Such Is Life: How Canfor (TSE:CFP) Shareholders Saw Their Shares Drop 56%

Even the best stock pickers will make plenty of bad investments. Anyone who held Canfor Corporation (TSE:CFP) over the last year knows what a loser feels like. In that relatively short period, the share price has plunged 56%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 12% in three years. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

Check out our latest analysis for Canfor

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the unfortunate twelve months during which the Canfor share price fell, it actually saw its earnings per share (EPS) improve by 5.7%. Of course, the situation might betray previous over-optimism about growth. The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

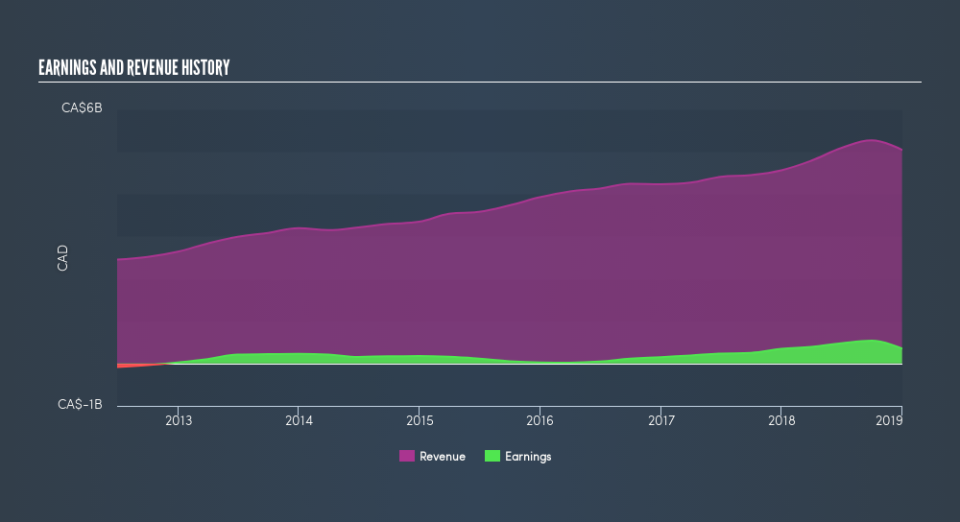

Canfor managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. This free report showing analyst forecasts should help you form a view on Canfor

A Different Perspective

Canfor shareholders are down 56% for the year, but the market itself is up 7.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.