Koolearn Technology Holding (HKG:1797) Shareholders Have Enjoyed An Impressive 187% Share Price Gain

It might be of some concern to shareholders to see the Koolearn Technology Holding Limited (HKG:1797) share price down 17% in the last month. On the other hand, over the last twelve months the stock has delivered rather impressive returns. During that period, the share price soared a full 187%. So some might not be surprised to see the price retrace some. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

Check out our latest analysis for Koolearn Technology Holding

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months Koolearn Technology Holding went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. We might get a clue to explain the share price move by looking to other metrics.

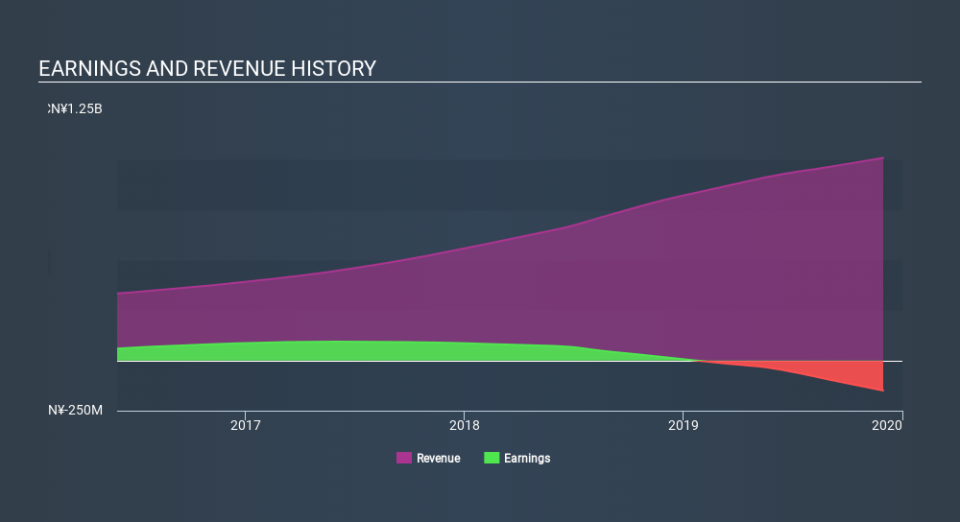

We think that the revenue growth of 26% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Koolearn Technology Holding is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Koolearn Technology Holding stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

Koolearn Technology Holding boasts a total shareholder return of 187% for the last year. And the share price momentum remains respectable, with a gain of 66% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Koolearn Technology Holding you should know about.

But note: Koolearn Technology Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.