LSU researchers to release tool that determines flood insurance premiums

A group of LSU graduate students are reverse engineering FEMA's flood protection formula and are providing a tool to determine homeowners' and buyers' flood premiums.

The Federal Emergency Management Agency's method for determining flood risk assessment, known as Risk Rating 2.0, has been the subject of much scrutiny. As southern Louisiana feels the burden of inflating insurance costs, local officials, federal lawmakers, and state attorneys general are seeking answers to how FEMA determines levels of flood risk and meeting dead ends.

Described as a "black box" during legal proceedings in New Orleans, officials have argued that FEMA is determining flood risks to an area -- which directly affect flood insurance premiums -- without explaining to homeowners how different factors affect individual risks.

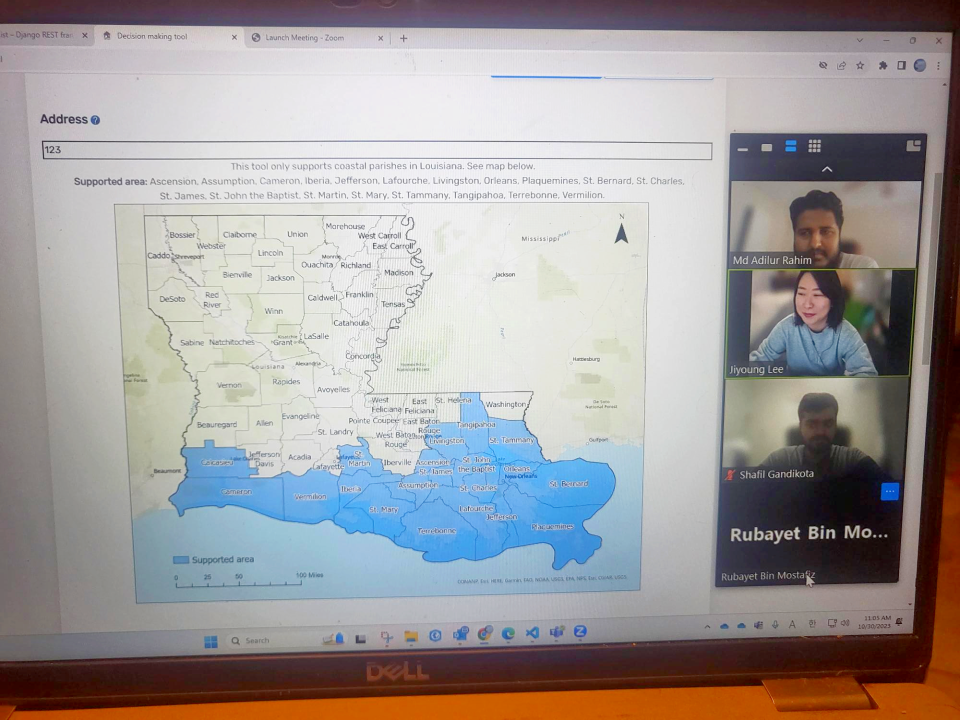

Enter researchers Md Adilur Rahim, Rubayet Bin Mostafiz, Jiyoung Lee and Shafil Gandikata. What officials saw as a black box, these researchers saw as a math equation. They had many of the variables; they just had to solve for X.

Rahim said it is every researcher's dream come true: Find a practical problem and hand the information to the public.

"Human welfare is the goal for any researcher," he said in a Zoom call with the three other researchers. The driving question, "How do we make people's lives easier to make decisions?"

Rahim and Mostafiz began researching FEMA's algorithm in July of 2021. Through the years of working on this project Rahim and Mostafiz have received their PhDs and are now assistant professors. Lee and Gandikata joined the project later. Their research is funded through a grant by Louisiana Sea Grant.

The tool they have created will be released to the public as a website, Flood Safe Home, in late December or early January. By plugging in information such as address, building attributes, and insurance information, the website will output the approximate flood insurance premium.

The four team members demonstrated the website to the Daily Comet/Houma Courier by plugging in data of a home in New Orleans, and later the address of Government Tower in Houma.

The tool pools all this information together so users can see their total costs. It provides drop down toolbars to adjust factors, allowing users to see how small variations can affect their final costs. For homebuilders, variables such as elevation can be adjusted. Loans can be plugged in to determine the total cost over time. Insurance users can plug in different deductibles to determine that cost over time.

"It just needs the building coverage value, what's the deductible value you want to take, and based on that, it affects the premium value," Rahim said. "So the user can play with that -- changing the coverage and deductible -- to see how the risk premium is changing."

More: Louisiana governor-elect Jeff Landry announces transition team leadership

More: U.S. Forest Service seeks candidates for committee that helps set recreational fees

The website generates a map, similar to Google Maps, where three different colored lines spring from the address marker and point to the closest bodies of water -- the potential flood risks. In both demonstrations, these were the coastline, a stationary body of water like a pond or lake and a source of running water like a bayou, river or stream.

The website isn't exact, Mostafiz explained, because they do not have access to the intellectual property FEMA has. For this reason, the team has gathered data from the University of Bristol, and the United States Geographical Survey to shore up their missing data.

This intellectual property researchers didn't have is the same data at the center of a legal battle between FEMA and a Freedom of Information request by St. Charles Parish.

During court hearings in New Orleans between Louisiana and FEMA over Risk Rating 2.0, North Lafourche Levee Director Dwayne Bourgeois said FEMA's levee data was inaccurate. Attorneys with the U.S. Department Justice said Bourgeois was "factually incorrect."

The four researchers were asked if they found inconsistencies in levee data, to which all four nodded their heads but said they couldn't correct for it. If they did, their website wouldn't generate similar outputs to FEMA's.

"There are different types of levees. Some are maintained by the federal government… and there are some other sorts of levees maintained by local communities," Mostafiz said. "The thing is how FEMA considered this Risk Rating 2.0, they just considered the federal levees that were on the U.S. Army Corps of Engineers. But historically in Louisiana, there is a lot of other levees that's maintained by local communities and they really benefit from that. How could FEMA not recognize that?"

He said they found this lack of data because the Louisiana Department of Transportation and Development also has a list of levees, and its included levees that were not in the Army Corps of Engineers's data.

So far the team's website will only apply to the southern-most parishes in Louisiana, but the plan to fill in the rest of Louisiana, and continue to expand out from there. For now, it encompasses Ascension, Assumption, Cameron, Iberia, Jefferson, Lafourche, Livingston, Orleans, Plaquemines, St. Bernard, St. Charles, St. James, St. John, St. Martin, St. Mary, St. Tammany, Tangipahoa, Terrebonne and Vermillion parishes.

This article originally appeared on The Courier: LSU researchers develop tool to predict flood insurance premiums