Such Is Life: How Veeko International Holdings (HKG:1173) Shareholders Saw Their Shares Drop 53%

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

Ideally, your overall portfolio should beat the market average. But in any portfolio, there will be mixed results between individual stocks. At this point some shareholders may be questioning their investment in Veeko International Holdings Limited (HKG:1173), since the last five years saw the share price fall 53%. The falls have accelerated recently, with the share price down 24% in the last three months.

See our latest analysis for Veeko International Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Veeko International Holdings moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

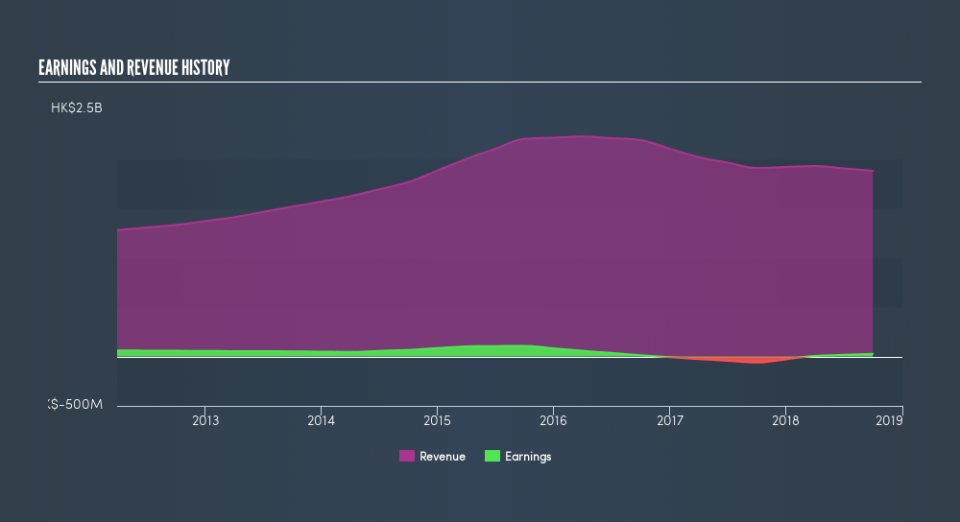

In contrast to the share price, revenue has actually increased by 3.2% a year in the five year period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Veeko International Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Veeko International Holdings, it has a TSR of -40% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Veeko International Holdings shareholders are down 7.4% over twelve months (even including dividends), which isn't far from the market return of -7.5%. However, the loss over the last year isn't as bad as the 9.7% per annum loss investors have suffered over the last half decade. Generally speaking we'd prefer see an improvement in the fundamental metrics before becoming enthusiastic about the stock. Before forming an opinion on Veeko International Holdings you might want to consider these 3 valuation metrics.

We will like Veeko International Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.