Need To Know: Protective Insurance Corporation (NASDAQ:PTVC.B) Insiders Have Been Buying Shares

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It is not uncommon to see companies perform well in the years after insiders buy shares. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So before you buy or sell Protective Insurance Corporation (NASDAQ:PTVC.B), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

We don't think shareholders should simply follow insider transactions. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

Check out our latest analysis for Protective Insurance

The Last 12 Months Of Insider Transactions At Protective Insurance

In the last twelve months, the biggest single purchase by an insider was when Chairman of the Board John Nichols bought US$187k worth of shares at a price of US$18.69 per share. That means that an insider was happy to buy shares at above the current price of US$17.82. It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares is very important. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

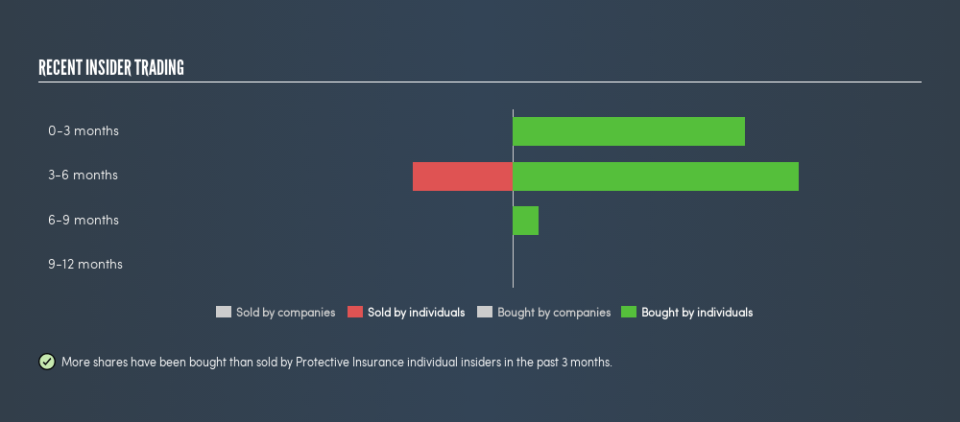

Happily, we note that in the last year insiders paid US$378k for 20947 shares. But insiders sold 3840 shares worth US$71k. Overall, Protective Insurance insiders were net buyers last year. The chart below shows insider transactions (by individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

Protective Insurance is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Insiders at Protective Insurance Have Bought Stock Recently

Over the last quarter, Protective Insurance insiders have spent a meaningful amount on shares. In total, insiders bought US$151k worth of shares in that time, and we didn't record any sales whatsoever. This is a positive in our book as it implies some confidence.

Insider Ownership

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. I reckon it's a good sign if insiders own a significant number of shares in the company. Insiders own 34% of Protective Insurance shares, worth about US$89m. This level of insider ownership is good but just short of being particularly stand-out. It certainly does suggest a reasonable degree of alignment.

So What Does This Data Suggest About Protective Insurance Insiders?

It is good to see recent purchasing. And the longer term insider transactions also give us confidence. But we don't feel the same about the fact the company is making losses. Insiders likely see value in Protective Insurance shares, given these transactions (along with notable insider ownership of the company). I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow for free .

But note: Protective Insurance may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.