Such Is Life: How China Glass Holdings (HKG:3300) Shareholders Saw Their Shares Drop 62%

Investing in stocks inevitably means buying into some companies that perform poorly. But long term China Glass Holdings Limited (HKG:3300) shareholders have had a particularly rough ride in the last three year. So they might be feeling emotional about the 62% share price collapse, in that time. And more recent buyers are having a tough time too, with a drop of 23% in the last year. The falls have accelerated recently, with the share price down 14% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

Check out our latest analysis for China Glass Holdings

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

China Glass Holdings became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

Revenue is actually up 8.3% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating China Glass Holdings further; while we may be missing something on this analysis, there might also be an opportunity.

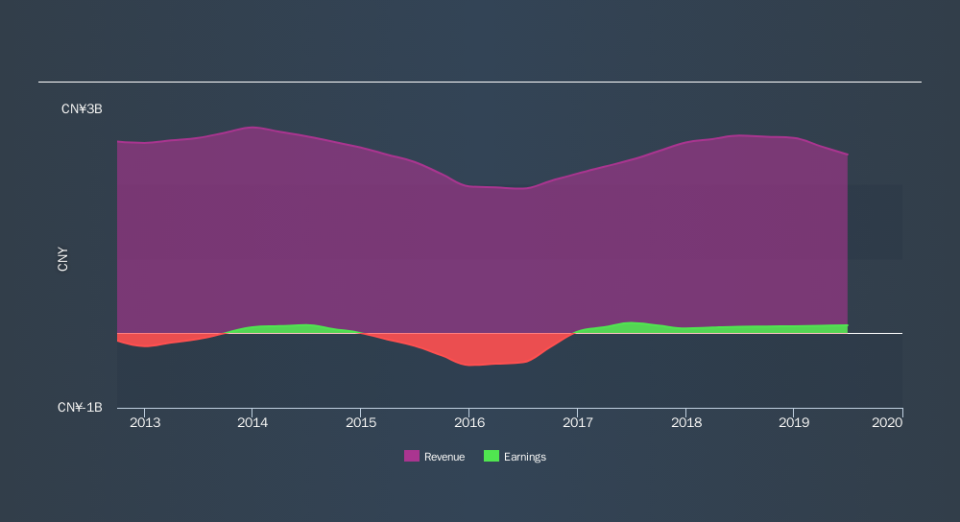

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at China Glass Holdings's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 1.4% in the twelve months, China Glass Holdings shareholders did even worse, losing 23%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 15% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is China Glass Holdings cheap compared to other companies? These 3 valuation measures might help you decide.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.