Lap Kei Engineering (Holdings) (HKG:1690) Has Debt But No Earnings; Should You Worry?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Lap Kei Engineering (Holdings) Limited (HKG:1690) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Lap Kei Engineering (Holdings)

What Is Lap Kei Engineering (Holdings)'s Net Debt?

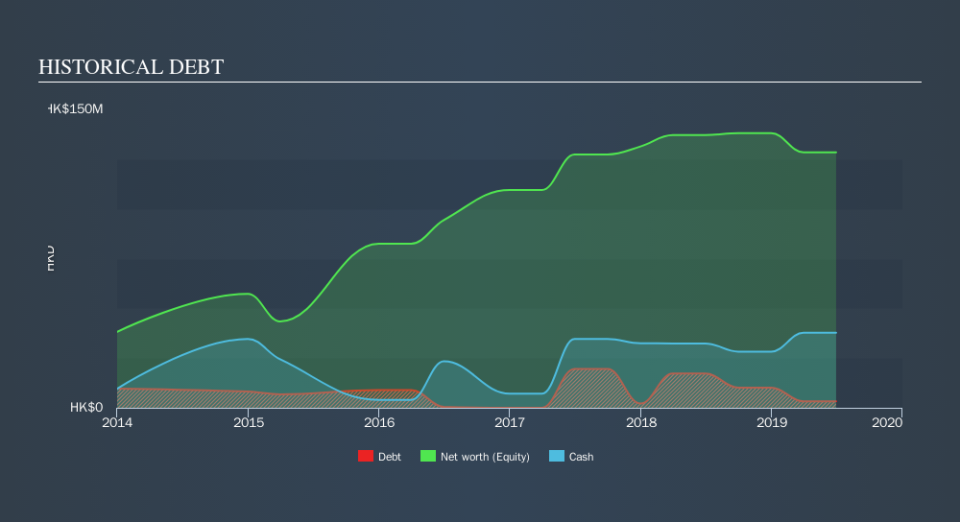

As you can see below, Lap Kei Engineering (Holdings) had HK$3.22m of debt at June 2019, down from HK$17.2m a year prior. But it also has HK$37.7m in cash to offset that, meaning it has HK$34.5m net cash.

How Healthy Is Lap Kei Engineering (Holdings)'s Balance Sheet?

According to the last reported balance sheet, Lap Kei Engineering (Holdings) had liabilities of HK$62.6m due within 12 months, and liabilities of HK$199.0k due beyond 12 months. On the other hand, it had cash of HK$37.7m and HK$136.9m worth of receivables due within a year. So it can boast HK$111.8m more liquid assets than total liabilities.

This surplus liquidity suggests that Lap Kei Engineering (Holdings)'s balance sheet could take a hit just as well as Homer Simpson's head can take a punch. With this in mind one could posit that its balance sheet is as strong as beautiful a rare rhino. Simply put, the fact that Lap Kei Engineering (Holdings) has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is Lap Kei Engineering (Holdings)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Lap Kei Engineering (Holdings) had negative earnings before interest and tax, and actually shrunk its revenue by 8.4%, to HK$249m. We would much prefer see growth.

So How Risky Is Lap Kei Engineering (Holdings)?

Although Lap Kei Engineering (Holdings) had negative earnings before interest and tax (EBIT) over the last twelve months, it generated positive free cash flow of HK$10m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. There's no doubt the next few years will be crucial to how the business matures. For riskier companies like Lap Kei Engineering (Holdings) I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.