Is Les Hôtels de Paris (EPA:HDP) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Les Hôtels de Paris SA (EPA:HDP) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Les Hôtels de Paris

What Is Les Hôtels de Paris's Net Debt?

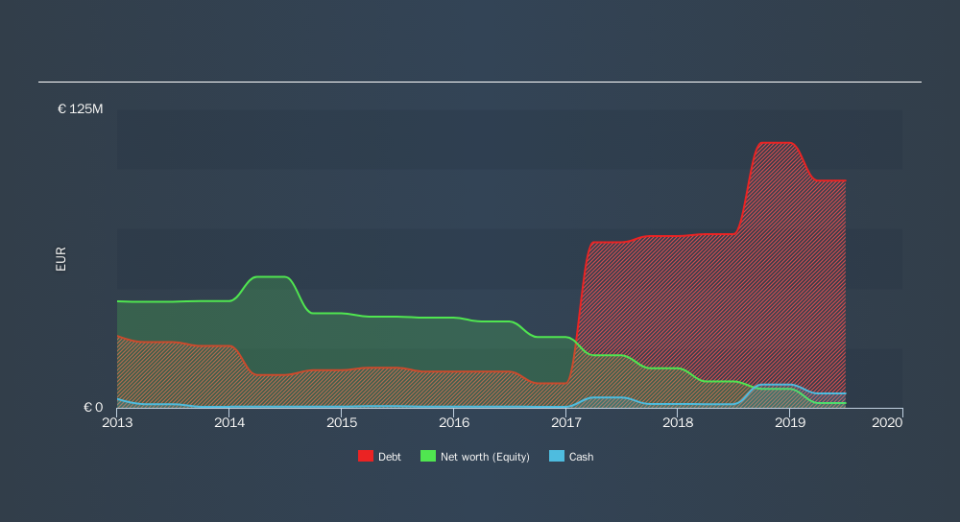

The image below, which you can click on for greater detail, shows that Les Hôtels de Paris had debt of €95.2m at the end of June 2019, a reduction from €102.9m over a year. However, it does have €6.03m in cash offsetting this, leading to net debt of about €89.1m.

How Healthy Is Les Hôtels de Paris's Balance Sheet?

The latest balance sheet data shows that Les Hôtels de Paris had liabilities of €40.1m due within a year, and liabilities of €127.4m falling due after that. Offsetting this, it had €6.03m in cash and €9.45m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €152.0m.

This deficit casts a shadow over the €31.9m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Les Hôtels de Paris would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 0.29 times and a disturbingly high net debt to EBITDA ratio of 12.5 hit our confidence in Les Hôtels de Paris like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. However, the silver lining was that Les Hôtels de Paris achieved a positive EBIT of €3.1m in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Les Hôtels de Paris will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Looking at the most recent year, Les Hôtels de Paris recorded free cash flow of 32% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

To be frank both Les Hôtels de Paris's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But at least its EBIT growth rate is not so bad. After considering the datapoints discussed, we think Les Hôtels de Paris has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. While Les Hôtels de Paris didn't make a statutory profit in the last year, its positive EBIT suggests that profitability might not be far away.Click here to see if its earnings are heading in the right direction, over the medium term.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.