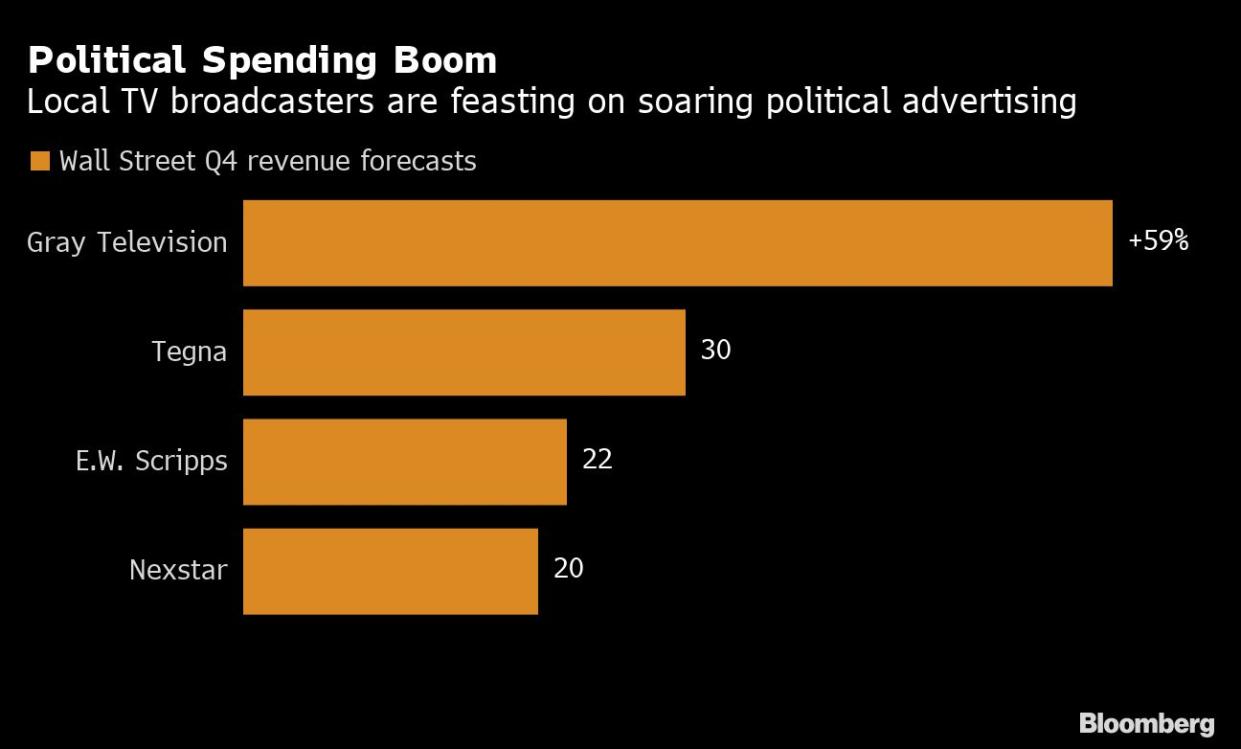

Local TV Stations Are Cleaning Up on Political Advertising This Election Season

(Bloomberg) -- Political ads are rolling in at a record pace at TV stations across the US, especially in states with tight races that may decide which party controls the Senate.

Most Read from Bloomberg

Take for instance KSNV-TV, an NBC affiliate in Las Vegas. Campaign spending this year at the station owned by Sinclair Broadcast Group Inc. reached $54 million through Oct. 5, according to spending tracker AdImpact.

“The market is robust,” Sinclair said in an emailed statement.

KSNV’s haul shows how old-fashioned local TV is benefiting from a heated political climate that has produced record spending for midterm, or nonpresidential, election campaigns. Broadcasters are expected to take in nearly $5 billion, roughly 51% of the unprecedented $9.7 billion in midterm campaign advertising, according to AdImpact.

“TV is still the leader in terms of ad dollars, and that doesn’t look like it will change any time soon,” said Mitchell West, a director of CMAG, the campaign-tracking arm of data consultancy Kantar.

In just the past few weeks, the Las Vegas station has seen a river of orders for hundreds of spots aimed at Nevada voters in a race considered a toss-up. The amounts vary: $73,823 for 64 spots for Republican Senate challenger Adam Laxalt; $256,900 for 251 ads for Democrat Catherine Cortez Masto, the incumbent.

Tight Senate races in large states are helping to boost spending, along with hot-button issues including abortion, guns and gambling. Older audiences -- the ones you reach on TV news programs and other broadcast shows -- tend to vote at higher rates than younger cohorts who may be more easily reached online.

“The real core voting demographics can still be very effectively reached by placing buys during Jeopardy or the morning news,” West said.

Estimates by CMAG show broadcasters can expect to take over 50% more than they did four years ago and might slightly exceed the 2020 presidential election year.

“It will probably rival if not exceed the last presidential election -- which is highly unusual,” said Steve Lanzano, president of the Television Bureau of Advertising, a TV trade association.

The political gusher has broadcasters wryly acknowledging years of what they call premature predictions of their demise.

“I think we look pretty good for a ‘dead’ medium,” Lanzano said.

Soothing Balm

The campaigns offer balm for an industry challenged by declining viewership and sluggish ad growth. Local TV ad revenue excluding political spending has hovered around $12 billion for much of the past decade, with spikes every other year when campaigns are most active, according to estimates from Kagan, part of S&P Global Market Intelligence.

At Sinclair, election-year spending countered weakness in core ads. First-half political revenue was double the 2018 level, and up over 20% from 2020, Chief Financial Officer Lucy Rutishauser said on Aug. 3.

Political revenue for Sinclair in the third quarter came to $89 million, putting the year on par with the record 2020 presidential year, she said.

“It has not disappointed,” Rutishauser said.

Other broadcasters, too, report heavy spending. Several tied the spending to geography, with high income in states that are closely contested.

Nexstar Media Group Inc., with 200 TV stations in 116 markets, reported second-quarter political revenue up about 80% over the same period two years ago. Its stations this year are benefiting from Senate ads in Ohio and Pennsylvania, and ads for governor races in Illinois, New York, Pennsylvania, Ohio, and Alabama.

Nexstar Territory

“We’re right in the eye of the storm in the most competitive races,” Chief Executive Officer Perry Sook told investors Aug. 4. “Eighty percent of all competitive races will be contested in the Nexstar footprint.”

Sook said it’s possible spending exceeds the presidential year of 2020.

Senatorial campaign spending is expected to exceed $200 million in each of four states: Pennsylvania, Arizona, Georgia and Nevada, according to AdImpact. Gubernatorial races are on track to exceed $200 million in both Illinois and Georgia. In California, spending on ballot measures is north of $288 million, AdImpact projected. Proponents of an online gambling proposition in the state said this week that they were pulling back on TV spending after failing to gain traction.

“We are seeing an unprecedented wave of political spending which accelerates as we head towards November,” Fox Corp. Chief Executive Officer Lachlan Murdoch told investors Aug. 10.

Most Read from Bloomberg Businessweek

The Twitter Deal Has Pierced Elon Musk’s Reality Distortion Field

Hedge Fund Managers Paid for Stockpicking Genius Aren’t Showing Much of It

Biden Is Walking a Tightrope as the World Clamors for US Oil and Gas

Twitter Faces Only Bad Outcomes If the $44 Billion Musk Deal Closes

The Great Post-Covid Online Shopping Bet Was a Costly Delusion

©2022 Bloomberg L.P.