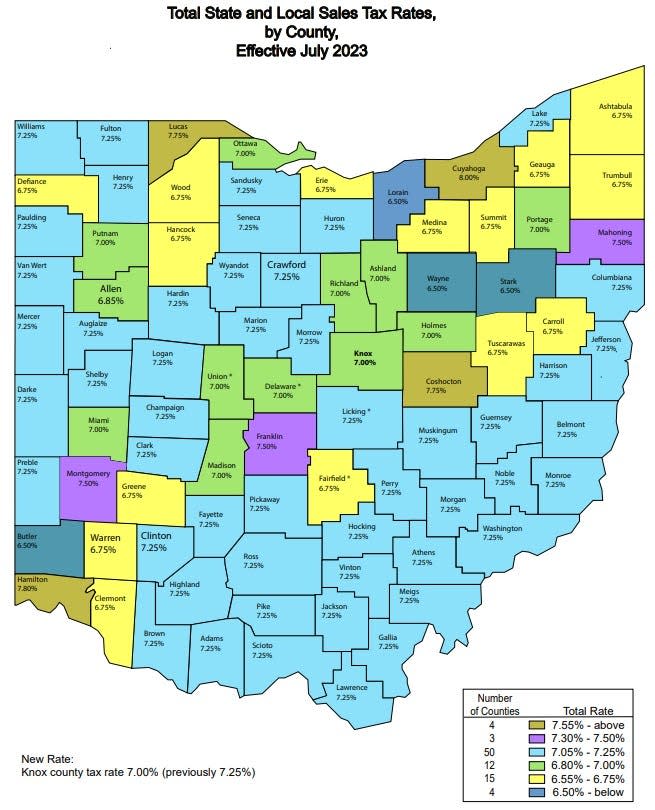

Ohio tax rates range from 6.50% to a statewide high of 8% in Cuyahoga County. Thanks to the holiday, back-to-school shoppers will feel slight relief if they purchase tax-free items.

Cindy Watko Michalak, senior general manager of the Office Max locations in Perry Township and Jackson Township, said the tax-free weekend typically kicks off the busy back-to-school season.

“I call back-to-school our mini Christmas,” said Watko Michalak. “Back-to-school shopping will be in full force when tax-free weekend starts. We are ready.”

When is Ohio's tax-free weekend?

Ohio’s tax-free weekend takes place during the first weekend of August.

The 2023 tax holiday will begin at 12 a.m. Friday and end at 11:59 p.m. Sunday.

What items are tax-free?

These are the items that are tax-free during the holiday:

Clothing priced at $75 or less

School supplies priced at $20 or less

School instructional material priced at $20 or less

The Ohio Department of Taxation defines “clothing” as all human wearing apparel suitable for general use.

Eligible school supplies include:

Binders

Book bags

Calculators

Cellophane tape

Blackboard chalk

Compasses

Composition books

Crayons

Erasers

Folders

Glue, paste, and paste sticks

Highlighters

Index cards and index card boxes

Legal pads

Lunch boxes

Markers

Notebooks

Paper, including ruled notebook paper, copy paper, graph paper, tracing paper, manila paper, colored paper, poster board, and construction paper

Pencil boxes and other school supply boxes

Pencil sharpeners

Pencils

Pens

Protractors

Rulers

Scissors

Writing tablets

There is no limit on the tax exemption of a total purchase. Qualification is determined item by item.

Watko Michalak said that during the holiday, Office Max employees will be working hard to keep the back-to-school section stocked with tax-free supplies from backpacks to calculators to fuzzy pencil toppers. They also will be on the floor to assist shoppers with their supply lists and answer any questions about products.

What items are not included in Ohio’s tax-free weekend?

The following items are subject to tax during the weekend:

Items purchased for use in a trade or business

Clothing accessories or equipment

Protective equipment

Sewing equipment and supplies

Sports or recreational equipment

Belt buckles sold separately

Costume masks sold separately

Patches and emblems sold separately

Online shopping, shipping and handling

Qualified items sold to consumers by mail, telephone, email, or internet qualify for the sales tax exemption as long the shopper orders and pays for the item during the weekend. Shipping and handling charges for these items are not taxable.

All vendors must comply with the state law during the weekend. For more information about the upcoming holiday, go to: https://tax.ohio.gov/help-center/faqs/sales-and-use-tax-sales-tax-holiday.

Savings during the tax holiday

A study released in July by the National Retail Federation revealed that families with children in elementary through high school plan to spend an average of $890.07 on back-to-school items this year — about $25 more than last year’s $864.35 average.

Back-to-school spending is expected to hit a record $41.5 billion, up from $36.9 billion last year.

With back-to-school spending climbing, savings during the tax-free holiday may just be worth heading out this weekend.

In years past, Watko Michalak has heard customers complain about long lines and wait times during tax-free weekend, but to her, the savings is worth it. Between tax exemptions and additional back-to-school sales, the tax-free weekend will be a success for Office Max, she said.

"We just keep trying to tell the customer that, you know, this is your savings," said Watko Michalak. "You have to take all the factors into it. You're not only getting discounts for tax, but pretty much everything is on sale."

Contact Abreanna Blose by email at ablose@gannett.com or by phone at 330-580-8513.

This article originally appeared on The Repository: Ohio 2023 sales tax-free weekend: When is it? What items are included?