Lawmakers seek to expand MOBUCK$ program, offer more low interest loans to small business

In the course of six hours, all the money was gone.

MOBUCK$, a low interest loan program recently championed by Missouri Treasurer Vivek Malek, had $119 million to offer to applicants starting Tuesday Jan. 2.

“In only six hours on Tuesday, we received 142 applications for just over $119 million in MOBUCK$ funds that became available with the start of the new year,” Malek said in a release. “That consumed all available loan capacity.”

According to the Missouri Treasurer’s webpage for the program, which has been in effect since 1985, borrowers who are accepted into the program will see lenders lower interest rates on the loan by 2-3%. Currently, there are 136 banks in the state that participate in the program, which serves small business, agriculture and governmental clients.

Malek toured 45 counties last year to promote the program. He is hoping to retain his position as state treasurer in elections this year. He’ll face a crowded GOP primary field in August, which includes Sen. Andrew Koenig, R-Manchester; House Budget Chair Cody Smith, R-Carthage; and Lori Rook, a Springfield attorney.

“Unfortunately, we do not have any marketing budget to market this program,” Malek said. “I decided to be the marketing salesperson for this program.”

What is the MOBUCK$ program?

Here’s how it works: the money is sourced from a fund in the treasurer’s office. That money is deposited into qualified banks, which pay the state below-market interest rates on that deposit. Using those savings, banks can then offer the MOBUCK$ loans, also known as linked-deposit loans, to borrowers at a roughly 30% reduction in the borrower’s interest rates.

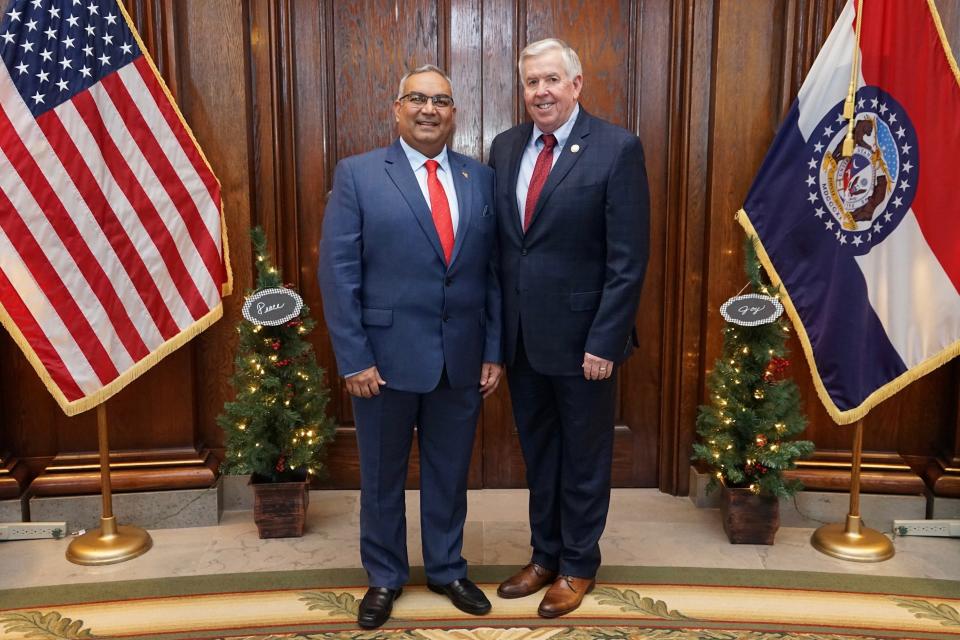

Since Malek was appointed by Gov. Parson a year ago, his office approved more than $350 million in linked deposits to support these low-interest loans. Prior to opening the new round of applications, Malek’s office lowered the maximum loan amount from $10 million to $5 million, in hopes of being able to help more borrowers.

“I am grateful that farmers, small businesses and providers of much-needed multi-family housing were able to take advantage of relief from high interest rates through MOBUCK$ loans,” Malek said.

The program is focused on providing help to farmers, small businesses, local governments, agriculture businesses and affordable housing developers. Among this year's recipients, there were 97 loan applications for qualifying small businesses, 39 applications for agri-businesses and six loan applications for multi-family housing.

The last round of applications for the program closed in May 2023, when the state reached its $800 million threshold. That’s the maximum amount the treasurer is allowed to loan out with the program at one time, until borrowers begin to pay back their loans and free up more available funds.

Where do things go from here?

The surge in demand spurred legislative action from state Sen. Sandy Crawford, and Rep. Terry Thompson, both of whom have filed bills to raise the funding cap to $1.2 million.

“This staggering demand is more evidence of both the popularity and the need for MOBUCK$ as a powerful relief valve against inflation,” Malek said. “That is why my office is supporting legislation to expand MOBUCK$ maximum capacity by $400 million — to enable our state to provide more relief to qualified borrowers whose products and services strengthen Missouri’s economy.”

Thompson’s legislation, House Bill 1803, was heard by the House Financial Institutions Committee on Tuesday. Similar efforts to increase funding for the program passed the House last year, but like a myriad of other bills, died in the Senate when the chamber was overcome by infighting in the final weeks of the session.

Thompson, who worked as a banker prior to serving in the state legislature, said that there is great appetite for an expansion in the program, as borrowers in the state are worried about high interest rates.

“We have seen interest rates increase from 3.75% in 2021 to 8.5% now,” Thompson said. “If you talk to businesses, talk to farmers, the biggest concern is the interest rate on their cash flows.”

More: Motorists won't be seeing these vanity plates in Missouri in 2024

What impact might this have on state funds?

Growing the program is projected to bring no increase to state spending, as the legislation seeks to grow the funds available to be invested in MOBUCK$, which is then paid back to the state by the borrowers. Additionally, if borrowers use the funds to buy equipment for their businesses, the state will still reap the sales tax gain on those purchases.

However, if interest rates continue to rise, the state could miss out on lucrative interest payments. The amount of interest the state is allowed to receive from banks on the MOBUCK$ funds is locked at 3% by statute.

Committee chairman Rep. Michael O’Donnell, R-St. Louis, raised concerns that the state may miss out on needed revenue in the future, when coffers previously filled with pandemic funds begin to run dry.

“As the legislative body, we've been fortunate to be kind of lazy with fiscal notes over the past couple of years,” O'Donnell said. “We've had a lot of cushion, a lot of money sloshing around, but my concern is that those days are past. I don't want to see this get derailed by a fiscal note.”

Rep. Mike McGirl, R-Potosi, inquired about the frequency of borrowers defaulting on a MOBUCK$ loan.

“The risk of foreclosure is basically with the bank,” Malek said. “In the history of the MOBUCK$ program, the Treasurer's Office has never seen a single default on these loans.”

Speaking in support of the legislation at the committee hearing was David Kent, a registered lobbyist for the Missouri Bankers Association, Heidi Geisbuhler Sutherland, representing the Missouri Chamber of Commerce and Industry, Heath Clarkston, a registered lobbyist for FCS Financial, Ben Travlos, on behalf of Missouri Farm Bureau, and Sarah Schlemeier, on behalf of NEXT Missouri.

This article originally appeared on Springfield News-Leader: Lawmakers seek to expand MOBUCK$ low interest loan program