LHC Group's (NASDAQ:LHCG) Wonderful 410% Share Price Increase Shows How Capitalism Can Build Wealth

LHC Group, Inc. (NASDAQ:LHCG) shareholders might be concerned after seeing the share price drop 13% in the last month. But over five years returns have been remarkably great. To be precise, the stock price is 410% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

Check out our latest analysis for LHC Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

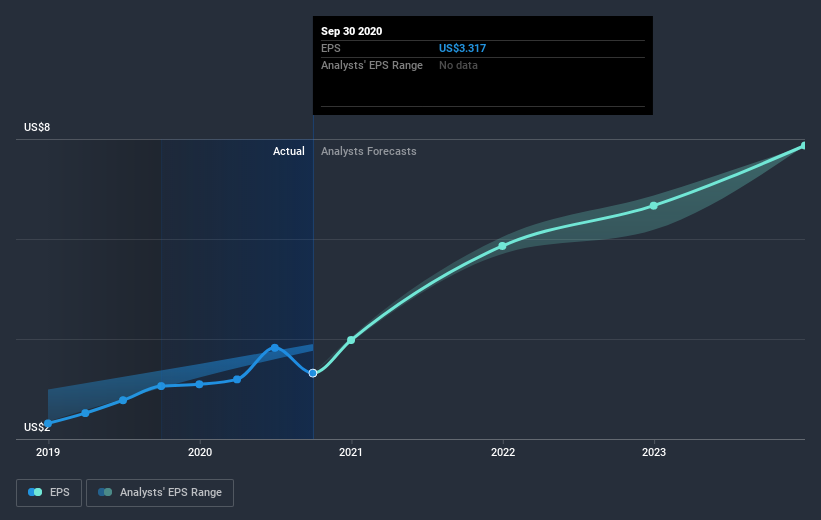

During five years of share price growth, LHC Group achieved compound earnings per share (EPS) growth of 14% per year. This EPS growth is lower than the 38% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 56.70.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on LHC Group's earnings, revenue and cash flow.

A Different Perspective

LHC Group shareholders have received returns of 45% over twelve months, which isn't far from the general market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 38% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. If you would like to research LHC Group in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.