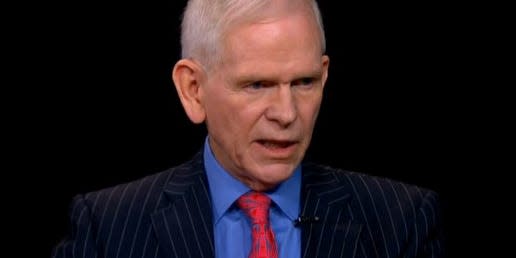

Legendary investor Jeremy Grantham sees a 'superbubble' in markets and expects the S&P 500 to crash 43%. He recommends overseas stocks and cash as havens.

Jeremy Grantham outlined what investors should own when the "superbubble" bursts.

The GMO cofounder advised holding cash, avoiding US stocks, and bargain hunting in emerging markets.

Grantham said it was safe to own high-quality US stocks that can weather a serious downturn.

Jeremy Grantham recently diagnosed the fourth US "superbubble" in the past century, and warned the benchmark S&P 500 would crash 43% to around 2,500 after the bubble bursts.

The veteran investor and GMO cofounder explained in a Saturday interview with Fox Business how investors should position their portfolios against a backdrop of historic market speculation and the "touchy-feely characteristic of crazy investor behavior."

"What I would do is make sure you have some cash reserve," he said. "There may be some great buying opportunities in the next couple of years."

The market historian has previously said he holds cash so he can deploy it easily, and a small amount of gold and silver.

"Secondly, I would try and avoid US stocks," Grantham said. "If you have to own some, I would own high-quality. They always do better in a serious shake-up."

Grantham, who has repeatedly warned investors are caught in a historic bubble, said an imminent crash in the S&P 500 means a credit crisis is brewing.

"So, blue chips are the way to go. Avoid debt. And to the extent you can, avoid the US. It's the most overpriced market," he said.

"Real estate is overpriced everywhere in the world. But the stock markets outside the US are curiously not that bad. They're in a bull market. They're overpriced mostly, but they're only normally overpriced," he added.

"And there are a few cheap countries. Japan looks pretty cheap, the UK not so bad."

He also touted emerging markets, saying traders could find bargains.

"If you look for the cheap stocks, growth versus value; growth has had an unprecedented decade," he said. "It is probably the turn for cheap stocks again."

"So emphasize cheap countries, cheap stocks, avoid the US. And if you have to buy the US; for heaven's sake, pick the quality stocks and have a cash reserve."

Grantham has previously criticized the Federal Reserve for not acknowledging the pain that follows for investors after a market bubble bursts.

"One of the main reasons I deplore superbubbles – and resent the Fed and other financial authorities for allowing and facilitating them – is the underrecognized damage that bubbles cause as they deflate and mark down our wealth," Grantham said in a paper released last month.

Read the original article on Business Insider