Such Is Life: How TruScreen (NZSE:TRU) Shareholders Saw Their Shares Drop 54%

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held TruScreen Limited (NZSE:TRU) over the last year knows what a loser feels like. The share price has slid 54% in that time. We note that it has not been easy for shareholders over three years, either; the share price is down 40% in that time. On the other hand the share price has bounced 5.9% over the last week.

View our latest analysis for TruScreen

Because TruScreen made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year TruScreen saw its revenue fall by 18%. That looks pretty grim, at a glance. In the absence of profits, it's not unreasonable that the share price fell 54%. Fingers crossed this is the low ebb for the stock. We don't generally like to own companies with falling revenues and no profits, so we're pretty cautious of this one, at the moment.

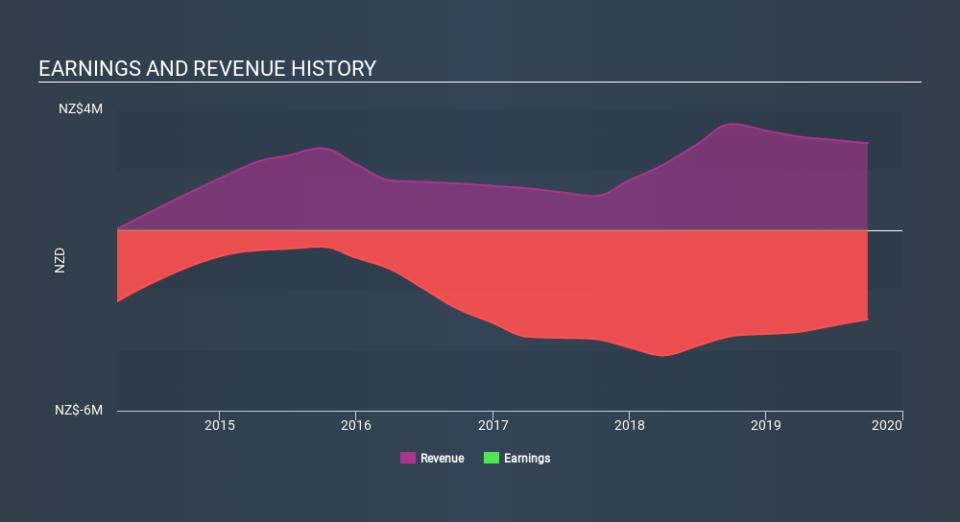

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

TruScreen shareholders are down 54% for the year, but the market itself is up 30%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9.1% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

But note: TruScreen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NZ exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.