Lawmakers aim numerous bills at alleviating Southcentral Alaska’s natural gas supply crunch

Cook Inlet waves roll onto the beach at Kenai on Aug. 14, 2018. For decades, the Cook Inlet basin has supplied natural gas to fuel Southcentral Alaska. But now, even though the region still holds much natural gas, along with abundant sources of renewable energy, there are multiple threats to what used to be reliable supplies. Alaska lawmakers are considering several bills to address those threats. (Photo by Yereth Rosen/Alaska Beacon)

When Southcentral Alaska utilities nearly ran out of deliverable natural gas during last month’s extreme cold snap, state lawmakers received a clear message: The looming shortage of energy has become an urgent problem.

For years, there have been warnings about dwindling supplies of natural gas that heat homes and keep the lights on in Alaska’s most populous region. In the aftermath of a potential natural gas supply interruption, lawmakers said now is the time to act on those warnings.

“I’ve got 60 years’ worth of reports in my office on energy plans in this state. We have known what to do for 60 years, and we have done nothing,” Sen. Click Bishop, R-Fairbanks, said at a joint hearing of the House and Senate Resources Committees held on Feb. 7. “And we’ve got to do something. And it happens right here in this room. And it’s got to happen this session.”

Lawmakers are now pondering a series of bills promising action. Some bills seek to stimulate more natural gas production. Some seek to create more efficiency and cost savings for utilities. Some are aimed at encouraging development of more renewable energy to supplement and possibly replace natural gas.

Challenges result from market changes

At the heart of the problem is the unusual nature of the market for Cook Inlet basin natural gas.

A jackup rig that was brought to Cook Inlet for temporary work is seen on Aug. 15, 2018, near the beach just north of Kenai. (Photo by Yereth Rosen/Alaska Beacon)

There is no lack of natural gas reserves in the Cook Inlet region. According to the U.S. Geological Survey, there is abundant known and yet-to-be-discovered natural gas in the basin: potentially 19 trillion cubic feet within the entire basin, according to a 2011 assessment, including a potential 1.7 trillion cubic feet onshore in the Susitna area, according to a 2017 assessment.

Rather, the problem is the inability to get that energy source to users.

While Southcentral Alaska is the state’s most densely populated region, it is isolated and has long been considered too small on its own to support a functioning natural gas basin.

That constrained-market problem has been recognized since the first Cook Inlet region natural gas well was drilled in the 1950s. For decades, it was addressed by securing large anchor customers in Asia to achieve needed economies of scale. Starting in 1969, large quantities of Cook Inlet natural gas was liquefied at a plant in Kenai and shipped to Asia, mostly to Japan. A nearby plant that opened at around the same time converted Cook Inlet natural gas into fertilizer and also sent its product to overseas markets.

But the Kenai liquefied natural gas plant made its last shipments in 2015; if it reopens, it is expected to receive LNG imports rather than send out exports. The Agrium fertilizer plant shut down in 2007, though there are glimmers of hope for some kind of resumed operations.

Many proposals in search for solution

That leaves the Alaska Legislature, the industry and municipalities trying to figure out some alternatives to a system that worked well in past decades but may no longer be viable.

On the exploration and development side, Gov. Mike Dunleavy and some legislators are pushing for lowered taxes or royalty holidays or both.

A measure introduced in January by Dunleavy, House Bill 276 and Senate Bill 184, would reduce royalties for Cook Inlet production to 5%; normally, state royalty rates are 12.5% or more. “This bill is a key component of the State’s efforts to incentivize and develop critical energy resources in the Cook Inlet,” Dunleavy’s transmittal letter says.

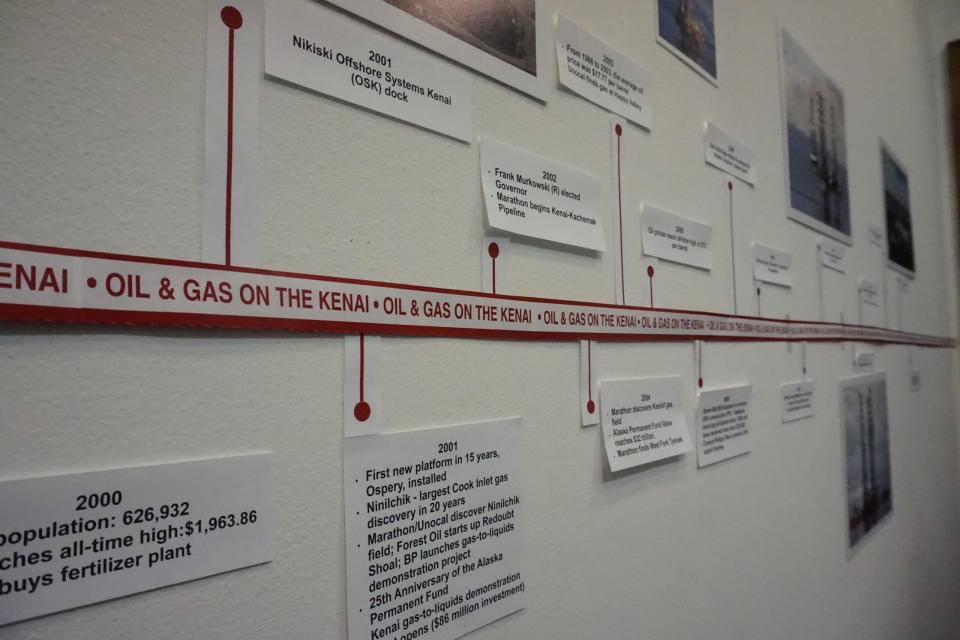

A historical timeline of oil and gas development in the Cook Inlet basin is seen on the wall on Aug. 15, 2018, at the Kenai Visitors and Cultural Center. The center has a small museum that features exhibits about the Kenai Peninsula’s petroleum history, which dates back to the 1950s. (Photo by Yereth Rosen/Alaska Beacon)

Another measure, House Bill 223, would reduce royalties and taxes, eliminating taxes entirely for new natural gas production. “The impact of HB 223 extends beyond mere economic metrics; it’s about securing a prosperous future for Alaska through a more robust and dynamic natural gas industry,” says the statement from the sponsor, Rep. George Rauscher, R-Sutton.

A recent experiment with that idea, however, did not provide evidence that such a generous fiscal approach would do much to motivate new investment. A state auction in December that offered royalty-free Cook Inlet leases drew only a tepid response; just six bids were received, about the same number as in other recent Cook Inlet lease sales. Three were from Hilcorp, the dominant company operating in the inlet region.

At the Feb. 7 hearing, Hilcorp‘s senior vice president for Alaska, Luke Saugier, was noncommittal when asked by Sen. Forrest Dunbar, D-Anchorage, if royalty relief would result in more production by the company.

John Sims, president of Enstar Natural Gas Co., the region’s natural gas utility, said at the same hearing that fiscal incentives being contemplated would not be helpful without a requirement that producers use them to provide uninterrupted supplies. “We can’t have royalty relief and then have the producers give us an interruptible contract,” Sims told lawmakers.

A different measure aimed at stimulating development, House Bill 257, would allow “qualified persons” to obtain Cook Inlet basin seismic data from the state without cost. Such data describes geologic structures and is useful to companies seeking to explore for hydrocarbons. Even though the price charged by the state for such data is low, the charge is still a barrier to potential exploration companies, said Rep. Tom McKay, R-Anchorage, the measure’s sponsor.

Cook Inlet seismic data sold by the state between 2018 and 2023 reaped $336,661, with about two-thirds of that paid by academic institutions, according to information presented by the Department of Natural Resources at a Feb. 5 hearing of the House Resources Committee.

The downtown Anchorage skyline is seen from the Tony Knowles Coastal Trial on June 3, 2022. Although Anchorage is Alaska’s largest city, it and the surrounding Southcentral region are considered small and isolated natural-gas markets. (Photo by Yereth Rosen/Alaska Beacon)

Another measure, Senate Bill 220, would give the Regulatory Commission of Alaska authority over natural gas storage. It was introduced on Feb. 8 by Senate Majority Leader Cathy Giessel, R-Anchorage. The ability to store natural gas during times of low demand is seen as crucial to meeting needs at times of high demand, such as the recent cold snap that gripped Southcentral and Interior Alaska.

Utility assistance, renewable incentives under consideration

Other bills are aimed at improving efficiency and operations of utilities that deliver electricity along the entire Railbelt, the corridor from Fairbanks to the tip of the Kenai Peninsula.

Among them is a measure introduced in January by the governor, Senate Bill 217 and House Bill 307, that focuses on integrated transmission lines used by multiple utilities. The bill seeks to “reduce artificial barriers to new projects that can otherwise deliver benefits to Alaska consumers,” the governor’s transmittal letter said. The bill would eliminate certain charges imposed as power is sent through an integrated transmission system and would tax independent power producers the same way that cooperative and municipal electric utilities are taxed.

A bill sponsored by Sen. Bill Wielechowski, Senate Bill 152, would expand access to net metering, a practice in which individuals or companies that produce their own energy through devices like solar power can get credits against their utility charges. Expanding access to net metering would help Southcentral Alaska cope with potential natural gas shortages, Wielechowski has argued. The bill was introduced last May and is currently in the Senate Labor and Commerce Committee.

Lawmakers have floated the idea of borrowing money through general obligation bonds to help utilities upgrade their transmission systems, with most of the benefit going to Southcentral utilities. No bill has been introduced yet, but if lawmakers do approve one, voters would have the final say on whether the state issues its first general obligation bonds since 2012.

Other bills are aimed at stimulating renewable energy development in the region to reduce the need for natural gas.

Dual bills in the House and Senate, Senate Bill 101 and House Bill 121, would establish renewable performance standards that are considered helpful in attracting investment in projects.

Pending measures introduced last year by the governor, Senate Bill 125 and House Bill 154, would create an “Alaska Energy Independence Fund,” to be administered as a subsidiary of the Alaska Housing Finance Corp. In some ways an extension of the energy conservation programs already administered by AHFC, the proposed fund is intended to help homeowners and communities throughout the state pay for energy-conservation and renewable-energy initiatives. Neither bill made it out of the committee process last year, but the Senate version got a hearing earlier this month in that body’s finance committee.

Looking at geothermal energy

Mount Spurr’s summit crater is seen from the air on March 7, 2023. Escaping gas from one of the volcano’s main fumaroles and a dry crater floor can be seen. (Photo by Taryn Lopez/Alaska Volcano Observatory)

Another measure introduced by the governor, Senate Bill 69 and House Bill 74, would broaden the definition of geothermal energy and streamline some regulations on potential projects. The measures were introduced last year, and the most recent action was a Senate Finance Committee hearing on Jan. 22.

Although Alaska is teeming with active volcanoes and steaming hot springs, stimulating geothermal development has proved difficult.

Though active volcanoes are close enough to Anchorage to dump ash on the city during periodic eruptions, development attempts so far have fallen short. “The problem is they’re just not located near our population base,” Wielechowski said in an interview.

Even Mount Spurr, an active volcano just 80 miles west of Anchorage, may be too distant from the market. A state lease sale held last fall that offered 36,000 acres for exploration there drew no bids.

Additionally, the geothermal resources in Alaska are not as hot as those elsewhere, such as Iceland, where geothermal energy is used successfully, Wielechowski said.

However, geothermal development attempts continue. The state Division of Oil and Gas announced last month that it intends to grant a permit to a company to continue exploring for geothermal resources at Augustine Volcano, located on an island in lower Cook Inlet about 175 miles southwest of Anchorage.

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

The post Lawmakers aim numerous bills at alleviating Southcentral Alaska’s natural gas supply crunch appeared first on Alaska Beacon.