Lucas Bols (AMS:BOLS) Takes On Some Risk With Its Use Of Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Lucas Bols N.V. (AMS:BOLS) makes use of debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Lucas Bols

How Much Debt Does Lucas Bols Carry?

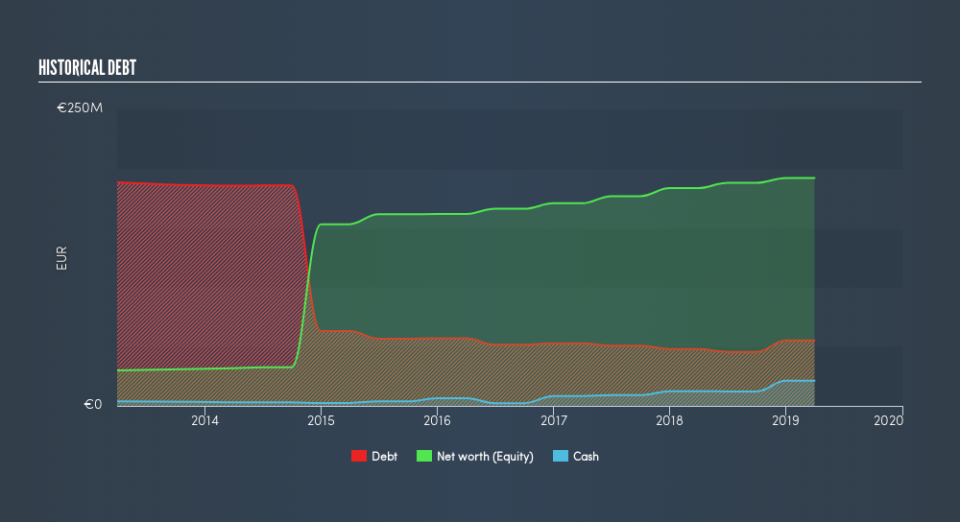

You can click the graphic below for the historical numbers, but it shows that as of March 2019 Lucas Bols had €55.2m of debt, an increase on €48.0m, over one year. However, it also had €21.2m in cash, and so its net debt is €34.0m.

How Strong Is Lucas Bols's Balance Sheet?

The latest balance sheet data shows that Lucas Bols had liabilities of €24.3m due within a year, and liabilities of €164.4m falling due after that. On the other hand, it had cash of €21.2m and €21.1m worth of receivables due within a year. So it has liabilities totalling €146.3m more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of €165.3m, so it does suggest shareholders should keep an eye on Lucas Bols's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Lucas Bols's net debt is sitting at a very reasonable 1.8 times its EBITDA, while its EBIT covered its interest expense just 6.9 times last year. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Unfortunately, Lucas Bols's EBIT flopped 18% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Lucas Bols can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Lucas Bols generated free cash flow amounting to a very robust 81% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

Lucas Bols's EBIT growth rate and level of total liabilities definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Taking the abovementioned factors together we do think Lucas Bols's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. Given Lucas Bols has a strong balance sheet is profitable and pays a dividend, it would be good to know how fast its dividends are growing, if at all. You can find out instantly by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.