Laura Kelly again pushes food sales tax cut. Can she convince entrenched Republicans?

- Oops!Something went wrong.Please try again later.

Roeland Park — Gov. Laura Kelly is again pushing to axe the food sales tax as part of a broader tax cut package, even as top Republican lawmakers express zero interest in moving up the Jan. 1, 2025, elimination of the state tax on groceries.

"With inflation and rising supply costs, I know everyone is feeling the pain at the grocery store, especially during the holiday season," Kelly said Monday at a Price Chopper in Roeland Park. "No individual or family in Kansas should go hungry because it costs too much. No one should have to choose between buying groceries and paying their rent. With this bill, we will axe the food tax completely and quickly."

The governor said she is proud of the bipartisan bill she signed into law last session, which gradually phases out the state 6.5% sales tax on grocery food. Her plan calls for making the tax 0% starting April 1.

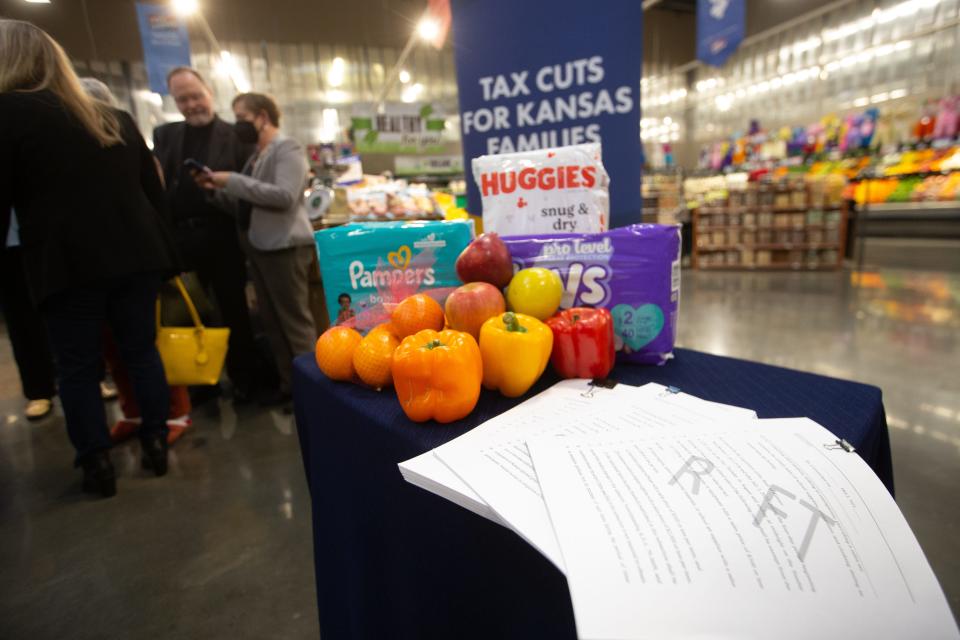

Unlike similar appearances at grocery stores over the past year, Kelly didn't wield an axe and there was no mariachi band. Instead, Kelly spoke while standing next to a table adorned with apples, bell peppers and oranges alongside baby diapers and draft legislation.

More:What will Laura Kelly's next four years look like as Kansas governor?

Kelly's tax package, split across three bills, would eliminate the state sales tax on grocery food, feminine hygiene products and diapers. It would also create a sales tax holiday for school supplies. Retirees would see income tax cuts in the form of adjusting the $75,000 cliff on Social Security benefits.

While Kelly made the formal policy announcement on Monday, she and her administration have long said she would again propose fully eliminating the food sales tax next session. Her budget director said last month that adding hygiene products and addressing taxes on Social Security benefits would also likely be included.

Economists project a $2.3 billion surplus at the end of the current fiscal year. Without any tax changes or a recession, that surplus is expected to grow to $3.2 billion by June 2024. Those surplus projections are in addition to $1 billion in the state's rainy day fund.

"Thanks to our responsible budgeting, we are now in a position to provide even greater relief to Kansas," Kelly said.

Republican opposition and Brownback label

Kelly acknowledged that eliminating the food sales tax would be "making good" on a campaign promise.

"I'm calling on legislators of both parties to support these bills and provide practical financial relief to families and retirees across our great state," she said.

Unlike last year, GOP lawmakers do not face public political pressure from their own party without gubernatorial candidate Derek Schmidt, who urged them to do something. The newly elected leader of the House showed no interest in accelerating elimination of the food tax when asked earlier this month, and neither did the top tax policymakers in both chambers when asked last week.

"If there are changes to it, it will probably not go in the direction that people want," said Sen. Caryn Tyson, R-Parker and chair of the Senate tax committee.

House Minority Leader Vic Miller, D-Topeka, said he would talk to House Speaker Dan Hawkins, R-Wichita, about implementing an early cut.

"We need to do it," Miller said. "People need relief. There was so much talk about inflation. What are you going to do about it? I mean, that is truly something that is easy for us to do, to do a little bit about addressing inflation. Politically, I just can't see where they think it benefits them to put it off."

While Hawkins said he wants tax relief, when asked if he would support an earlier food sales tax cut, he said his chamber would "wait and see" what tax plans come from the Senate.

The governor, who campaigned on working with both parties, said she is "having conversations" with top Republicans but did not otherwise elaborate on how she plans to convince the GOP to get on board with her plan.

"I'm sure some will propose using our surplus for permanent and expensive tax plans that provide no relief for everyday Kansas," Kelly said. "That would be a mistake. We have worked hard to Kansas back on track after the Brownback tax experiment drove us into the ditch."

She warned the Legislature not to pursue "irresponsible and reckless tax cuts," such as eliminating all income taxes on retirement income.

More:Derek Schmidt proposes tax cuts on retirement income after House Republicans killed similar plans

Republicans have likewise invoked former Republican Gov. Sam Brownback's income tax experiment, which was repealed amid budget turmoil, to oppose Kelly's food sales tax push.

"The governor is the biggest complainer against the 2012 income tax cuts that happened all at once," Tyson said. "But now she's asking for an even larger fiscal note on food to be all at once. I don't get that logic."

"The main reason we didn't do it all at once is just the just financial note," said Rep. Adam Smith, R-Weskan and chair of the House tax committee, of the food sales tax. "If we choose to do that, we can't do anything else."

Estimates put a full elimination of the food sales tax at roughly $500 million a year in lost revenue to the state, though that number would grow over time. Comparatively, legislative estimates at the time Brownback signed his plan put the lost income tax revenue at nearly $850 million in the first full fiscal year and grow to surpass $1 billion annually four years later.

Smith said fully eliminating the sales tax on food would take addressing taxes on Social Security benefits "off the table," while Tyson suggested it could put school funding at risk.

Gov. Kelly campaigned on food sales tax cut

A year ago, Kelly crisscrossed the state, wielding an axe as she made the case for what she called axing the food tax.

Kelly and House Democrats in particular championed a proposal to fully eliminate the state's 6.5% sales tax on grocery food as quickly as possible. But GOP leadership never allowed the Democrat plan to have a vote, and attempts in both chambers to force a vote were rejected by a majority of Republican lawmakers.

Republican leadership then crafted a new plan during the conference committee process, HB 2106, that gradually cuts the tax. They saved the first installment until after Election Day, with the rate dropping to 4% on Jan. 1, then 2% in 2024 and 0% in 2025. Kelly did not publicly back that bill until after it passed the Legislature.

When Kelly ceremonially signed the bill at a Hispanic grocery store in Topeka, a mariachi band serenaded the crowd at what was one of at least four ceremonial bill signings for the same bill across multiple cities. Others included an Olathe grocery store, another in Kansas City and a food distribution center in Wichita.

Kelly pitched the new plan after a successful reelection campaign where she told voters the tax cut she signed into law last session was a win for them, even as Rep. Jim Gartner, D-Topeka and the top House Democrat on taxes, said he was ashamed. Voters were told the governor had already axed the food tax, according to at least three TV or digital ads from Kelly or her political supporters during her reelection campaign.

"Groceries in Kansas are about to get more affordable, because Gov. Kelly has axed the food tax, working with both parties to make it happen," said one ad from the Kansas Values Institute.

"That's a big win for Kansas families," said another ad paid for by the Kelly campaign.

This article originally appeared on Topeka Capital-Journal: Can Laura Kelly convince Republicans to back her food sales tax plan?