It Looks Like Shareholders Would Probably Approve Centerra Gold Inc.'s (TSE:CG) CEO Compensation Package

We have been pretty impressed with the performance at Centerra Gold Inc. (TSE:CG) recently and CEO Scott Perry deserves a mention for their role in it. Coming up to the next AGM on 11 May 2021, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for Centerra Gold

Comparing Centerra Gold Inc.'s CEO Compensation With the industry

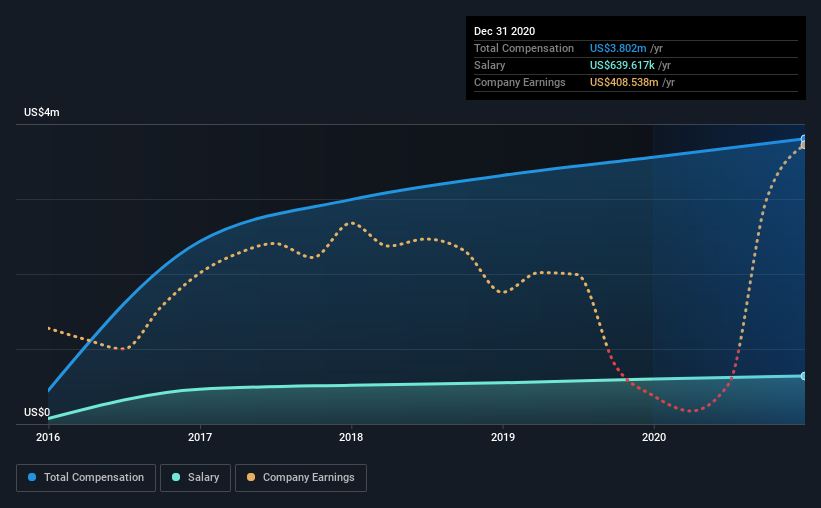

Our data indicates that Centerra Gold Inc. has a market capitalization of CA$3.4b, and total annual CEO compensation was reported as US$3.8m for the year to December 2020. That's a fairly small increase of 6.9% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$640k.

On comparing similar companies from the same industry with market caps ranging from CA$2.5b to CA$7.9b, we found that the median CEO total compensation was US$3.6m. So it looks like Centerra Gold compensates Scott Perry in line with the median for the industry. Moreover, Scott Perry also holds CA$852k worth of Centerra Gold stock directly under their own name.

Component | 2020 | 2019 | Proportion (2020) |

Salary | US$640k | US$601k | 17% |

Other | US$3.2m | US$3.0m | 83% |

Total Compensation | US$3.8m | US$3.6m | 100% |

Speaking on an industry level, nearly 95% of total compensation represents salary, while the remainder of 5% is other remuneration. Centerra Gold sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Centerra Gold Inc.'s Growth

Over the past three years, Centerra Gold Inc. has seen its earnings per share (EPS) grow by 17% per year. Its revenue is up 23% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Centerra Gold Inc. Been A Good Investment?

We think that the total shareholder return of 52%, over three years, would leave most Centerra Gold Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Seeing that company performance has been quite good recently, some shareholders may feel that CEO compensation may not be the biggest focus in the upcoming AGM. Seeing that earnings growth and share price performance seems to be on the right path, the more pressing focus for shareholders at the AGM may be how the board and management plans to turn the company into a sustainably profitable one.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 3 warning signs for Centerra Gold that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.