Such Is Life: How Tiong Woon Holding (SGX:BQM) Shareholders Saw Their Shares Drop 58%

Generally speaking long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Tiong Woon Corporation Holding Ltd (SGX:BQM) share price is a whole 58% lower. That's an unpleasant experience for long term holders.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Tiong Woon Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

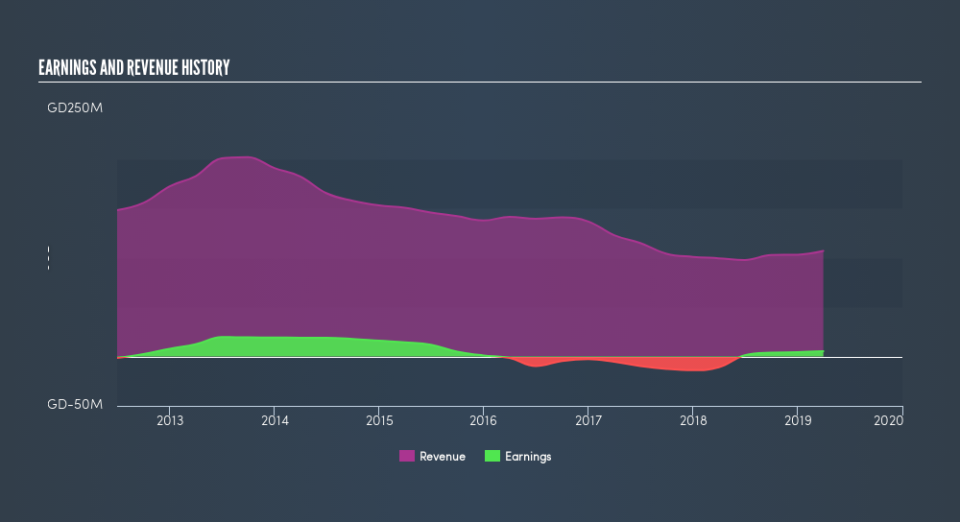

During five years of share price growth, Tiong Woon Holding moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 12% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

Take a more thorough look at Tiong Woon Holding's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market lost about 5.8% in the twelve months, Tiong Woon Holding shareholders did even worse, losing 8.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. However, the loss over the last year isn't as bad as the 15% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before deciding if you like the current share price, check how Tiong Woon Holding scores on these 3 valuation metrics.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.