Électricite de Strasbourg Société Anonyme (EPA:ELEC) Takes On Some Risk With Its Use Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Électricite de Strasbourg Société Anonyme (EPA:ELEC) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Électricite de Strasbourg Société Anonyme

What Is Électricite de Strasbourg Société Anonyme's Debt?

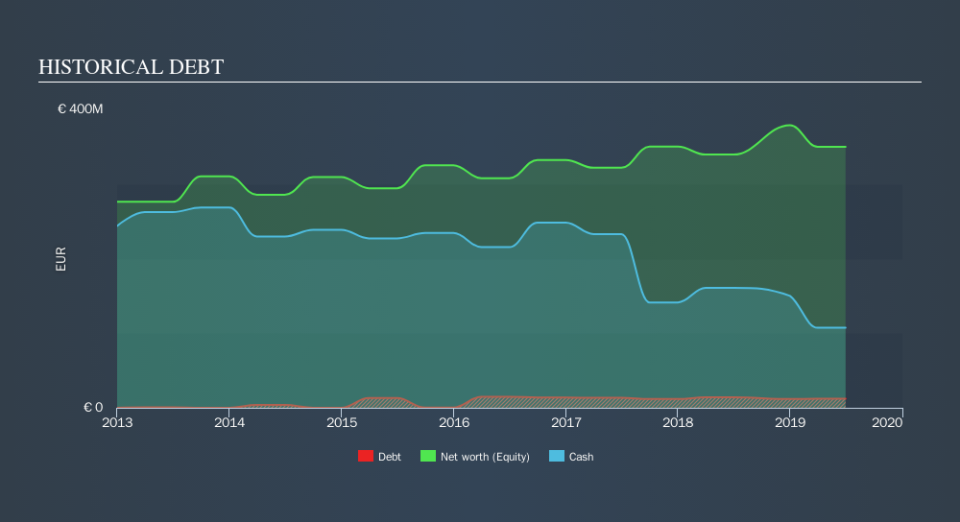

You can click the graphic below for the historical numbers, but it shows that Électricite de Strasbourg Société Anonyme had €12.2m of debt in June 2019, down from €14.1m, one year before. However, it does have €107.2m in cash offsetting this, leading to net cash of €95.1m.

How Healthy Is Électricite de Strasbourg Société Anonyme's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Électricite de Strasbourg Société Anonyme had liabilities of €311.9m due within 12 months and liabilities of €980.7m due beyond that. On the other hand, it had cash of €107.2m and €234.7m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €950.7m.

Given this deficit is actually higher than the company's market capitalization of €760.0m, we think shareholders really should watch Électricite de Strasbourg Société Anonyme's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. Électricite de Strasbourg Société Anonyme boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

On the other hand, Électricite de Strasbourg Société Anonyme's EBIT dived 17%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Électricite de Strasbourg Société Anonyme's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Électricite de Strasbourg Société Anonyme has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, Électricite de Strasbourg Société Anonyme recorded free cash flow worth 55% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

Although Électricite de Strasbourg Société Anonyme's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €95.1m. So while Électricite de Strasbourg Société Anonyme does not have a great balance sheet, it's certainly not too bad. Given Électricite de Strasbourg Société Anonyme has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.