Louisiana economist predicts national recession, says Louisiana poised for industrial boom

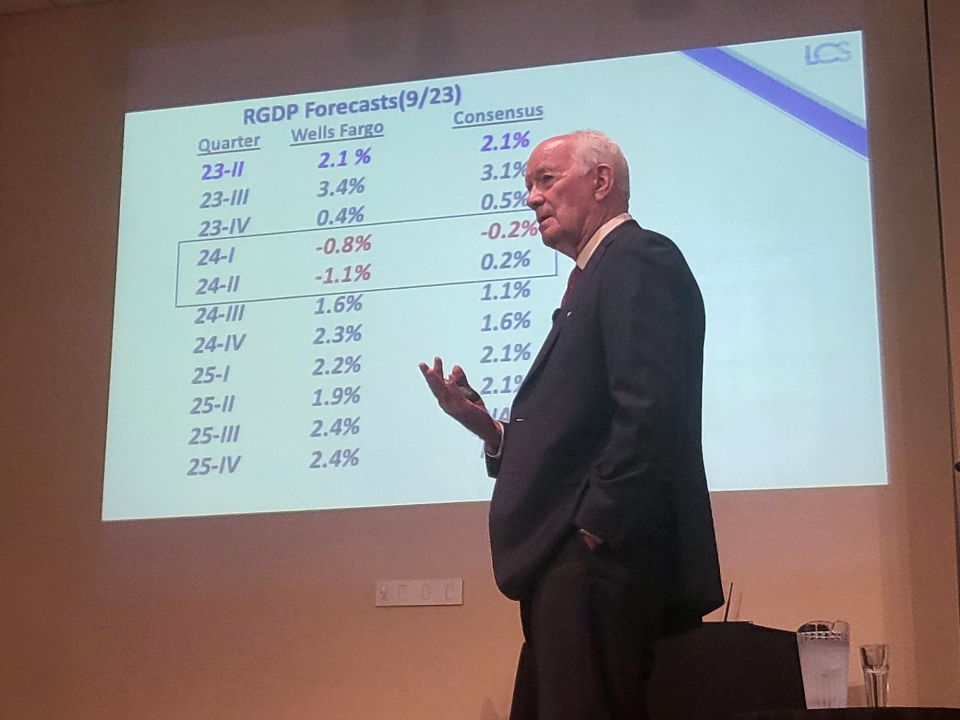

The United States faces a recession next year, but the Houma-Thibodaux area is expected to grow through it, economist Loren Scott says.

Scott released an economic forecast for 2024-2025 and is traveling Louisiana to deliver his findings. He spoke Oct. 4 at a joint meeting of the Bayou Industrial Group and South Central Industrial Association.

The rest of 2023 looks good, according to Scott, but the first half of next year the U.S. will dip into a slump, he said. Louisiana's industrial economy is poised to surge through the slump.

"There's just too many dad gum signals that we are," Scott said of the national recession. Louisiana however is sitting pretty, "We have an industrial boom going on in Louisiana unlike any we have ever seen before."

The Bad

The recession will be a short and shallow dip, Scott said, citing economic indicators such as the leading economic index being down for 16 consecutive months, the consumer price index being the worst in 40 years, a 9.1% inflation rate and more.

The Federal Reserve has increased interest rates by 5.25 percentage points in the past 25 months in an attempt to combat inflation. Scott predicts The Fed will hike rates again at or near the beginning of next year because of the price of oil.

"And that's one of the reasons I think what you are going to see right at the first of the year is the Federal Reserve raising rates at least another quarter of a percentage point," he said. "I think you can kind of put that in your bonnet and expect that to happen."

OPEC+ has pulled 4.1 million barrels per day off the market since last fall to inflate the barrel price, he said, and this increase has yet to work its way through the market and to the pump.

More: Could Louisiana's Steve Scalise or Mike Johnson be next speaker of the House?

More: Lafourche teens watch trial as part of diverse Gifted and Talented approach to teaching

The Good

Louisiana has grown through four of the past eight recessions, and Scott expects the same for this one. Indicators are so positive, he said, that Louisiana is looking at an industrial boom in its not-so-distant future.

Lafourche and Terrebonne are poised to have steady growth throughout the recession due to oil and gas, ship construction and recovering from two natural disasters: COVID-19 and Hurricane Ida. The recession, he said, will almost be a nonfactor for the parishes.

"You folks are almost not going to get tapped by it at all," he said.

According to Scott, it is extraordinarily abnormal for an area hit by a natural disaster not to recover. In the previous two disasters, Louisiana lost 12,200 jobs. The parishes have recovered 56% of all of those at this time, and he expects that to continue to rise.

Ship building contracts for companies in Lafourche and Terrebonne will bolster job growth in the area. Danos, Gulf Island Fabricators, Edison Chouest Offshore, Bollinger Shipyards and Thoma-Sea all have contracts going into the next year to produce ships, and all are increasing their manpower.

Oil is a key component of Terrebonne and Lafourche's economy. The demand for oil will go down, Scott said, because of the recession. If the U.S. goes into a recession, the rest of the world will also, he added.

"Because when the United States sneezes, everyone else gets a cold," he said.

This will reduce the demand for oil and push the price down. Supply is much harder to predict, he said, "Now that's fairly straightforward we can put our bucks on that. The problem here is always the supply side."

Supply of oil can be disrupted by a multitude of factors: OPEC+, COVID-19 and Russia's war on Ukraine are just a few examples. Despite that, oil production in the United States is poised to hit record levels at the end of this year.

The number of offshore rigs has gone down since 2000: 149 rigs in 2000 compared to 15 in 2023. Rigs are for drilling, however, and platforms are increasing. Saudi Arabia may be manipulating the market to get the price of the barrel near $81-per-barrel, Scott said. But according to Scott, American companies can make the same profit at $42-per-barrel as they could at $81-per-barrel in 2014.

Natural gas will be part of Louisiana's growth through the recession. Scott cited a number of projects set to finish before 2025 that will grow the global natural gas market. These projects, he said, will be in Louisiana and in Texas.

Scott predicts the price of natural gas to average $3 this year, and grow to $6 by 2025.

"But what's important for Louisiana, especially below I-10, is not the price of natural gas here, it's the price of natural gas here versus the price of natural gas in Europe and Asia - that's the key," he said. "We have $34 billion in projects underway right now. We have another $122 billion announced on the way."

Scott's forecast can be purchased here: https://www.lorenscottassociates.com/

This article originally appeared on The Courier: National recession coming, Louisiana poised for boom, economist says