Livongo Bounces Back After Revenue Guidance Boost

Dr. Jennifer Schneider, the president of Livongo Health Inc. (NASDAQ:LVGO), couldn't have been more succinct in describing what the Mountain View, California-based company does: "make it easier for members to stay healthy." In doing so, the company also hopes to put its investors in the pink.

Livongo is an information technology company that uses its software platform to improve the health of patients with chronic conditions, including hypertension, diabetes and weight issues.

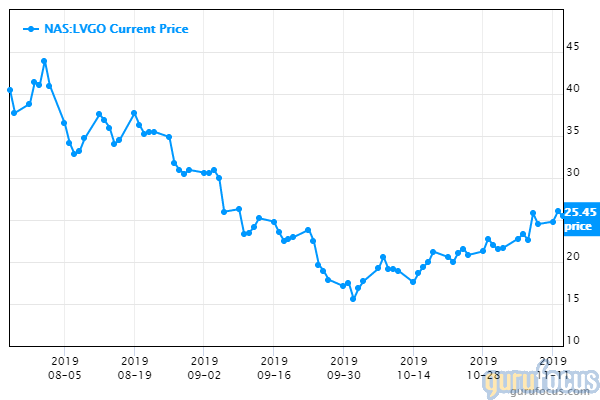

The company had a strong opening when it went public on July 25. Its stock climbed 60% above the initial public offering, which had been priced at $28. The company sold about 12.7 million shares, raising $355.2 million.

After its coming out party, Livongo shares began a steady retreat, dropping from a 52-week high of nearly $46 to a low of just over $15 in late September, when the company reported a second-quarter loss that was bigger than expected. Since then, the stock has bounced back to about $25, aided by a strong third quarter and a boost in revenue guidance for the year.

Analysts think the stock still has plenty of headroom. Tipranks reported that nine analysts set the company's average price target of nearly $44, with a high forecast of $50 and a low of $40.

A big reason for optimism is the company's expansion of its Applied Health Signals platform beyond commercial and into government and fully insured markets, according to Livongo CEO Zane Burke. In the company's third-quarter earnings release, Burke explained the company was recently awarded its largest contract to date to bring its diabetes solution to members of the Federal Employees Health Benefits Program. Livongo also boosted its presence in the insured market through an expanded relationship with Blue Cross and Blue Shield of Kansas City.

In early 2018, the company partnered with Eli Lilly (NYSE:LLY) to use data to achieve better treatment results for diabetes patients. Lilly, of course, is a leading provider of diabetes drugs.

About 30 million Americans and 425 million adults worldwide have diabetes, according to Dr. Sherry Martin, Lilly diabetes' vice president of medical affairs. In an email interview with FiercePharma last year, she said it's well known that the long-term costs of managing diabetes are becoming overwhelming.

The Lilly-funded study results were published this May in the Journal of Medical Economics. They showed that access to Livongo's diabetes management program saved nearly $90 per diabetes member per month. Another study showed the company's diabetes platform improved the health of people with Type 2 diabetes.

Diabetes is the main source of Livongo's revenue, but use of its platforms for hypertension and weight management are growing. The company appears to have a huge opportunity given is it serving less than 1% of the U.S. market.

Other diabetes drug makers, including Novo Nordisk A/S (NYSE:NVO) and Merck KgAA (XTER:MRK), are also using tech to improve patient health. Novo is using the app of a private company, Glooko, that enables patients to measure blood glucose, activities and meals. Merck is working with Blue Mesa Health on building solutions for people with prediabetes.

Sanofi (NASDAQ:SNY) partnered with Verily in 2016 to create a joint venture to develop solutions for people with Type 2 diabetes. They plan to expand it to Type 1 patients and to people at risk for developing the disease.

Disclosure: The author has a position in Eli Lilly.

Read more here:

Medtronic Introduces Robotics Challenger to Intuitive System

Analysts Like Biogen's Chances of Getting Alzheimer's Drug Approved

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.