Live Blog From Top U.S. Mortgage Conference – MBA Annual 2021

This post originally appeared on The Basis Point: Live Blog From Top U.S. Mortgage Conference – MBA Annual 2021

The mortgage industry’s top conference is this week in San Diego, and I’ll be live blogging it for The Basis Point’s readers. The Mortgage Bankers Association’s MBA Annual 2021 brings together 3000+ top banking, lending, trading, fintech, and regulatory players. This year is especially exciting as pandemic risks ease and we can all meet to improve the business of serving America’s housing consumers. And it’s very big business.

Below is the size of the U.S. mortgage market by volume right now.

You can see banks and lenders funded $4.11 trillion in new mortgages last year.

They’ll fund $3.74 trillion in new mortgages this year, and $2.38 trillion next year.

Next year is a more normal volume year for the mortgage industry, and this will be a hot topic at MBA Annual 2021.

Notice how refinance mortgages drop sharply from $2.14 trillion this year to $649 billion next year.

This transition to a purchase market will be another hot topic for MBA Annual 2021.

Total new and existing home sales will go from an estimated 6.88 million this year to 7.48 million next year.

But the MBA estimates only 4.83 million of those home sales will be financed this year. And 4.74 million home sales will be financed next year.

Still, “only” $649 billion in refinances and “only” 4.74 million home purchase loans for $1.73 trillion in purchase volume is very big indeed.

And this is just the annual activity!

===

In the bigger picture, there are almost $12 trillion in total mortgage balances outstanding right now.

Servicing, retaining, caring for, and meeting other lending and banking needs of these long-term borrowers may end up as the hottest MBA Annual 2021 topic.

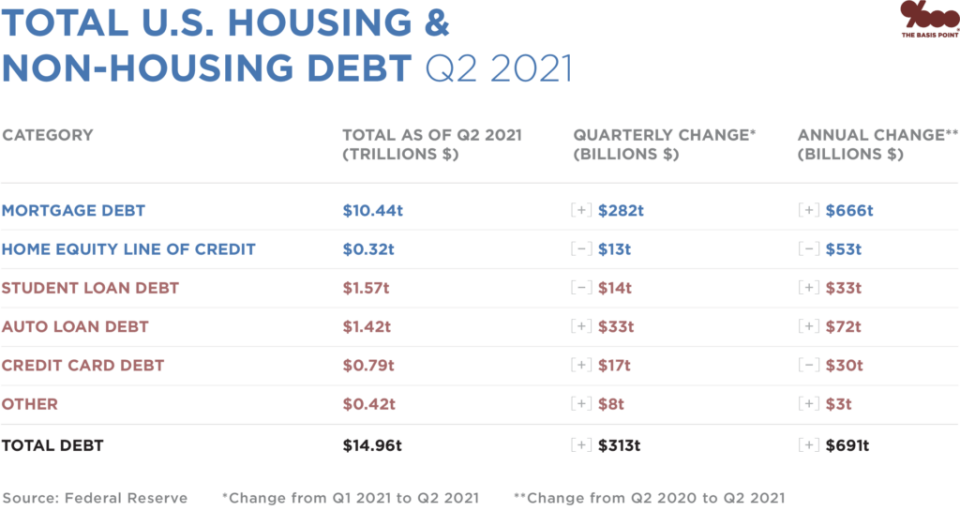

Below is New York Fed data showing $10.44 trillion in mortgage balances outstanding right now.

The MBA’s outstanding balance estimate is $11.5 trillion this year and $12.2 trillion next year.

And Inside Mortgage Finance estimates $12 trillion outstanding now.

You get the point: it’s absolutely giant.

AND MOST IMPORTANT: long-term financial plans of consumers are at the center of it.

That’s why I like to show this table because it shows the other outstanding debt people have right now.

===

One of the key market trends right now is that American homeowners have $9.15 trillion in tappable home equity, per mortgage data and software giant Black Knight.

Tappable equity is home equity that can be taken out and still leave 20% equity in the homes.

This is a key definition because it leaves room to breathe if home prices dropped.

Which is likely at some point after this long tear home prices have been on.

I also like connecting this tappable equity data point to the non-housing debt in the table above.

Why? Because housing debt is far cheaper than non-housing debt.

That’s better for consumers who are fortunate enough to own homes.

These stats set up a trend I see for next year of responsible cash out.

This is the tone of American housing at the moment.

And I will do my best to quickly document it over the next few days.

I’ll be running to lots of meetings, and hosting demo showcases of the hottest fintech firms out there.

But I’ll keep updating here too.

And yes: I did take this picture 🙂

Chime in below or hit me at @thebasispoint on twitter — or on LinkedIn — if you want to see anything here.

DO YOU LIKE MONEY? GET MORE AT THE BASIS POINT®

What To Do When 1 in 8 Home Purchases Have A Low Appraisal

6 Charts Explain Why Mortgage Rates Much Higher Despite Weaker Jobs Data