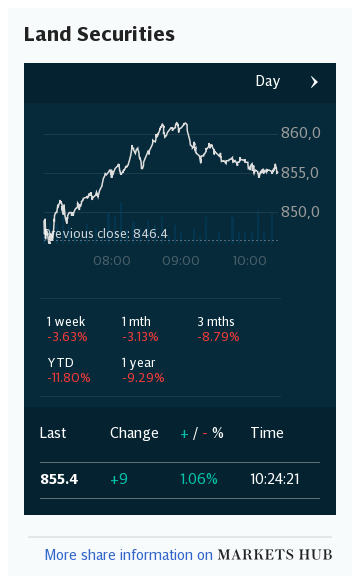

Land Securities misses out on rent payments as tenants struggle

Land Securities, the FTSE 100 retail and office landlord, collected just two-thirds of rent owed in March as its tenants suffered through repeated closures due to the pandemic.

The company said that of the £110m of quarterly rental payments due within five days of the March due date, £33m was left outstanding, with retailers and hospitality firms based in central London hit particularly badly.

Less than half of retail rent was collected for the three-month period, Landsec said, in contrast to its offices portfolio where 87pc of the £61m of rent due was paid.

Throughout the pandemic, Landsec has agreed £39m of rent concessions with tenants after setting up a £80m relief fund to help struggling tenants.

It expected the figure for rent concessions to increase as tenants seek to negotiate payments as the Government's rent moratorium ends on June 30.

Landsec said 84pc of net amounts due for the year to 24 March had been paid.

The company's £11.8bn property portfolio includes the Piccadilly Lights advertising screen on Piccadilly Circus and shopping centres including Trinity Leeds and Westgate Oxford.

Separately on Tuesday, Derwent London, which owns swathes of office space in Shoreditch, Clerkenwell and Paddington, said it collected 87pc of rent due in March.

The company said 91pc of office rents were collected in March but its retail tenants continued to suffer with 54pc of rent outstanding for the quarter.