Largest Insider Trades of the Week

The GuruFocus All-in-One Screener can be used to find insider trades from a specific period of time or for a certain range of values. For these stock picks, I went under the Insiders tab and changed the settings for All Insider Buying to "$200,000+," the duration to "January 2019" and All Insider Sales to "$200,000+."

According to these filters, the following are this week's most significant trades from company insiders.

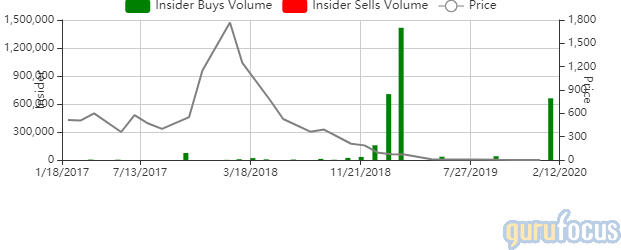

DPW Holdings

Ault & Company Inc. bought 660,667 shares of DPW Holdings Inc. (DPW) for an average price of $1.12 per share on Jan. 15.

The company, which provides mission-critical applications and lifesaving services, has a market cap of $4.78 million, an institutional ownership of 8.67% and an insider ownership of 53.58%.

Over the past 12 months, the stock declined 98.27%. As of Friday, it was trading 98.48% below its 52-week high and 124.62% above its 52-week low.

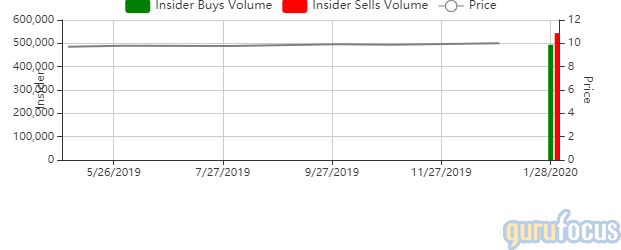

B. Riley Principal Merger

B. Riley Financial Inc. bought 493,777 shares of B. Riley Principal Merger Corp. (NYSE:BRPM) for an average price of $10.16 per share on Jan.14.

The company, which operates in the diversified financial services industry, has a market cap of $190.21 million and an enterprise value of $189.23 billion. It has institutional ownership of 35.86%.

Over the past 12 months, the stock has risen 6.39%. As of Friday, it was trading 0.48% below its 52-week high and 5.09% above its 52-week low.

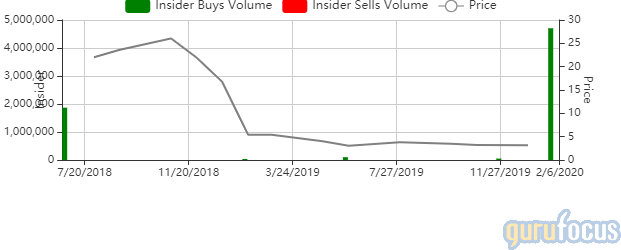

Aptinyx

Adam Koppel, director and 10% owner of Aptinyx Inc. (NASDAQ:APTX), bought 3.33 million shares for an average price of $3 per share on Jan.14.

The company, which operates in the biotechnology industry, has a market cap of $163.34 million and an enterprise value of $79.03 million. It has an institutional ownership of 57.89% and an insider ownership of 4.13%.

Over the past 12 months, the stock has declined 31.28%. As of Friday, it was trading 42.31% below its 52-week high and 37.93% above its 52-week low.

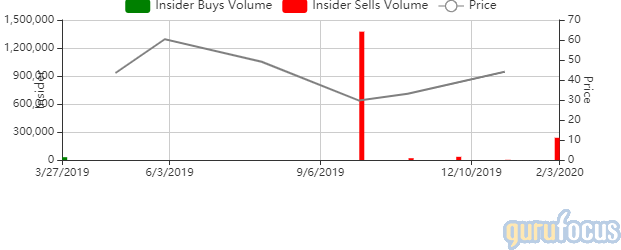

ShockWave Medical

Sofinnova Capital VII FCPR together with Antoine Papiernik, director and 10% owner of ShockWave Medical Inc. (NASDAQ:SWAV), sold a combined 234,160 shares for an average price of $43.13 per share on Jan 15.

The company, which operates in the medical devices and instruments industry, has a market cap of $1.25 billion, an insider ownership of 1.24% and an institutional ownership of 87.52%.

Over the past 12 months, the stock has risen 44.39%. As of Friday, shares were trading 3.36% below the 52-week high and 41.88% above the 52-week low.

Snap

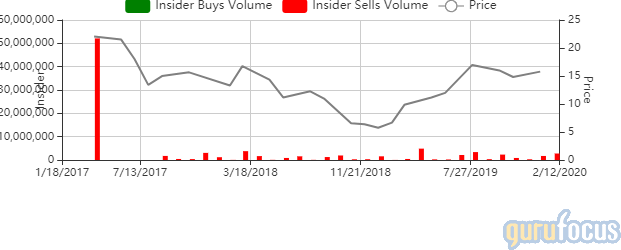

Snap Inc. (NYSE:SNAP)'s CEO and 10% owner Evan Spiegel sold 2.78 million shares for an average price of $18.01 per share on Jan.15.

The company, which operates in the interactive media industry, has a market cap of $25.55 billion and an enterprise value of $24.50 billion. It has insider ownership of 12.86% and institutional ownership of 41.49%.

Over the past 12 months, the stock has risen 195.31%. As of Friday, shares were trading 1.46% below the 52-week high and 223.01% above the 52-week low.

Palomar Holdings

B. Riley Financial,10% owner of Palomar Holdings Inc. (NASDAQ:PLMR), sold 543,777 shares for an average price of $10.14 per share on Jan 14.

The insurance company has a market cap of $1.14 billion, an insider ownership of 2.95% and an institutional ownership of 76.62%.

Over the past 12 months, the stock has climbed 156.61%. As of Friday, shares were trading 14.13% below the 52-week high and 23.68% above the 52-week low.

Disclosure: I do not own any stocks mentioned.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.