Such Is Life: How Casablanca Group (HKG:2223) Shareholders Saw Their Shares Drop 60%

We think intelligent long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. For example the Casablanca Group Limited (HKG:2223) share price dropped 60% over five years. That is extremely sub-optimal, to say the least. Unhappily, the share price slid 1.4% in the last week.

See our latest analysis for Casablanca Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Casablanca Group became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

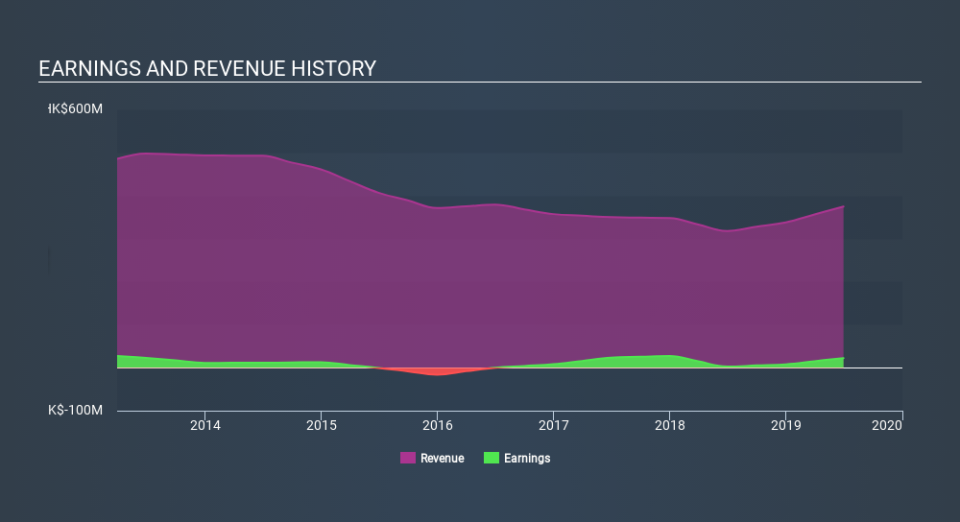

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. However, revenue has declined at a compound annual rate of 6.9% per year. With dividends up, but revenue down, some investors might be concluding that the company is no longer growing.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Casablanca Group's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Casablanca Group's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Casablanca Group's TSR of was a loss of 59% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Casablanca Group shareholders are down 12% for the year (even including dividends) , but the market itself is up 9.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 16% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Casablanca Group better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Casablanca Group you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.