Luckin's Shooting Star Falls on Fabricated Sales

On Thursday, April 2, Luckin Coffee Inc. (NASDAQ:LK) disclosed the results of an internal investigation that found its chief operating officer fabricated 2019 sales by approximately 2.2 billion yuan ($310 million). Shares were down 75% following the news, erasing more than $5 million of the company's market cap.

Luckin Coffee was founded in 2017 in Beijing. Starbucks (NASDAQ:SBUX), which entered the Chinese market in 1999, is its biggest competitor. While Starbucks has the advantage of foreign appeal, Luckin has both the homefield advantage and the price advantage, with prices about a third of what its rival charges.

Both companies focus their efforts on building in the wealthiest and most populated cities, but Luckin managed to grow its number of locations to 4,500 by the beginning of 2020, slightly more than the 4,200 locations that Starbucks took 20 years to achieve. More than 1,100 of Luckin's stores operate within a quarter of a mile from a Starbucks location, making the competition direct and fierce. However, Luckin is not a Starbucks clone; it competes with a smaller, more tech-based and coffee-centered model compared to its rival's larger stores and lunch options.

While the number of stores and explosive footprint growth were not fabricated, the sales were. The internal investigation found that the company's COO, Jian Liu, and some of the employees who reported to him were engaging in misconduct, which included the fabrication of sales. The company said the following in a statement:

"The information identified at this preliminary stage of the Internal Investigation indicates that the aggregate sales amount associated with the fabricated transactions from the second quarter of 2019 to the fourth quarter of 2019 amount to around RMB2.2 billion... Certain costs and expenses were also substantially inflated by fabricated transactions during this period."

Guru shareholders

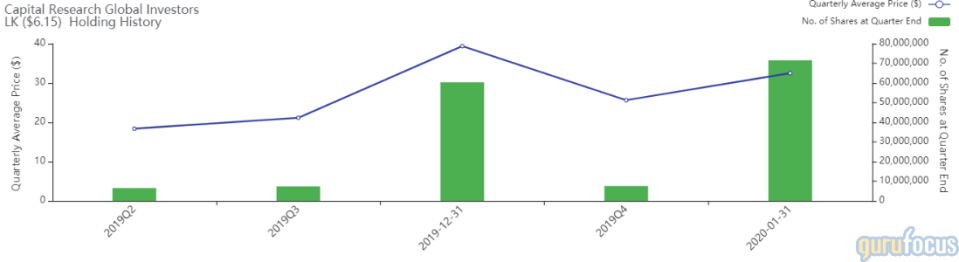

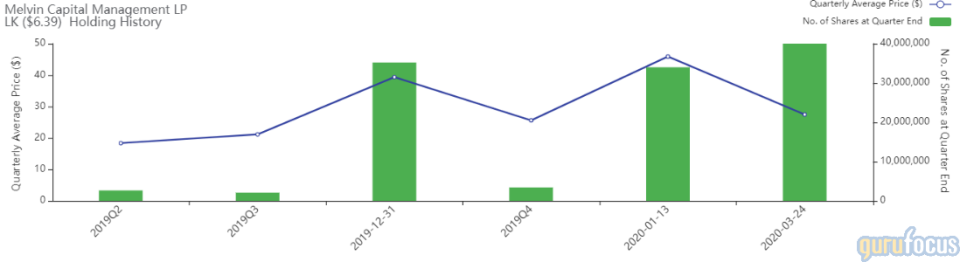

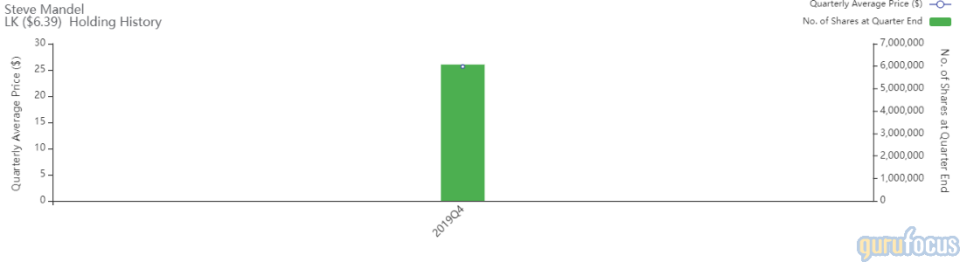

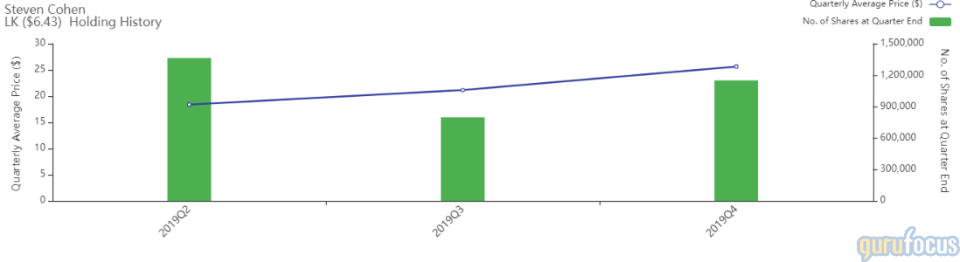

According to Securities and Exchange Commission filings and GuruFocus data, the investing gurus that hold the biggest stakes in Luckin are Capital Research Global Investors, Melvin Capital Management, Steve Mandel (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

The equity portfolio of Capital Research Global Investors consists of 402 stocks valued at $333.06 billion. With 71,522,960 shares, or 27.85% of shares outstanding, it is Luckin's largest guru investor. Over the course of one day, the value of the investment has lost $1.4 billion.

With an equity portfolio of 92 stocks valued at $11.91 billion, Melvin Capital Management is Luckin's second-largest guru shareholder; it owns 40,000,000 shares, or 15.80% of shares outstanding. Over the course of one day, the value of the investment is down $786 million.

Another prominent guru shareholder is Mandel's Lone Pine Capital, which has an equity portfolio of 43 stocks valued at $18.86 billion. The firm owns 6,067,357 shares of Luckin, making up 2.40% of total shares outstanding. Over the course of one day, the value of the investment has lost $119 million.

Cohen's Point72 Asset Management, with an equity portfolio of 917 stocks valued at $19.02 billion, owns 1,149,536 shares of Luckin, or 0.45% of total shares outstanding. Over the course of one day, the investment has lost $22 million.

Luckin's future

Due to the reported fake sales, Luckin has said that investors can no longer rely on its prior guidance. The company's internal investigation links the fake sales reports back to the second quarter of 2019, though until the investigations are completed, the extent of the misinformation will remain unclear.

A company representative said that the company will "take all appropriate actions, including legal actions, against the individuals responsible for the misconduct." Luckin has suspended the employees implicated in the misconduct and terminated dealings with the private parties who aided in the fabrication of sales.

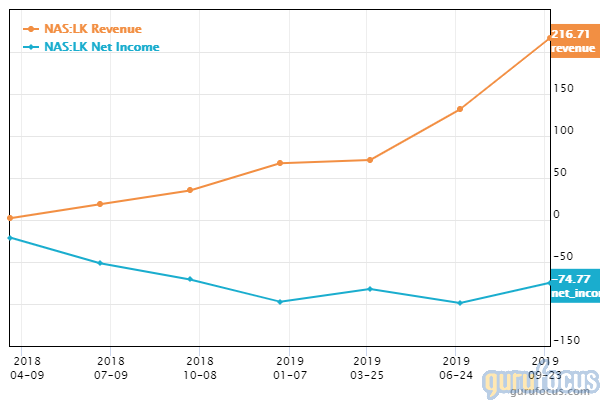

Even with the numbers from the fabricated sales, which the chart below is based on, the company has clearly been focusing on gaining market share by sacrificing profitability.

Thus, despite the company's financial strength and potential as a value opportunity given the drop in price, investors may want to hold off on this stock until the investigation is resolved and the company can begin moving its real net income closer to the positive range.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Investors should always conduct their own careful research or consult registered investment advisors before taking action in the stock market.

Read more here:

Invesco European Growth Fund's 1st-Quarter Buys

5 Food Delivery Stocks Seeing Increasing Sales During Covid-19 Crisis

Buying What the Fed Buys

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.