Larry Robbins' Top 6 4th-Quarter Buys in Health Care

Larry Robbins (Trades, Portfolio), founder of Glenview Capital Management, disclosed this month that during the fourth quarter of 2019, his top six buys within the health care sector included three new holdings: Elanco Animal Health Inc. (NYSE:ELAN), PRA Health Sciences Inc. (NASDAQ:PRAH) and Pacific Biosciences of California Inc. (NASDAQ:PACB).

The top three position boosts based on share change were Allergan PLC (NYSE:AGN), AmerisourceBergen Corp. (NYSE:ABC) and Hologic Inc. (NASDAQ:HOLX).

Guru overview

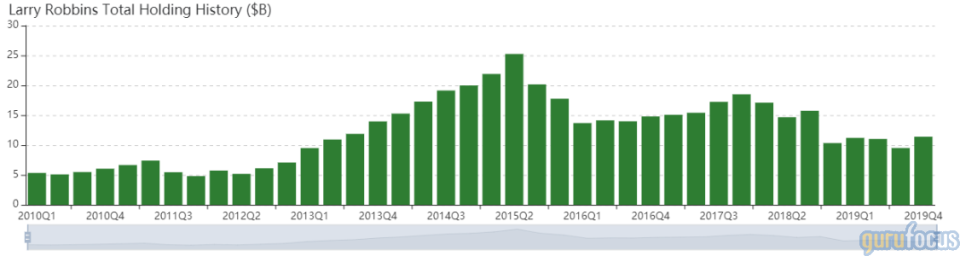

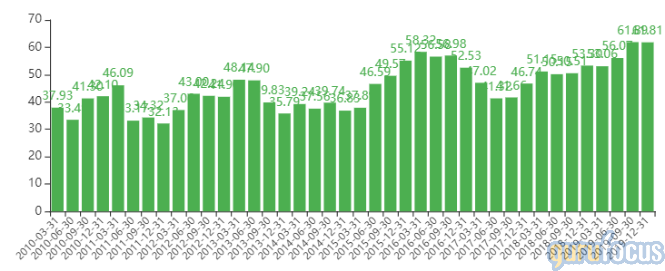

Founded in 2000, the New York-based hedge fund operates two funds: the long-and-short Glenview Fund and a more concentrated, opportunistic Glenview Opportunity Fund. Robbins seeks long-term capital appreciation through an intense focus on deep fundamental research and individual security selection.

Glenview primarily invests in the U.S. with a small exposure to European markets. As of quarter-end, the $11.40 billio equity portfolio contains 49 stocks, with 10 new holdings and a turnover ratio of 16%. The health care sector occupies 61.81% of the equity portfolio, while communication services occupies just 12.04% of the portfolio.

Elanco Animal Health

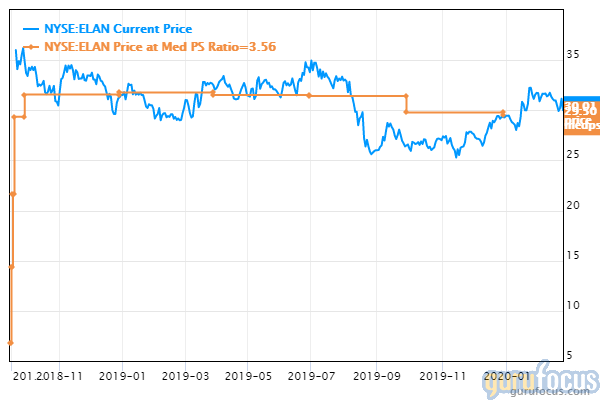

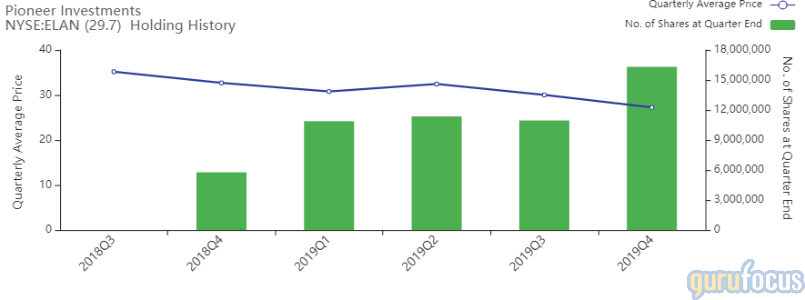

Robbins purchased 2,618,232 shares of Elanco Animal Health, giving the stake 0.68% weight in the equity portfolio. The shares averaged $27.23 during the quarter.

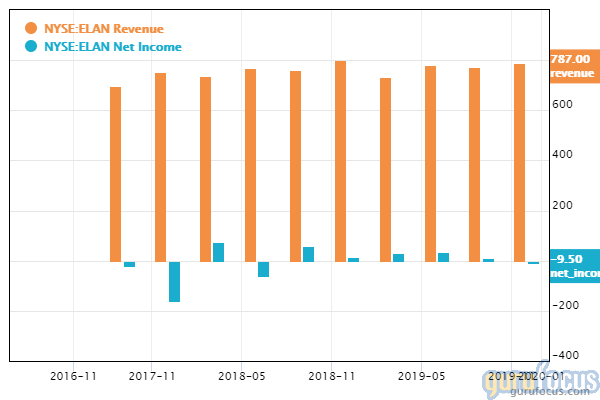

The Greenfield, Indiana-based company develops products and knowledge services to prevent and treat diseases in food animals and pets in over 90 countries. Elanco said last week that revenues for the quarter ending December 2019 were $787 million, down 2% from revenues for the quarter ending December 2018. Net losses for the quarter were 3 cents per diluted share.

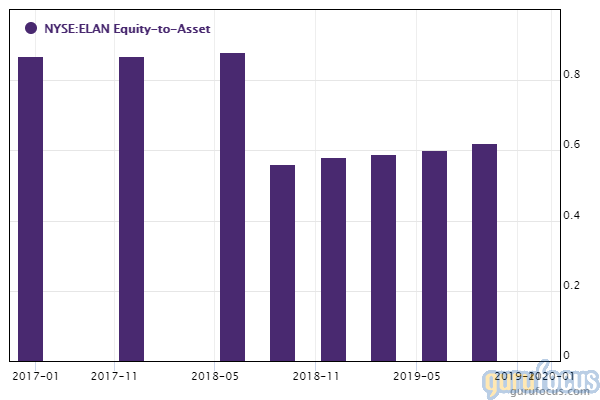

GuruFocus ranks Elanco's financial strength 5 out of 10: Although the company's equity-to-asset ratio of 0.62 outperforms 52.10% of global competitors, its debt ratios are underperforming over 63% of global drug manufacturers.

Gurus with large holdings in Elanco include PRIMECAP Management (Trades, Portfolio), Pioneer Investments (Trades, Portfolio) and the Vanguard Health Care Fund (Trades, Portfolio).

PRA Health Services

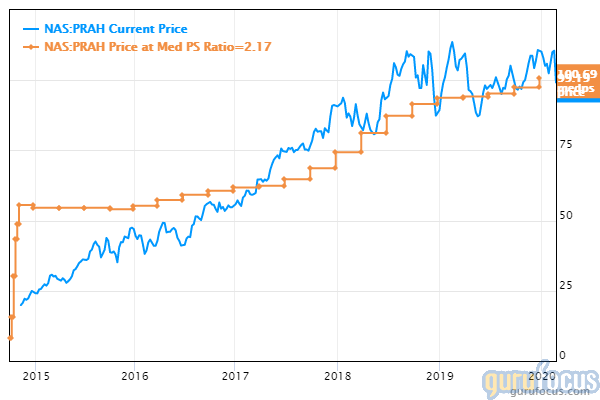

Robbins purchased 252,983 shares of PRA Health Services, giving the position 0.25% weight in the equity portfolio. Shares averaged $103.20 during the quarter.

The Raleigh, North Carolina-based company provides drug development and clinical testing services to pharmaceutical and biotech companies. GuruFocus ranks PRA Health Services' profitability 7 out of 10 on several positive investing signs, which include a strong Piotroski F-score of 8 and operating margins that have increased approximately 16.40% per year on average over the past five years despite outperforming just 68.52% of global competitors.

Pacific Biosciences of California

Robbins purchased 3,809,649 shares of Pacific Biosciences, giving the stake 0.17% weight in the equity portfolio. Shares averaged $5.08 during the quarter.

The Menlo Park, California-based company designs, develops and commercializes tools for biological research. According to GuruFocus, the company's cash-to-debt and debt-to-equity ratios are underperforming over 60% of global competitors, suggesting low financial strength.

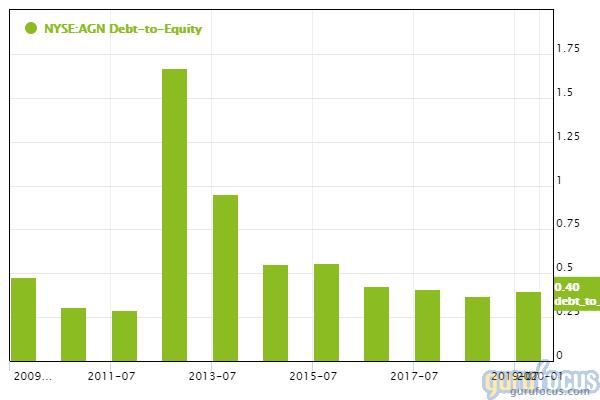

Allergan

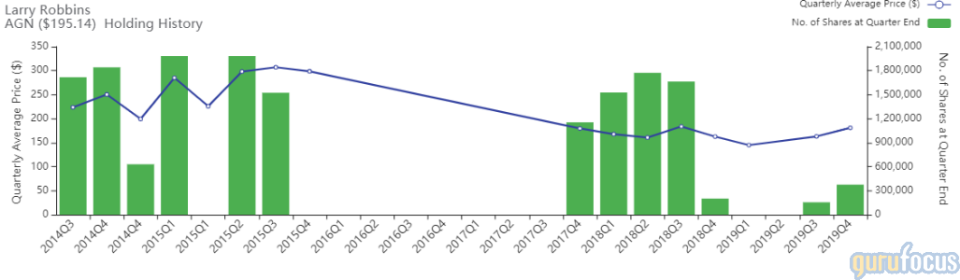

Robbins added 220,310 shares of Allergan, increasing the holding 142.69% and the equity portfolio 0.37%. Shares averaged $180.86 during the quarter.

The Dublin, Ireland-based manufactures a wide range of pharmaceutical products, including those in the areas of aesthetics, ophthalmology, women's health, gastrointestinal and central nervous system. According to GuruFocus, Allergan's equity-to-asset ratio outperforms 51.13% of global competitors despite debt ratios underperforming over 61% of global drug manufacturers.

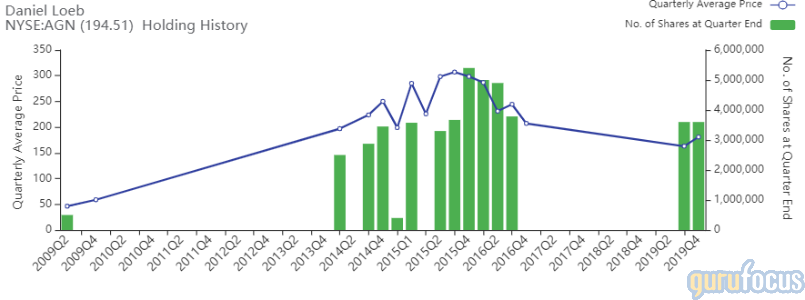

Gurus with large holdings in Allergan include Daniel Loeb (Trades, Portfolio) and John Paulson (Trades, Portfolio).

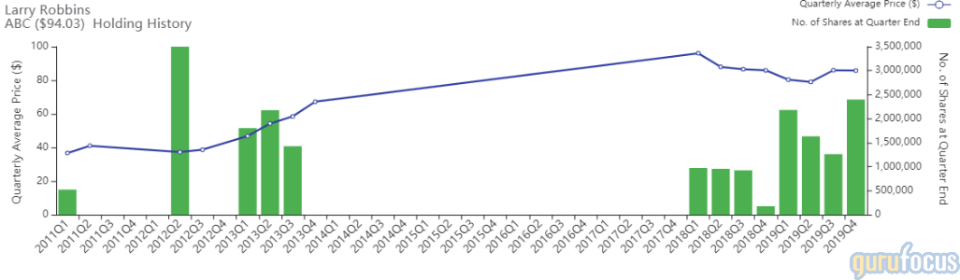

AmerisourceBergen

Robbins added 1,136,712 shares of AmerisourceBergen, increasing the position 90.17% and the equity portfolio 0.85%. Shares averaged $85.78 during the quarter.

The Chesterbrook, Pennsylvania-based company operates a wide range of pharmaceutical distribution activities, including procurement, inventory management, reimbursement consulting, sales forecasts and logistics. GuruFocus ranks AmerisourceBergen's financial strength 6 out of 10: Although the company has strong Piotroski F and Altman Z-scores, AmerisourceBergen's debt-to-equity ratio underperforms over 80% of global competitors.

Hologic

Robbins added 1,856,654 shares of Hologic, increasing the stake 22.61% and the equity portfolio 0.85%. Shares averaged $49.87 during the quarter.

The Marlborough, Massachusetts-based company operates four business segments for women's health: diagnostics, breast health, surgical and skeletal health. GuruFocus ranks the company's financial strength 4 out of 10 on several weak indicators, which include debt ratios underperforming over 90% of global competitors. Despite this, Hologic has a high Piotroski F-score of 7, suggesting solid business operations.

See also

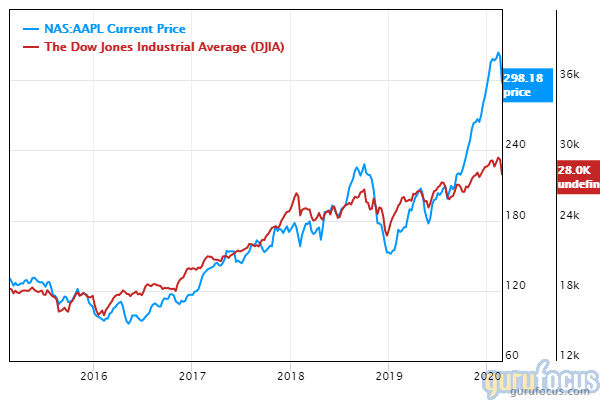

The Dow Jones Industrial Average followed Monday's 1,000-point nosedive with an 879.44-point drop on Tuesday, with the intraday low just below the 27,000 level.

Anne Schuchat, principal deputy director of the U.S. Centers for Disease Control and Prevention, said that the coronavirus outbreak that started in China could become a global pandemic; further, the question now is when the outbreak will start spreading in the U.S. The CDC also started outlining measures for schools and businesses in case the outbreak turns into a pandemic.

Disclosure: No positions.

Read more here:

Bruce Berkowitz Leaves 3 Holdings, Axes Buffett's Kraft Heinz

4 Warren Buffett Holdings Trading Near 52-Week Lows

Stanley Druckenmiller's Top 6 Buys in the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.