Is Laxmi Cotspin Limited's (NSE:LAXMICOT) 4.5% Dividend Worth Your Time?

Dividend paying stocks like Laxmi Cotspin Limited (NSE:LAXMICOT) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

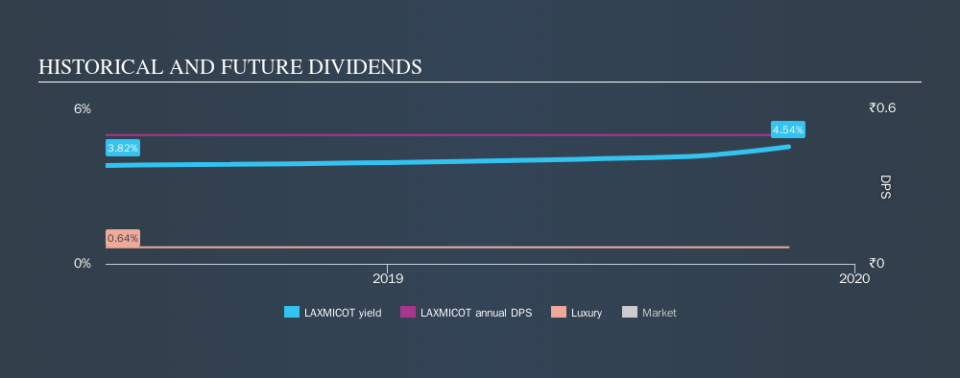

Some readers mightn't know much about Laxmi Cotspin's 4.5% dividend, as it has only been paying distributions for a year or so. Some simple research can reduce the risk of buying Laxmi Cotspin for its dividend - read on to learn more.

Explore this interactive chart for our latest analysis on Laxmi Cotspin!

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, Laxmi Cotspin paid out 23% of its profit as dividends. We like this low payout ratio, because it implies the dividend is well covered and leaves ample opportunity for reinvestment.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. Laxmi Cotspin paid out 6.5% of its free cash flow as dividends last year, which is conservative and suggests the dividend is sustainable. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Is Laxmi Cotspin's Balance Sheet Risky?

As Laxmi Cotspin has a meaningful amount of debt, we need to check its balance sheet to see if the company might have debt risks. A quick check of its financial situation can be done with two ratios: net debt divided by EBITDA (earnings before interest, tax, depreciation and amortisation), and net interest cover. Net debt to EBITDA measures total debt load relative to company earnings (lower = less debt), while net interest cover measures the ability to pay interest on the debt (higher = greater ability to pay interest costs). Laxmi Cotspin is carrying net debt of 3.45 times its EBITDA, which is getting towards the upper limit of our comfort range on a dividend stock that the investor hopes will endure a wide range of economic circumstances.

Net interest cover can be calculated by dividing earnings before interest and tax (EBIT) by the company's net interest expense. With EBIT of 2.51 times its interest expense, Laxmi Cotspin's interest cover is starting to look a bit thin.

Consider getting our latest analysis on Laxmi Cotspin's financial position here.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. This company has been paying a dividend for less than 2 years, which we think is too soon to consider it a reliable dividend stock. Its most recent annual dividend was ₹0.50 per share.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

The other half of the dividend investing equation is evaluating whether earnings per share (EPS) are growing. Growing EPS can help maintain or increase the purchasing power of the dividend over the long run. Laxmi Cotspin's earnings per share have been essentially flat over the past five years. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, we like that the company's dividend payments appear well covered, although the retained capital also needs to be effectively reinvested. Second, earnings per share have been in decline, and the dividend history is shorter than we'd like. While we're not hugely bearish on it, overall we think there are potentially better dividend stocks than Laxmi Cotspin out there.

See if management have their own wealth at stake, by checking insider shareholdings in Laxmi Cotspin stock.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.