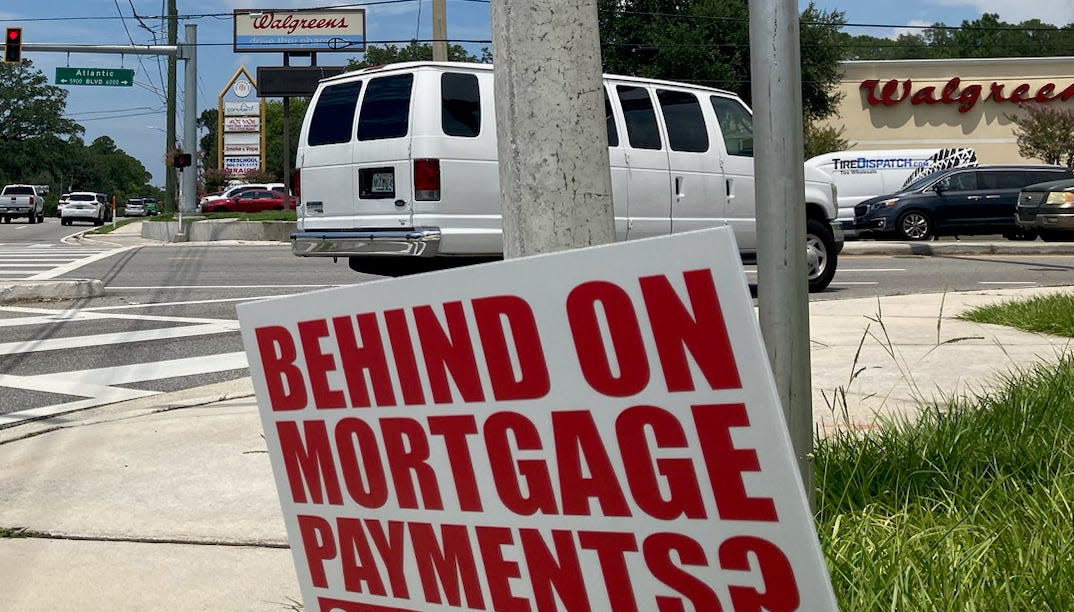

Long time coming, owner of Jacksonville mortgage-relief company pleads guilty to wire fraud

The owner of a Jacksonville business that offered “forensic audits” to help people challenge their mortgages has pleaded guilty to wire fraud after taking payments and not delivering results.

Brian Roy Lozito, 53, of Orange Park took a deal with a maximum possible sentence of 20 years behind bars to settle a 13-count indictment that had hung over him since late 2020.

No sentencing date has been set for the businessman, who pleaded guilty to a single federal count that followed years of earlier civil litigation under Florida's Deceptive and Unfair Trade Practices Act.

Lozito owned American Investigative Services LLC, a company that charged $1,000 to $2,500 to review customers’ mortgages for problems like documents that were improperly notarized or “robo-signed” by someone signing forms without knowing whether what they signed was correct, according to a plea agreement filed Friday.

Robo-signing's damage: Jacksonville's LPS agrees to $127 million settlement over improper practices

Past complaints, fresh start: Mortgage loan operator shut down in Clay County moves to Georgia

Robo-signing's damage: Jacksonville's LPS agrees to $127 million settlement over improper practices

Past complaints, fresh start: Mortgage loan operator shut down in Clay County moves to Georgia

Company employees told customers that if the company found problems, “the consumer would own his/her home free and clear, even if the consumer stopped making mortgage payments,” the plea deal said.

Employees of the company, whose address had moved from Clay County to a Southside Jacksonville apartment complex, pledged to get quitclaim deeds or other help for customers, but instead in 2016 and 2017 a series of customers told the Better Business Bureau or the state Attorney General’s Office they’d been cheated, the plea deal said.

Investigators identified about 150 customers who had collectively paid $164,193 for help that never materialized, the agreement said. Lozito has to forfeit that money as part of the plea deal.

A state judge had ruled in January 2020 that Lozito and the company owed that same amount plus $750,000 in fines for violating the state unfair practices law and about $46,000 in attorney fees. Court records don't reflect that money being colected however.

The state had also sued Lozito and a different business over other unfair trade complaints in 2010, but that case was eventually dismissed.

The federal indictment listed initials of a string of customers who paid through banks in Connecticut, Delaware, Maryland, Washington, D.C. and Hawaii, and the plea agreement said the money was sent to an account Lozito controlled at VyStar Credit Union.

The company told customers it would refund their money if it couldn’t help them, but it didn’t give refunds and didn’t deliver the services customers had been promised, the U.S. Attorney’s Office said in a release Monday about the guilty plea.

This article originally appeared on Florida Times-Union: After years in court, Jacksonville mortgage scammer guilty of wire fraud