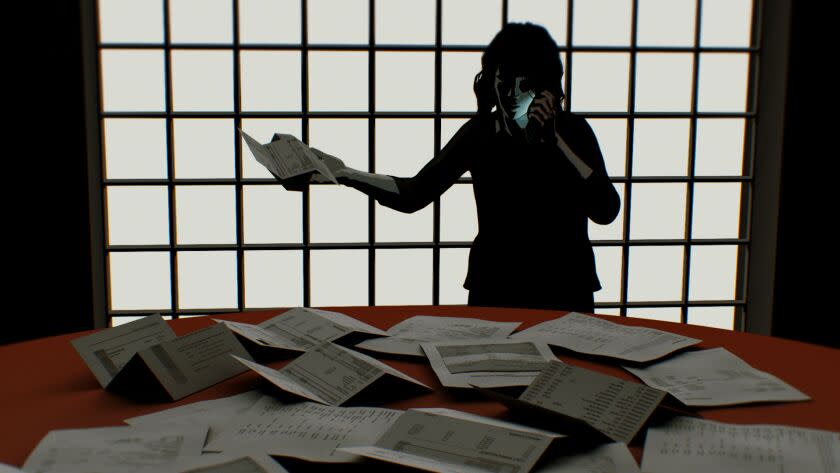

Letters to the Editor: A reporter turned her identity theft hell into a valuable public service for readers

To the editor: A heartfelt thank you to Times reporter Jessica Roy for sharing her harrowing identity theft saga.

My ordeal occurred in 2019 with a physical break-in of my house. Months of wrestling with authorities and banks stirred feelings of guilt and embarrassment. I tried to share my experience with friends so they could take protective measures, but they reacted as if I was paranoid.

My bank for 40-plus years could do nothing but shift my money to a new account. Twice my money was moved, and each time my new password suddenly became invalid and a new phone number was associated with the account.

I finally moved everything to a new bank, which agreed to call to verify transactions over $200. But last year, the bank was sold, and things seem more lax now.

When I read Roy's sentence, "I feel like saying, 'There's nothing you can do! Good luck!'" I felt that at last someone understood my experience. We are fellow soldiers on the front line in a war that should not have to be fought.

Lynne Culp, Van Nuys

..

To the editor: About 40 years ago, a friend working close to me received a call from his bank. He was told that one of his checks it received did not match the signature on record.

It turned out his wife had written the check at a supermarket but forgotten to sign it. Later, the cashier saw the blank signature line and signed it with the check writer's name. The bank suspected fraud and notified my friend quickly.

That was then. Banks — and other businesses — have gotten lazy. Repaying defrauded customers must be cheaper than preventing fraud.

Only legislation can require them to do their job, because competitive pressure drives a race to the bottom of service and protection.

Douglas Marshall, Bell

..

To the editor: Roy's article struck a chord. It was so disappointing to read how much effort she had to expend and how apathetic police, banks and credit bureaus seemed to be.

Having been in a similar situation, I found the only truly listening ear was a bank employee whose identity had also been stolen. Law enforcement is limited by the lack of a single central database on fraud and inadequate measures for punishing these thieves.

At some point, if you have an identity at all, it will be stolen. Then perhaps someone will care.

Joy Leong, Fullerton

..

To the editor: No doubt countless Times readers like me took immediate steps to protect their identities after learning of Roy’s harrowing experience.

Her account truly presents utility journalism as a great community service. This is the kind of reporting extremely useful to anyone — and that's all of us — susceptible to identity theft. Her tips on what consumers can do to protect themselves are an invaluable resource.

Glad to know she was able to share that such an exasperating ordeal is ultimately manageable.

Tom Stapleton, Glendale

..

To the editor: After reading Roy's piece, I changed a key password that used my child's name and birthdate. I'm sure many other readers did as well.

Thank you, Ms. Roy, for such a well-written account of your horrific (ongoing) experience with identity theft and your list of steps to take to prevent it. You're right the website selling me protein powder does not need to know my birthday.

I must admit, knowing about the Equifax data breach a few years ago, it was really hard for me to provide my Social Security number when I asked for a credit freeze.

Maureen Tomlin, Venice

This story originally appeared in Los Angeles Times.