I lost my shirt investing in the music industry, but the boom times aren’t over

As a past investor in the music business and an avid music fan, recent headlines about the industry caught my attention. At a glance, the industry seems to be in rude health.

In the US, revenue reached an all-time high of $8.4bn in the first six months of 2023. But just recently Spotify announced that it is laying off 17pc of its staff, including the chief financial officer and the UK managing director. So what’s the real story here?

It appears that the industry’s performance is robust but it is up against extremely ambitious targets. Spotify, for example, is reducing its headcount partly to redirect spending towards funding future growth, which is something that we see across most industries that experience rapid growth and then stagnation.

The industry has had its fair share of difficulties over the years, but despite its critics, I believe that the music business will always have potential for growth and reinvention.

Music in many parts of the world is now seen as a utility, like electricity: the idea of not having Spotify or a similar service is unthinkable even for the light music fan.

The asset itself, the song, will continue to hold its value and be a good investment. Classic songs will be around for a very long time generating substantial income.

The higher rate environment has created difficulties for the asset class, but its resilience should not be underestimated. A Dylan or Springsteen song, with their unwavering human themes of love, loss and happiness, will be listened to for many years to come.

When looking at the music business and its earning potential, we must also not forget live. We are in the era of the mega tour – just look at Beyoncé and Taylor Swift. Live music always underpinned an artist’s income, but post-pandemic touring has been enormous with so much pent-up demand and people’s desire to connect.

However, as is true for any industry, a business that does not evolve will die out. In today’s times, that means a business must keep up with technological change.

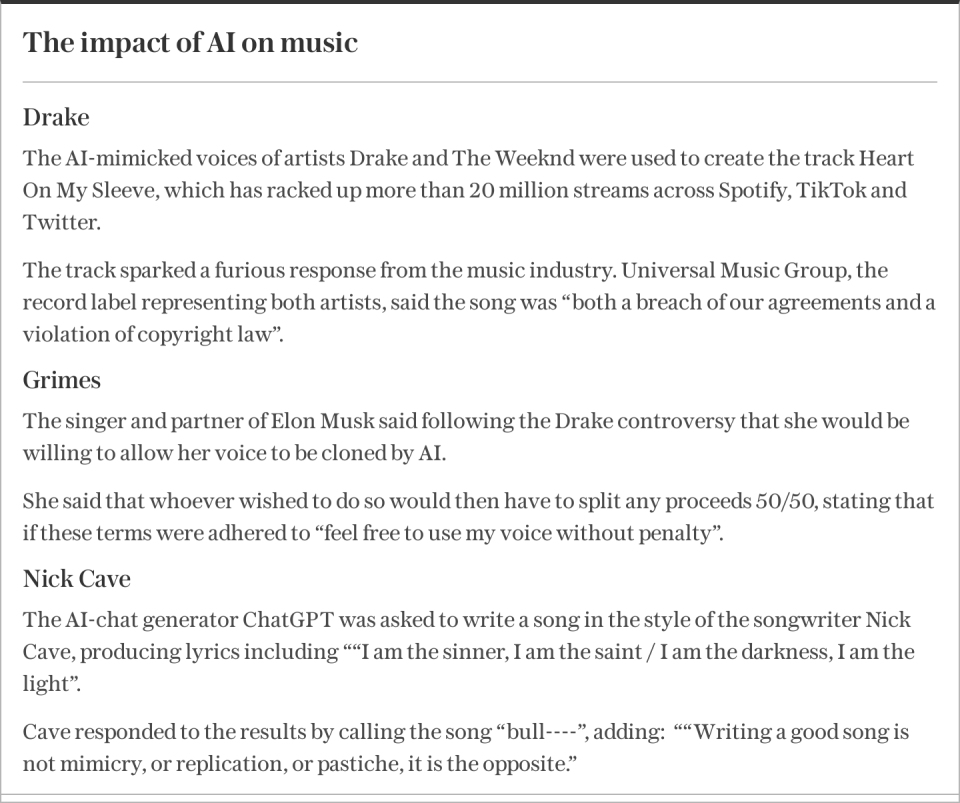

AI brings incredible opportunities for the industry to make each song even more relevant to individuals as music reacts to your emotional needs and learns what you need to wake up to, concentrate with, relax by or dance the night away. But it also raises existential questions around one of the most human of traits: creativity.

The companies able to walk this tightrope will be the ones who maintain their relationships with artists. Those that run scared and cannot balance the commercial advantages of machine learning with creative thought will be left behind.

The companies that will do the best are those that think of technology not as a threat but rather an opportunity for growth. Changing the mindset to be positive can be a lifeline. Just look at the music industry when they were faced with the birth of streaming.

When we bought EMI in 2007, we realised that streaming was a big opportunity for the music business but it required a complete strategic overhaul. My view was very simple yet very contrarian at the time: the CD would become obsolete and technology would redefine how music was sold, distributed and used.

Most of the music industry rejected digital and dug their heels in. They focused on suing companies like Napster and hung onto the CD.

On the other side, our contrarian approach allowed us to grow the cash flow at EMI from a £100m negative to a £250m positive in three years.

What was interesting at the time was that despite our performance, our valuation was still falling. EMI’s valuation fell from 20 times to eight times even though we were demonstrating the financial benefits of embracing technology.

People could just not understand which way the tide was turning and they did not want to bet on an industry that they thought was doomed.

Seeing the direction an industry is heading in is, of course, not the only thing that is required for success. With EMI we ended up in a very costly seven-year legal battle where we ultimately lost all our money.

However, if you are not able to see the need for change in the first place and embrace it, you are bound to be left behind. Seek out the innovators and make friends with them, rather than suing them. Know things will move fast and move faster.

There are plenty of learnings for other industries facing digital disruption. Take the news business. The sheer amount of content that is being produced in this technological era – from real news to fake news to deep fakes – means that greater value is placed on being a trusted source or brand.

The competition over consumer attention also means that brands need a clear identity and must prioritise putting resources into the areas where they can demonstrate impartiality and value. It is hard to be first to a story these days as technology has made news faster than ever before.

Value has to come from elsewhere, whether that is an increasingly specialised approach or more thoughtful, in-depth, quality writing.

Technology provides the greatest challenges and opportunities facing business and indeed the whole of society today. For most industries, it is life or death: if you do not embrace it, someone else will.

It is difficult to push against the status quo and you can be met with resistance. But if you do not seek the opportunity in the challenge, the downside of being left behind will be inevitable failure.

Guy Hands is the founder of private equity firm Terra Firma Capital Partners.